PB Fintech Limited IPO (Policy Bazaar IPO)

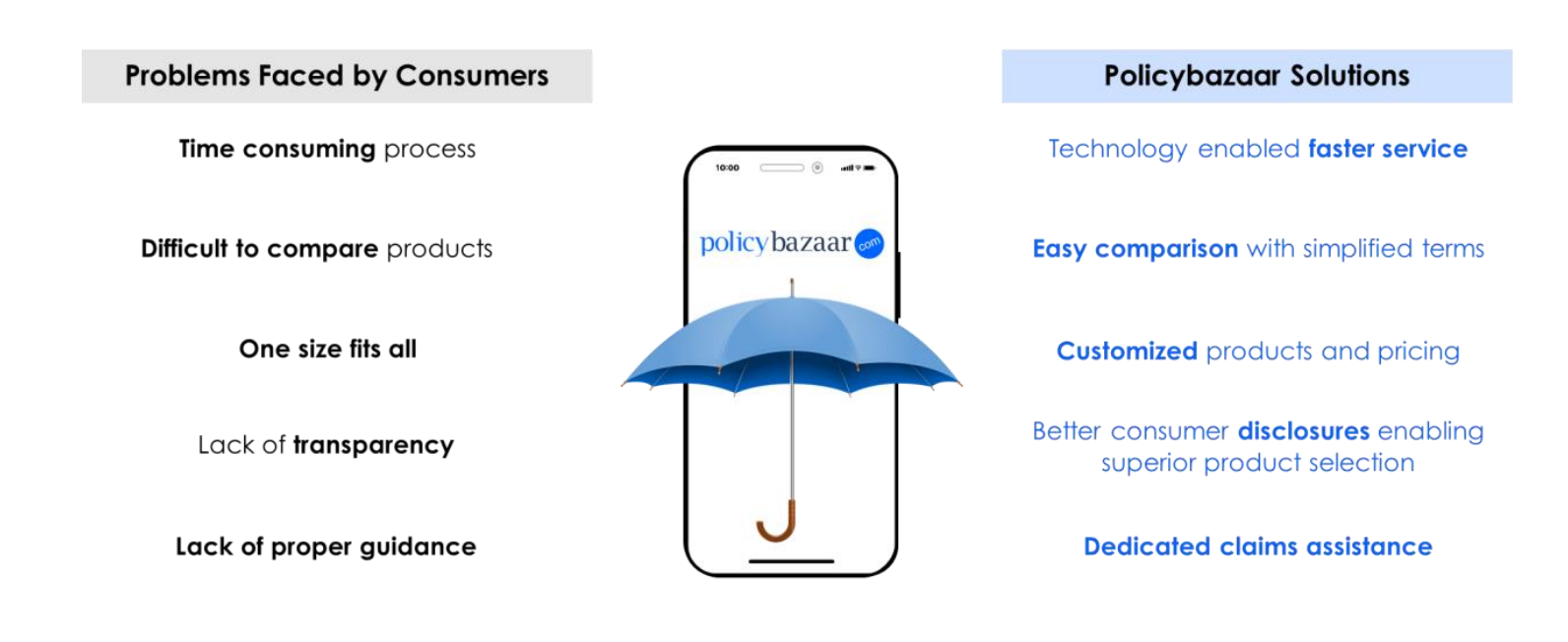

The company has built India’s largest online platform for insurance and lending products leveraging the power of technology, data, and innovation. It provides convenient access to insurance, credit, and other financial products and aims to create awareness amongst Indian households about the financial impact of death, disease, and damage. Policybazaar was launched in 2008 to respond to Consumers’ need for more awareness and choose the best options for insurance available in the market. The company has been successful in building India’s largest online marketplace for insurance and lending products, leveraging the power of technology, data, and innovation. The company offers online research-based purchases of insurance and lending products. It further facilitates partners to innovate and design customized products for consumers by leveraging extensive data insights.

