Prudent Corporate Advisory Services Limited IPO

i. Prudent Corporate is an independent retail wealth management services group in India and is amongst the top mutual fund distributors in terms of average assets under management (“AAUM”) and commission received. The company offers a technology-enabled, comprehensive investment and financial services platform with end-to-end solutions critical for financial products distribution and presence across both online and offline channels.

iii. Prudent Corporate Advisory Services Limited provides retail wealth management services. The company offers Mutual Fund products, Life and General Insurance solutions, Stock Broking services, SIP with Insurance, Gold Accumulation Plan, Asset Allocation, and Trading platforms.

iii. The company grew faster among national distributors (amongst the top 10 mutual fund distributors) in terms of commission and AAUM with a CAGR of 34.4% and 32.5% respectively for the five year period ending Fiscal 2021

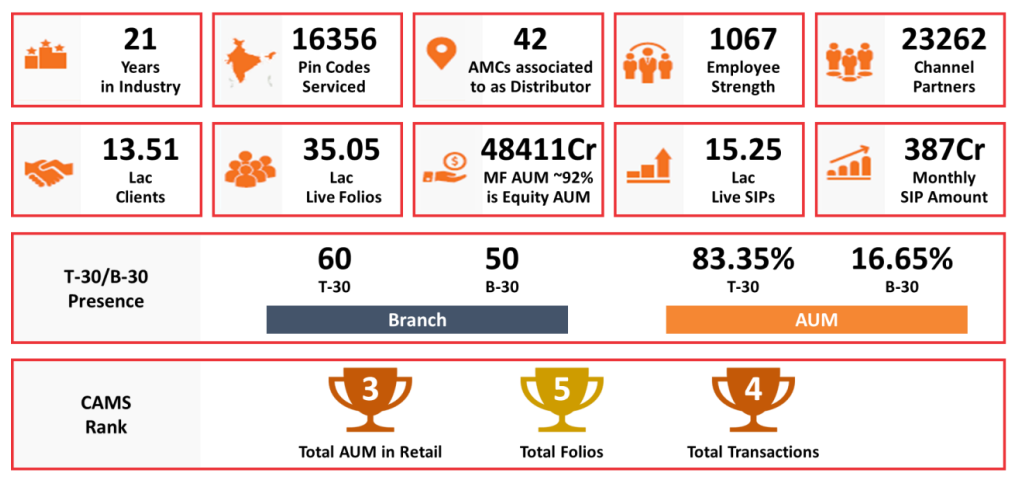

iv. Incorporated in 2003, they provided wealth management services to 13,51,274 unique retail investors through 23,262 MFDs on its business-to-business-to-consumer (“B2B2C”) platform and are spread across branches in 110 locations in 20 states in India.

v. The Company is one of India’s leading independent and fastest-growing financial services groups. The company has built a nationwide network, servicing 16,356 PIN codes. Prudent Corporate Advisory Services has 1,067 employees strength, 35.05 lakhs live folios and 15.25 lakhs live SIPs as of December 31, 2021.

vi. Competitive Strengths:

- The company operate in an underpenetrated Indian asset management industry, that has grown at a CAGR of more than 20%.

- Growing independent financial products distribution platforms.

- The company have a granular retail AUM with a mix skewed towards high-yield equity AUM.

- The value proposition has led to increased participation and a long-standing relationship with MFDs.

- The company have a track record of innovation and use of technology to improve investor and partner experience.

- Pan-India diversified distribution network with the ability to expand into underpenetrated B-30 markets.

Objects of the Prudent Corporate Advisory Services Limited IPO:

Prudent Corporate Advisory Services Limited IPO Details:

| Open Date: | May 10 2022 |

| Close Date: | May 12 2022 |

| Total Shares: | 8,549,340 |

| Face Value: | ₹ 5 Per Equity Share |

| Issue Type: | Book Built Issue |

| Issue Size: | 538.61 Cr. |

| Lot Size: | 23 Shares |

| Issue Price: | ₹ 595-630 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | May 23 2022 |

Promoters And Management:

Financials of Prudent Corporate Advisory Services Limited IPO:

| Particulars (in crores) | December 21 | March 21 | March 20 | March 19 |

| Revenue from operations | ||||

| Commission and Fees Income | 314 | 277 | 229 | 215 |

| Interest Income | 3 | 3 | 5 | 6 |

| Net gain on fair value changes | 4 | 6 | 1 | 0 |

| Total Revenue from operations | 321 | 286 | 234 | 221 |

| Expenses | ||||

| Commission and Fees Expense | 176 | 153 | 120 | 125 |

| Employee benefits expense | 48 | 55 | 48 | 43 |

| Impairment on Financial Instruments | 0 | 2 | 1 | -0.9 |

| Operating Profit | 97 | 76 | 65 | 54 |

| OPM% | 29.90% | 26.40% | 27.30% | 24.60% |

| Finance Cost | 2 | 2 | 3 | 3 |

| Depreciation | 9 | 8 | 8 | 8 |

| Other Income | 7 | 8 | 1 | 3 |

| Profit (Loss) before tax | 77 | 60 | 37 | 28 |

| Tax expenses | 20 | 15 | 9 | 8 |

| Profit (Loss) for the period | 57 | 45 | 27 | 21 |

| No.of shares | 4 | 4 | 4 | 4 |

| Earnings per share | 14 | 11 | 7 | 5 |

Comparison With Peers:

| Name of the Company | Face Value | EPS (in Rs) | PE | PAT (In Cr.) | Mcap (in crores) |

| Prudent Corporate Advisory Services Limited | 5 | 19 | 34 | 76 | 2520 |

| Listed Peer | |||||

| IIFL Wealth Management Ltd | 2 | 65.13 | 26.6 | 578 | 15,560 |

| ICICI Securities Ltd | 5 | 42.85 | 12.3 | 1,383 | 16,948 |

| Central Depository Services (India) Limited | 10 | 29.78 | 42.8 | 311 | 13,292 |

| Computer Age Management Services Limited | 10 | 56.2 | 43.2 | 274 | 11,847 |

| HDFC Asset Management Company Limited | 5 | 65.32 | 30.8 | 1,393 | 42,892 |

| Nippon Life India Asset Management Ltd | 5 | 11.96 | 25.8 | 744 | 19,247 |

| UTI Asset Management Company Ltd | 10 | 42.09 | 18.6 | 534 | 9,940 |

Recommendation on Prudent Corporate Advisory Services Limited IPO:

Lead Manager of Prudent Corporate Advisory Services Limited IPO:

Registrar of Prudent Corporate Advisory Services Limited IPO:

Company Address:

Discussion on Prudent Corporate Advisory Services Limited IPO:

2 Comments

Leave a Reply

You must be logged in to post a comment.

LISTED one day before @650/660 in premium. But immediately, turned downward and now down by 10%.

sir update about ethos ipo