- July 10, 2019

- Posted by: Umesh Paliwal

- Categories: Blog, Mutual Funds

Disinvestment is a tool vide which Govt. sells its stakes in the Stock Market and in return gets the desired funds. Therefore, in 2014 the Govt. has launched CPSE ETF. The CPSE ETFs in 2014 was listed at 10% gain at 19.45 against an offered price of Rs.17.45.

In the budget of 2019, the disinvestment target is more than 1.05 lakh crores. The government is planning to achieve that goal mostly through ETFs.

Till then 4 Follow on tranches have been launched and in every tranche, the govt has offered a discount of 5%, 3.5%, 4.5%, and 4% respectively.

The benchmark index is Nifty CPSE. The Fund Offer is managed by Reliance Nippon AMC.

Offer Description

The Tranche 6 follow-on fund offer is expected to have a base size offer of Rs 8,500 crore with an additional greenshoe option up to INR 12000 and is also offering a discount of 3%.

(i) CPSE AUM: ~ INR 10500 cr

(ii) Anchor: 18th July. The size for Anchor is 30%.

(iii) Non Anchor: 19th July. The size of Non-Anchor is 70%.

(iv) Base Size: INR 8500 Cr with greenshoe up to INR 12000 cr

(v) Discount: 3%.

What is ETF?

1. Can be sell and buy any time of the day.

2. They can be listed on Exchange.

3. Brokerage is low.

4. New Units are offered only through new Tranches.

Holdings in CPSE ETF:

Index constituents |

Weightage |

| ONGC | 20% |

| NTPC | 20% |

| Coal India | 20% |

| Indian OIl | 20% |

| Power Fin Corporation | 7.80% |

| BEL | 6.04% |

| Oil India | 3.01% |

| NBCC | 1.84% |

| NLC | 0.73% |

| SJVN | 0.58% |

This Index previously though consist of 11 PSUs.It is to be noted that REC has been excluded from the CPSE ETF Portfolio now. So from here onwards we will have only 10 companies under CPSE ETFs.

More than 75% stakes consist of ONGC, NTPC, Coal India and Indian Oil.

There is no lock-in period for Retail Investors. They can sell it on the very next day of allotment.

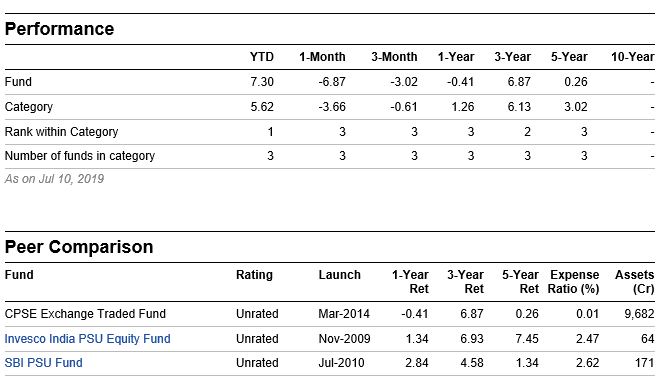

Performance of the CPSE ETF since inception:

The CPSE ETF has given a return of 8.16 % since inception.

In the 5 Tranche i.e. last tranche, the ETFs received a bumper subscription of 30000 Cr as compared to its size of 10000 Cr and has given Rs.14000 gain per application of 2 lakh.

Source: Value Research

Valuation of the CPSE ETF

(i) Portfolio P/B Ratio= 1.30

(ii) Portfolio P/E Ratio= 7.88

Nifty CPSE index is trading at a 36-45 percent discount to the Nifty50 Index valuation.

How to Apply?

The investors can apply through ICICI MFs website, HDFC Securities app, Zerodha App or many other portals. In the case of oversubscription, the ETFs units will be given depending upon the number of the application.

Should You Invest?

The Index consist of only PSU stocks and the performance of the PSU stocks in the last 5 years is not attractive neither does the future the way Govt. is eating out the reserves by a way of dividend or Buyback to meet their disinvestment target. The CPSE ETFs though we can say is available at an attractive valuation but it has more to do with the under performance of the fund. The CPSE ETFs is a good option for short ( Listing gain) to mid-term and but certainly not a long term bet the way PSUs stocks have underperformed.

64 Comments

Leave a Reply

You must be logged in to post a comment.

Any updates on Tranche 7?

There is any lock in period for anchor ?

as per i knw…30 days lock in period for anchor investors

Market wizard I have cpse etf 24.70 plz advisce what to do.

Should have exited at 23.70.

kya ye last offer tha cpse ka…as i hv listen from my broker ..

What to do in ETF?

How much time frame to get original price?

Please guide us MW

bcoz grey market transaction sattled in loss of buyers of application.

