Indiamart IPO

Background of the Company

(i) They are India’s largest online B2B marketplace for business products and services with approximately 60% market share of the online B2B classifieds space in India in fiscal 2017, according to KPMG.

(ii) They primarily operate through their product and supplier discovery marketplace, www.indiamart.com or “IndiaMART”. The online marketplace provides a platform for mostly business buyers, to discover products and services and contact the suppliers of such business products and services.

(iii) IndiaMART had an aggregate of 325.8 million and 552.6 million visits in fiscal 2017 and 2018, respectively, of which 204.8 million and 396.9 million comprised mobile traffic, or 63% and 72% of total traffic, respectively.

Business Model of India Mart

(i) IndiaMART provides a robust two-way discovery marketplace connecting buyers and suppliers. Buyers locate suppliers on the marketplace, including both Indian small and medium enterprises, or “SMEs”, and large corporates, by viewing a webpage containing the supplier’s product and service listings, or a “supplier storefront”, or by posting requests for quotes called “RFQs” or “BuyLeads”.

(ii) The marketplace offerings from which buyers can search for and view product and service listings cover a wider range of industries spread across India, rather than relying on a single target industry or type of geography. As of March 31, 2018, we had organized our listings across 52 industries.

How they do earn Money?

i) As we discussed earlier that they provide the market for SMEs manufacturers to find buyers on their e-platform. They offer monthly pricing schemes for the subscription packages in addition to annual and multi-year subscription models. They offer basic and premium subscription models, which include a set number of RFQ credits (depending on the level of the paid subscription package) that may be used by the suppliers. Suppliers may view sample RFQs before selecting a paid subscription package.

ii) They also charge for the leads generation on their platform.

iii) Advertising revenue

As of March 31, 2018, they had 59.81 million registered buyers and had 4.72 million supplier storefronts in India. The Indian supplier storefronts had listed 50.13 million products, of which 75% of goods comprised products and 25% were services.

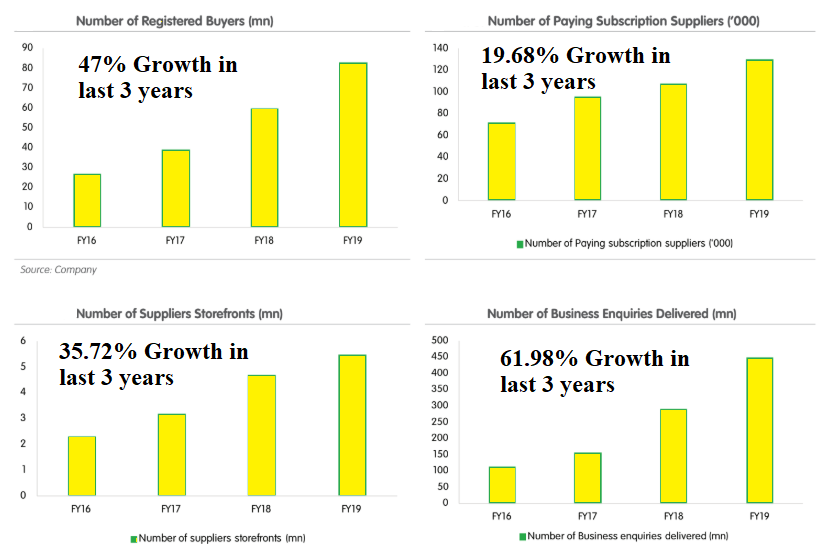

Graphical Presentation of Business

Key Growth Metrics

The most important metric among all is ” Number of Paying Subscription Suppliers” because most of the company’s income is coming from this segment only and it has shown a robust CAGR growth of ~20% in last 3 years.

Objects of the Indiamart IPO:

Indiamart IPO Details:

| Open Date: | Jun 24 2019 |

| Close Date: | Jun 26 2019 |

| Total Shares: | 4,887,862 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 475 Cr. |

| Lot Size: | 15 Shares |

| Issue Price: | ₹ 970-973 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Jul 04 2019 |

Promoters And Management:

Financials of Indiamart IPO:

| Year | Revenue | EBITDA | PAT | Equity | Net Worth | EPS | Cash Flow | RONW |

| 2017 | 323 | -9 | -13 | 0.9169 | -390 | -14.18 | 17 | -3.3% |

| 2018 | 410 | -182 | -72 | 0.9997 | -321 | -72.02 | 45 | -22.4% |

| 2019 | 533 | 42 | 12.5 | 2.8592 | 159 | 4.37 | 35 | 7.9% |

B) Consolidated Financials( Fig. in Crs)

| Year | Revenue | EBITDA | PAT | Equity | Net Worth | EPS | Cash Flow | RONW |

| 2017 | 331 | -59.5 | -64 | 0.9169 | -390 | -69.80 | 17.6 | -16.4% |

| 2018 | 429 | -57.2 | 54 | 0.9997 | -321 | 54.02 | 46.7 | -16.8% |

| 2019 | 548 | 49.8 | 20 | 2.8592 | 159 | 6.99 | 40.1 | 12.6% |

Comparison With Peers:

Recommendation on Indiamart IPO:

Lead Manager of Indiamart IPO:

Registrar of Indiamart IPO:

Bid Details of Indiamart IPO as on

26-Jun-2019 21:00:00 IST

Total Number of Applications in Retail Category: 421005

Application-wise Subscription in Retail Category: 12.95x

Discussion on Indiamart IPO:

57 Comments

Leave a Reply

You must be logged in to post a comment.