PB Fintech has two flagship products:

a) Policy Bazaar (100% subsidiary) – It basically caters to consumer demand for higher awareness, choice, and transparency towards the online sale of insurance products. It has thus evolved as India’s largest digital insurance marketplace, with market share of 93.4% (based on the number of policies sold); it constituted 65.3% of the digital insurance sales in India by volume as of FY20. It has partnered with ~51 insurers, and ~48m consumers have registered on its platform.

b) Paisabazaar (100% subsidiary) is the largest digital consumer credit marketplace, with market share of 51.4% on the basis of disbursals. It began its operations in FY14 with the goal to transform personal credit access by offering ease, convenience, and transparency in selecting a variety of consumer credit products. It is widely used to access credit scores, with ~21.5m consumers as of Mar’21. It has partnered with ~54 lenders across banks, NBFCs, and fintechs offering a wide choice of consumer credit products,such as personal loans, business loans, credit cards, home loans, and LAP.

SWOT Analysis

1. Strength

a) Leading player in online insurance distribution

b) Policy Bazaar is synonymous with policy in India. So, go to platform for buying and selling insurance.

c) They recently got the broker approval from SEBI. Now, they can take corporate business as well.

2. Weekness

a) Selling health insurance policy online is difficult as it involves the role of advisors to make understand the product features, what is covered, what is not covered etc.

b) Totally dependent upon the commission the companies are paying to them. In future, if they reduce the commission, the profitability might go down.

3. Opportunities

a) Premiums via online channel stand much Penetration levels remain the lowest for India across most segments lower at 1% for India v/s 5.5% for China and 13.3% for the US.

b) Increase of good telecommunication network and more smart phone users, have enabled consumers to book policies and loan online.

c) Total Gross Written Premium in General Life of FY20-21 stands ~2 Lakh Crores and with India GDP at ~200 Lakh Crores, the GWP/GDP size is just 1%, whereas global average is 2.8%. So, huge opportunity is available in Non-Life business and with greater penetration of telecom, more and more policies will be sold through digital mode.

4. Threats

The new D2C(Direct to Consumer) companies such as Go-Digit and Acko, they are investing heavily in Digitising insurance and underwriting. So, if more and more companies focussing on going digital first, competition will increase for PB Fintech.

How they have generated revenue in FY20-21?

Commission Income = 35%

Outsourcing Services = 52%

Rewards and Others = 12%

Competitive Strengths

a) Consumer-friendly brands offering a wide choice, transparency, and convenience

b) Collaborative partner for Insurer and Lending Partners

c) Capital efficient model with low operating costs

Objects of the PB Fintech Limited IPO (Policy Bazaar IPO):

PB Fintech Limited IPO (Policy Bazaar IPO) Details:

| Open Date: | Nov 01 2021 |

| Close Date: | Nov 03 2021 |

| Total Shares: | 61,403,061 |

| Face Value: | ₹ 2 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 6017.50 Cr. |

| Lot Size: | 15 Shares |

| Issue Price: | ₹ 940-980 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Nov 15 2021 |

Promoters And Management:

Financials of PB Fintech Limited IPO (Policy Bazaar IPO):

| Particulars (in Cr.) | Mar-21 | Mar-20 | Mar-19 |

| Sales | 886 | 771 | 492 |

| Employee Benefit Expenses | 554 | 520 | 397 |

| Internet Charges | 58 | 50 | 31 |

| Advertisement and Marketing | 367 | 445 | 345 |

| Other Expenses | 65 | 74 | 53 |

| Operating Profit | -158 | -318 | -334 |

| OPM % | -17.83% | -41.25% | -67.89% |

| Other Income | 70 | 84 | 36 |

| Interest | 11 | 11 | 7 |

| Depreciation | 41 | 47 | 30 |

| Profit before tax | -141 | -294 | -337 |

| Net Profit | -150 | -304 | -346 |

| NPM % | -16.93% | -39.43% | -70.33% |

| No. of shares | 40 | 40 | 40 |

| EPS in Rs | -3.75 | -7.60 | -8.65 |

Comparison With Peers:

Recommendation on PB Fintech Limited IPO (Policy Bazaar IPO):

Lead Manager of PB Fintech Limited IPO (Policy Bazaar IPO):

Registrar of PB Fintech Limited IPO (Policy Bazaar IPO):

Company Address:

Discussion on PB Fintech Limited IPO (Policy Bazaar IPO):

4 Comments

Leave a Reply

You must be logged in to post a comment.

Apply.

Problem in Policy Bazar Model:

One of India’s leading private sector general insurers i.e. HDFC ERGO has recently withdrawn their plans from Policy Bazaar…

Sir may i know about GMP

GMP is 170