PowerGrid InvIT IPO

A) What is InvIT?

1) An investment trust is something that has assets under its management and generates revenues from those assets and returns to the stakeholders or in this case, InvIT unitholders.

2) One of the most important factors underlying an investment trust is the underlying assets it owns.

3) They could be toll gates, transmission lines, rental buildings, and other investment yielding platforms.

B) When does PoweGrid InvIT Formed?

PowerGrid has registered an InvIT on 07.01.2021. This yield vehicle instrument has transmission lines and substations as its assets. It generates money through these transmission lines.

C) Why this IPO is coming and how investors will earn?

Here, PowerGrid has transferred 5 project assets to PowerGrid InvIT. Now, to pay the debt of these transmission assets, PowerGrid InvIT needs money. That is why they are coming up with an IPO to raise money to pay off the debt of these assets.

These assets will get rental income from PowerGrid. This income then will be distributed among the investors in the form of dividends. A simple mechanism is we (consumers) pay money to the PGCIL and it pools the money and distributes it to the various managers of the substations and in turn, PowerGrid InvIT pays to its shareholders the interest, which it calls DPU or distribution per unit.

Initially, PowerGrid InvIT has acquired five projects with a total network of 11 power transmission lines of approximately 3,698.59 ckm and three substations having 6,630 MVA of aggregate transformation capacity, as of December 31, 2020, across five states in India.

D) What is the minimum size of investment?

This is not the regular IPO where retail investors can put Rs.15000 application. The minimum ticket size is somewhere around 1 lakh.

QIB Quota = 75%

HNI Quota = 25%

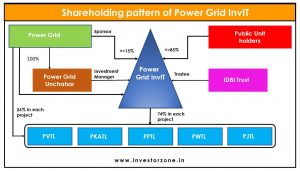

E) Shareholding Pattern Post-listing

F) Video to understand basics of InvIT

G) Video to understand Yield and Chances of Allotment

H) Video to understand how investors of PowerGrid InvIT will earn money?

Objects of the PowerGrid InvIT IPO:

| Name of the asset | Amount |

| PVTL | 783 Cr |

| PKATL | 186 Cr |

| PPTL | 1300 Cr |

| PWTL | 1540 Cr |

| PJTL | 1182 Cr |

PowerGrid InvIT IPO Details:

| Open Date: | Apr 29 2021 |

| Close Date: | May 03 2021 |

| Total Shares: | 773,499,100 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 7734 Cr. |

| Lot Size: | 1100 Shares |

| Issue Price: | ₹ 99-100 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | May 11 2021 |

Promoters And Management:

Financials of PowerGrid InvIT IPO:

| Year | Revenue | Finance cost | Other expenses | PAT | Shares | EPS |

| 2018 | 345 | 115 | 8 | 114 | 44.2 | 2.58 |

| 2019 | 984 | 328 | 32 | 248 | 99.86 | 2.48 |

| 2020 | 1334 | 429 | 38 | 378 | 120 | 3.15 |

| 9MFY21 | 1090 | 291 | 31 | 337 | 121 | 2.79 |

| Projects | 2022 | 2023 | 2024 |

| Expected cash flows | |||

| POWERGRID Vizag Transmission Ltd | 260 | 225 | 201 |

| POWERGRID Kala Amb Transmission Ltd | 65 | 61 | 56 |

| POWERGRID Parli Transmission Ltd | 308 | 308 | 307 |

| POWERGRID Warora Transmission Ltd | 343 | 343 | 342 |

| POWERGRID Jabalpur Transmission Ltd | 242 | 242 | 242 |

Comparison With Peers:

| Company | Revenue (cr) | Asset Size (cr) | Circuit (Km) | No. of transmission lines | Mcap |

| Indi Grid | 1243 | 10816 | 7570 | 13 | 9146 |

| PowerGrid InvIT | 1334 | 6321 | 3689 | 11 | NA |

Recommendation on PowerGrid InvIT IPO:

Lead Manager of PowerGrid InvIT IPO:

Registrar of PowerGrid InvIT IPO:

Discussion on PowerGrid InvIT IPO:

13 Comments

Leave a Reply

You must be logged in to post a comment.

Powergrid InviT Pre Open Link

NSE – https://t.co/Qi987cQgnN

BSE – https://t.co/lSn4696KUj https://twitter.com/gk2524/status/1393046827151237120?s=20

Dear All,

PowerGrid InvIT will be listing on Friday 14th May 2021

Issue Price: *Rs.100 /- per unit*

Market Lot: *100 units*

Scrip Code: *543290*

ISIN No.: *INE0GGX23010*

Scrip ID: *PGINVIT*

Exchange: *BSE & NSE*

BSE Listing Circular Link: https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20210512-43

Team EdelweissPartners

https://kosmic.kfintech.com/ipostatus/

Power grid invit

Would be available

Tommorow on above site

PGInvIT – Basis –

NIB ( HNI ) – 4.62216x

QIB – 4.77015 x

Unblocking of Funds – mostly today i.e. Tuesday, 11th May 2021

I hope this IPO profits every investor!

i want to withdraw it..can anybody quickly tell how can i do it..i m not getting it in ICOCI

Why you want to withdraw it?

Today is last date to apply. Minimum 3-4 applications are required to get one confirmed lot…

We have started our Youtube channel to spread the knowledge of IPO, Buyback, NCD and Unlisted shares to our community. The videos will be informative so I request to please Subscribe our Channel…… Below is the link…

https://www.youtube.com/channel/UCDw0c2V5kARgu5JKb-q-ujA

The IndiGrid InvIT which was listed in 2016-17, is currently giving ~10% of Interest every year. Let us see how much we get in Power Grid that only be known after six month when they distribute dividends till then only projections can be made.

The 5 Assets are awarded under the Tariff Based Competitive Bidding (TBCB) mechanism on a build-own-operate-maintain (“BOOM”) basis with a long-term Transmission Service Agreement (TSA) of 35 years from the

COD. The average remaining term of the TSAs is over 32 years.

So, clear visibility of cash-flows for the next 32 years.

There is no lottery system here. The allotment will be done on proportionate basis.

I applied one lot.What is the chance of allotment?(Resident individual)