💡 *IPO Expected soon*

*Affle (India) Ltd – Tentative 500Crs*

*Sterling and Wilson Solar Ltd (SWSL) – 4500Crs*

Pls update your *UPI ID’s* to apply for further IPO’s

bhai ye upi id ka kya seen h ipo mein….koi easy words mein btaao…

💡 *CPSE ETF*

*Sources*

CPSE AUM : ~ INR 10500 cr

FFO :

*Anchor : 18th July*

*Non Anchor : 19th July*

Anchor : 30% size, Rest to Non Anchor

*Base Size : INR 8500 Cr to upsize of INR 12000 cr*

To be removed from INDEX : RECL (~ INR 650 cr) expected to be sold in market

IOCL : Govt owns almost INR 250 cr, Weight ~ 18.2% in Index

On Size of 12K cr : IOCL expected buying of INR 1950-2000 cr from market.

*Discount : 4% (net of IOC adjustment around 3.2%)*

Net discount to retail investors?

4%

Application rate- 3100-3200

Please discuss here harshit bhai

https://investorzone.in/cpse-etf-tranche-6-opening-on-19-07-2019-should-you-invest/

*💥CPSE FFO 5💥*

*👉Only one day*

19th July 2019 for retail investors.

*👉 Allotment date 26th July 2019*

👉 Tentative listing 29th July 2019

👉Issue size 8000 cr to 11500 cr

👉Portfolio holding:

ONGC

Coal India

NTPC

Indian oil

PFC

Bharat electronics

Oil India

NBCC

NLC India

✅Last two offering return V/S Nifty

👍CPSE FFO 3 27.85% V/S 11%

👍CPSE FFO 4 11.97% V/S 2%

🗣Get your fund ready in advance to get allotment.

Happy Investing !!!

retail discount?

💡 *CPSE Sr.5*

Tentatively 18th & 19th July

18th – Anchor

19th – Anchor

Issue size : 8000cr to 12000cr.

Discount : Confirmation awaited

tax benefits like in elss funds is supposed to be offered…

My pridiction 100% correct that 3 to 4000 profit.

UC

1200+

UC nhi lga…aisa kyu

UC is at 20% of listing price.

ohhh…i got it

Bumper listing gain.

₹3 to 4000 profit.

I applied 2 from 2 accounts, None I got 🙁

What about you…

Allotment done… Check it out and congrats to the one who have been alloted the same😊😊

https://www.linkintime.co.in/IPO/public-issues.html

check allotment

Payment start debiting from Banks.

0/3

💡 *IndiaMart InterMash Limited IPO Basis of allotment update*:

*Retail Investor will get 15 Equity share* as per below allotment ratio:

*35:421 – Bid Lot 1* (15 Shares)

*1:12 – Bid Lot 2 to 13* (from 30 shares to 195 shares)

*Final HNI Subscription: 62.077345*

Tentative Listing Date: *04-July-2019*

ALLOTMENT TODAY EVE AFTER MARKET…

6 applications applied

What is the current GMP for india mart ?

160-165

I have applied for one lot but dint get any information for allotment or refund in bank account…does anybody have update on this..

Hi… Allotment is still not done.. Please maintain paitence

Thank u

3 July maybe allotment is possible

💡 *IndiaMART IPO*

*Day 3 at 6:00PM*

The following data is assuming the shares will be issued at @973/- (upper price band)

QIB*: 30.83X (*Excluding Anchor)

NII: 62.13X (Interest cost = ~81/-)

*RII: 13.33X*🏇

Empl: 06.05X

Total: 36.07X

Applications: 3,94,000 Approx

No. of *Application-wise: 12.10X*

*GMP 165 – 170*📯

*Kostak 225/-*

QIB 30

NII 62

RII 12

EMPLOYEES 6

OVERALL 35

QIB subscribed 1.05 times….NII Subscribed 4%….Retail investors – 2.5 times…

whats ur opinion MW

IndiaMart GMP 125-130/ Sub To 1400 @ Ahmedabad

Interaction with India Mart Management

https://www.timesnownews.com/videos/et-now/exclusive/indiamart-ipo-opens-today-brijesh-agarwal-of-indiamart-to-et-now/34892

QIB subscribed 1.05 times….NII Subscribed 4%….Retail investors – 2.5 times…

whats ur opinion MW

Premium of Rs 135-40

Whilst IndiaMART pricing has improved 7% CAGR over the last 3 years and is greater than 2x of Just Dial’s pricing thereby indicating stickiness from suppliers, based on our channel checks with over 75 suppliers across the country (slide 5), the stress in the MSME sector (slide 6 and 7) could be the single biggest risk for IndiaMART’s revenue and pricing growth (deferred revenue is 85% of cash and bank balance).