You should have exited around 23.70. Nevertheless, the Govt will soon come up with another Tranche of CPSE ETF which will give chance to exit.

AAny views on etf?

I am holding some applications

How many units you are holding?

15k shares

cpse etf ka bomb fuss ho gya😂

haha!! should bounce back. aaj ruk jao

haha

m to 3 months tk ruka hun…no worries

Team please note , Allotment process for *CPSE ETF NFO 5 has been completed at NAV of Rs 24.6936 per unit.*

*Allotment Ratio* as below

Anchor – 17.27%

NII & QIB – 8.75%

Retail & RPF – 100%

SMS and email communication on allotment will start shortly.

*Refund -*

RTGS completed which includes refund to corporates

NEFT in process and will be completed by 4 PM today

Refund includes partial allotment Refunds also.

*Rejections-*

Rejection and refund process also started . Will receive the complete rejection file today around 5 PM

*Search option Kbolt and RMF website*

Porting is in process and you can search details in Kbolt at around 3 PM.

We are enabling status check option in RMF website some will be available at 4 pm (approx)

In case you are still unable to search any details you can raise in CRM with below category.

Request/Grievance –CPSE NFO-(in appropriate sub category)

price is under pressure…no profit no loss in current situation

Looks so. Monday picture would be clear.

Etf allotment is available

https://investeasy.reliancemutual.com/online/transaction/cpseauth

CPSE ETF FFO 5 Allotment NAV – RS.24.6936

allotment done kya??

hopefully…allotment should be done tmrw or day aftr.

Is there any buyers of CPSE ETF applications even now ?

Application rate- 2100-2200

3k to 3.5k

at which price we will get allotment??

@MW how they calculated alotment price. Thank you.

Cpse details as of now

Total collection 50kcrs

Non anchor 29622crs

Anchor 19980crs

Non anchor

Retail 4792crs

Retirement 1140crs

Anchor

Qib 20335crs

Nii 3353crs

Total book size 11500crs

Non anchor confirm allotment 5932crs

2118crs left in non anchor.

means…full allotment to retail investors??

yes

@MW,

Can you confirm the allotment price of CPSE ETF unit?

when it will be decided?

CPSE Numbers so far

Retail 4.8 K Cr

Retirement 1.1 K Cr

Others 23.5 K Cr

Apps 3 L

As @ Monday 10am

CPSE ETF

4500 / 4700

it is interesting.

thank you sir @MW.

Want to buy 10 App

What is the GMP for CPSE ETF ?

4500

Hello MW,

WILL RETAIL GET FULLY ALLOTMENT?

yes

*CPSE ETF follow-on fund offer oversubscribed, investors put in bids worth Rs 25,000 cr so far*

3400/3500

https://investeasy.reliancemutual.com/Online/scheme/landingpage

experts please share current GMP for final decision.

https://www.business-standard.com/article/markets/cpse-etf-anchor-issue-subscribed-8-times-opens-for-retail-investors-today-119071900067_1.html

https://www.reliancemutual.com/FundsAndPerformance/Pages/AnchorInvestorslist.aspx

Anchor list

Thank you @MW sir

Anchor portion subscribed 19980 Cr. Approx 6x subscription.

Dear Admin,

can we track this CPSE ETF subscription ratio like IPO subscription data?

and today is anchor portion opening, so by the day end can we know how much anchor portion subscribed?

No such live data is available like IPO. But yes at the end of the day we can able to get the information.

kindly post that information so we all can get that clear idea for tomorrow.

thank you.

to all experts,

please share current GMP for final decision.

Invest 20 lacs in CPSE ETF and short one lot each of ONGC, NTPC, Coal India and Indian Oil in FNO. and make 3% return guaranteed.

Will get discount?

Can you please explain your calculation?

CPSE ETF FFO 5

Date: 19-July-2019 Only One Day

Application Amount:

Min:5000

Max:2Lac

Discount Offered by GOI: Up to 3%

Issue offer: 8000cr+Green Shoe

CMP: 25.97

Apply=✅

Recommend=✅

How the Allotment price is being calculated?

considering that govt holding in IOC Ltd is only 52% and its holding cannot go below 51.5%, these shares would be bought from market and hence there wouldn’t any discount on these shares and hence the actual discount may be close to 2.5%

CPSE ETF 3000 (2Lakh App)

Latest GMP?

3200-3300

Could someone please clarify – can someone make a 20L application to get the discount and exit on listing ? Couple of questions –

– is part of the issue reserved for retail investors ?

– if I apply as as HNI investor, is there a lock-in period ?

I guess 30 percent is reserved for retail.

There is no lock for any investor. Only anchor investor may have a lock in for 30 days (not sure though)

1. There is no lock-in period except Anchor.

What is the source of the information for discount on this ETF ?

Why do say that IOC will not get any discount and hence the effective discount of 3.2%