One 97 Communications Limited IPO (Paytm IPO)

i. One 97 Communications was started in 2000, which launched Paytm in 2009, as a “mobile-first” digital payments platform to enable cashless payments for Indians, giving them the power to make payments from their mobile phones.

ii. It offers consumers a wide selection of payment options on the Paytm app, which include

(i) Paytm Payment Instruments, which allows to use digital wallets, sub-wallets, bank accounts, buy-now-pay-later, and wealth management accounts.

(ii) Major third-party instruments, such as debit and credit cards and net banking.

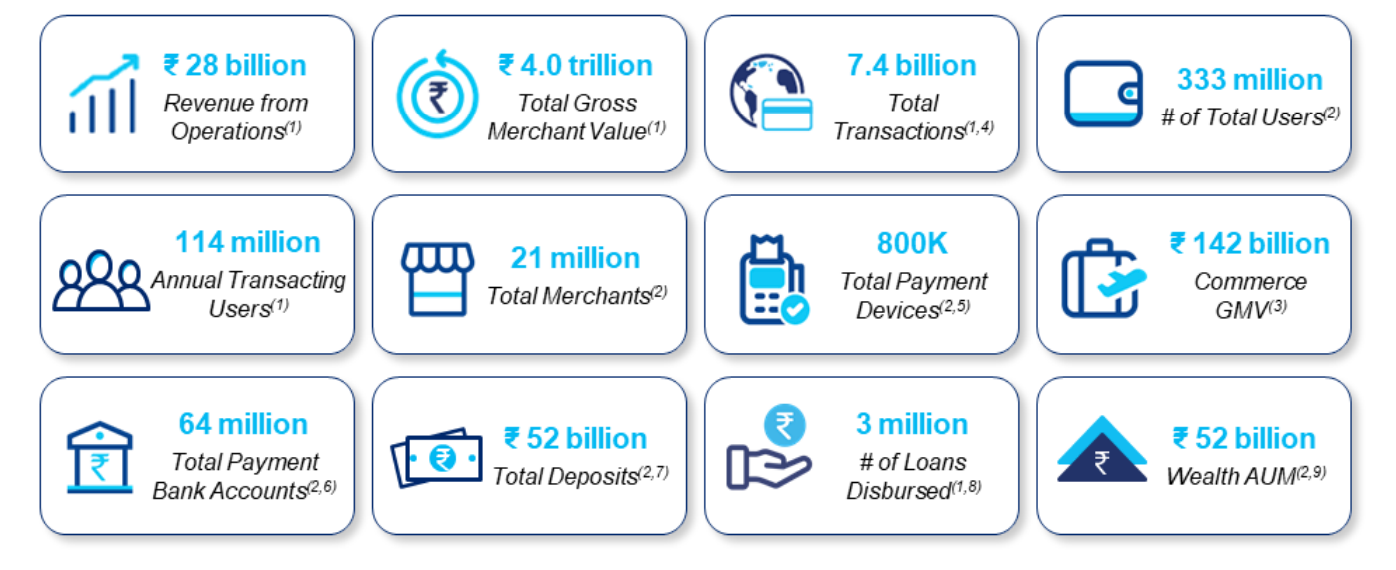

iii. The company’s ecosystem serves 333 million consumers and over 21 million merchants.

Competitive Strengths

i. Trusted brand, scale and reach

ii. Deep insights of Indian consumers and merchants

iii. Leadership and our distinctive culture

Objects of the One 97 Communications Limited IPO (Paytm IPO):

One 97 Communications Limited IPO (Paytm IPO) Details:

| Open Date: | Nov 08 2021 |

| Close Date: | Nov 10 2021 |

| Total Shares: | 8.5 Cr |

| Face Value: | ₹ 1 Per Equity Share |

| Issue Type: | Book Built Issue |

| Issue Size: | 18,300 Cr. |

| Lot Size: | 6 Shares |

| Issue Price: | ₹ 2080-2150 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Nov 18 2021 |

Promoters And Management:

Financials of One 97 Communications Limited IPO (Paytm IPO):

| Particulars (in Cr) | 2021 | 2020 | 2019 |

| Payment and financial services | 2200 | 1900 | 1700 |

| Commerce and cloud services | 690 | 1100 | 1500 |

| Other Operting Income | 0 | 225 | 0 |

| Other Income | 380 | 260 | 347 |

| Total Income | 3270 | 3485 | 3547 |

| Payment Process Expense | 1916 | 2265 | 2257 |

| Marketing Expense | 530 | 1400 | 3408 |

| Other Expenses | 2337 | 2473 | 2078 |

| Total Expenses | 4783 | 6138 | 7743 |

| Profit/Loss | -1513 | -2653 | -4196 |

Comparison With Peers:

Recommendation on One 97 Communications Limited IPO (Paytm IPO):

Lead Manager of One 97 Communications Limited IPO (Paytm IPO):

Registrar of One 97 Communications Limited IPO (Paytm IPO):

Company Address:

Discussion on One 97 Communications Limited IPO (Paytm IPO):

4 Comments

Leave a Reply

You must be logged in to post a comment.

acha hua apply nhi kiya maine..only smart move i made this year

Sir

In view of current subscription figures, should we apply this ipo

Sir what about GMP?

Current GMP is 150 per share.