The recent appreciation in the stock price of Just Dial (up 56% in last 3 months) followed by the launch of IPO of IndiaMART reminds us of the 56% appreciation in the stock price of Navneet Education from December 2016 till May 2017, when IPO of SChand was launched and fully subscribed. In sectors where investible options are limited, investors tend to lean towards the best available option till the investible universe within the sector expands and the Indian Internet sector is one such sector. Thus, the appreciation in stock price of Just Dial and expected valuations of IndiaMART can pose valuation related risks for a segment, where growth headwinds in the near term are a possibility.

The bottom line of the company has suffered due to fair value through P&L (FTPVL) of financial adjustments for preferential shares conversion and ESOP for FY 2017, FY 2018 and FY 2019. Management claims that it has done away with all such adjustments, and it is confident of maintaining around 16% OPM (before such adjustments) it achieved in FY 2019 with continued growth in the top line.

Adjusting for the gain/losses due to FTPVL, the OPM stands at 16% and PAT would have been around Rs 47.7 crore, translating into an EPS of Rs 16.6 in FY 2019. On this EPS, P/E works out to 59 times. The nearest comparable listed player Just Dial trades around 24 times FY 2019 earnings.

Should we go for it

yes

IndiaMart InterMesh, an online marketplace for business products and services, said on June 21 it has raised more than Rs 213 crore from 15 anchor investors by allotting 21,95,038 equity shares at a price of Rs 973, the upper band of its IPO that opens on June 24. ICICI Mutual Fund, HDFC Mutual Fund, SBI Mutual Fund, Birla Mutual Fund, Hornbill Capital Advisers LLP are among the 15 anchor investors.

IndiaMart on Wednesday said it will launch its initial public offering from June 24 and has fixed a price band of Rs 970–973 per share.

The initial public offering (IPO) is of up to 48,87,862 equity shares, according to a statement by the company.

Promoters Dinesh Chandra Agarwal and Brijesh Kumar Agrawal will sell 14,30,109 shares through the issue, while investors Intel Capital (Mauritius), Amadeus IV DPF and Accion Frontier Inclusion Mauritius will offload 33,20,753 shares and 1,37,000 equity shares by other selling shareholders, it added.

At the upper end of the price band, the offer is expected to raise about Rs 475 crore.

The issue will open on June 24 and would close on June 26.

*IndiaMART InterMESH Ltd IPO.*

Dates : *24 to 26 June*

Price Band : *970-973*

Net Issue : *48,77,862 Shares*

Lot size : *15 shares*

Important Note: *This IPO is Closing before 30th June, so old System of ASBA Application Form will be Valid*

UPI is *Not* Mandatory

Anchor Book

https://d2un9pqbzgw43g.cloudfront.net/main/Anchor-allocation_IndiaMART.pdf

There is limit up to 50% for anchor investor?

It is very difficult to value “Subscription based model” online companies. You just simply can’t measure them on Price to Earning method as most of these companies are in loss.

so wt to do…apply or not…

https://entrackr.com/2019/06/india-needs-tech-companies-like-indiamart-going-for-ipo/

S/2 900

As of now looks clear avoid by means of fundamental and balance sheet but we have to look on the subscription figure on last day then only decide if a subscription is a huge go for some gain on the listing.

Should we invest or not

Will come with the analysis shortly Ashish bhai.

Thanks mw

1999: Incorporation of IndiaMART.

2007: Received investment from Bennett, Coleman and Company Limited and Times Internet Limited

2008: Received investment from Intel

2016: Raised series C funding from investment from Amadeus, Westbridge, AFIM and Intel

2017: Received further investment from Amadeus, Westbridge and AFIM, and also launched payment protection programmed PayX for the purpose of safe and secure payment gateway.

OFS by existing shareholders

a) 2,590,000 equity shares by intel capital (Mauritius).

b) 255,753 equity shares by Amadeus iv dpf limited.

c) 475,000 equity shares by accion frontier inclusion mauritius.

d) 852,453 equity shares by Dinesh Chandra Agarwal.

e) 577,656 equity shares by Brijesh Agrawal.

f) 137,000 equity shares by the other selling shareholders.

So it is a pure OFS. The company will not get anything in the IPO or rather their business model does not require any capex. The company is giving exit an opportunity to shareholders who have invested in the company at the early stages.