Fino Payments Bank Limited IPO

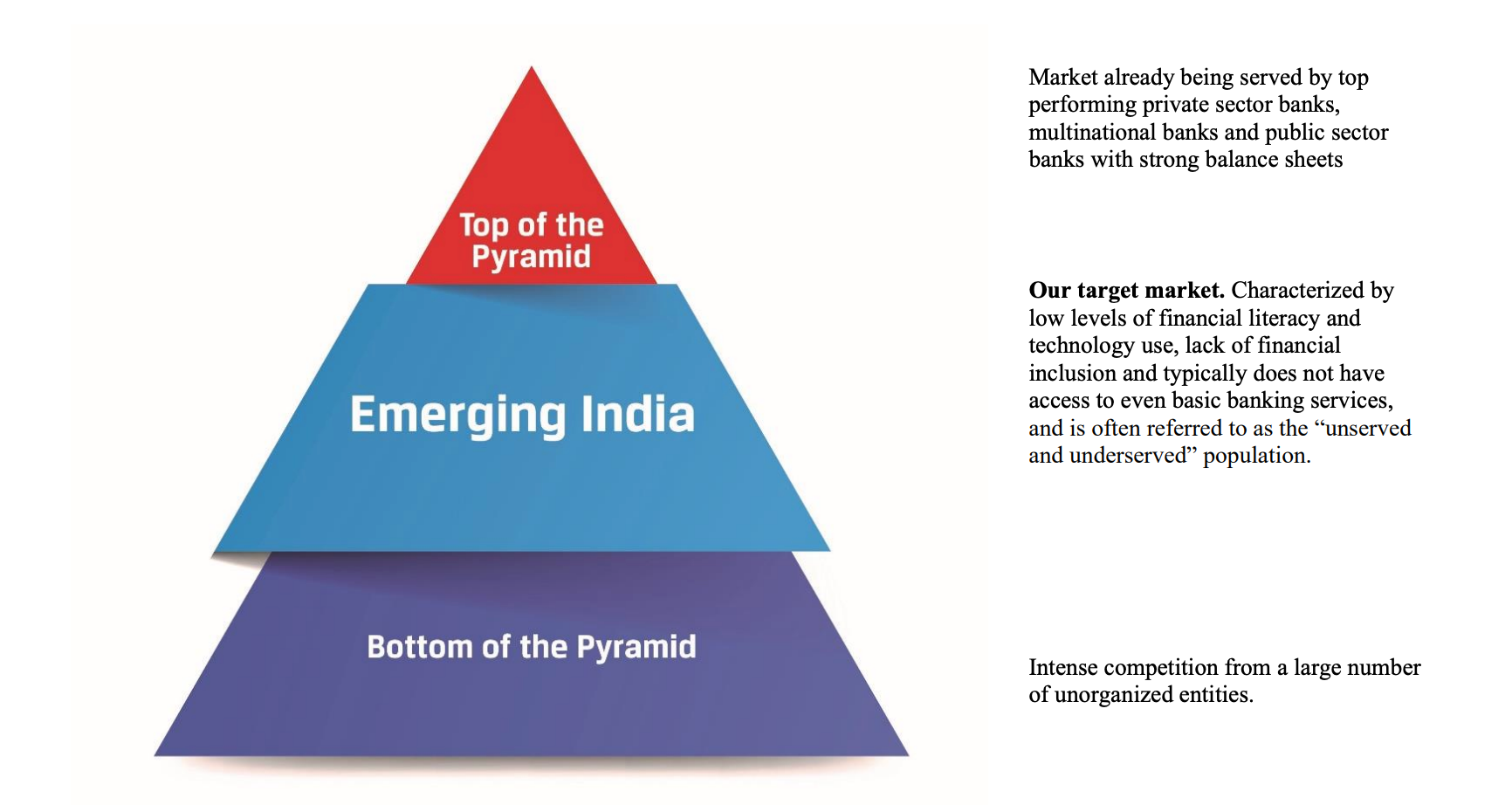

They are a growing fintech company offering a diverse range of financial products and services that are primarily digital and have a payments focus. They offer such products and services to the target market via a pan-India distribution network and proprietary technologies, and since 2017, they have grown the operational presence to cover over 94% of districts as of March 31, 2021.

Fino-Paytech Bank first became profitable in the fourth quarter of financial year 2020 and have been profitable in subsequent quarterly periods. In addition, in the financial years 2019, 2020 and 2021, the platform facilitated approximately 15 Cr, 31 Cr and 43 Cr transactions, respectively and had gross transaction value of ₹456,84 Cr, ₹944,52 Cr and ₹1,329,30 Cr, respectively.T

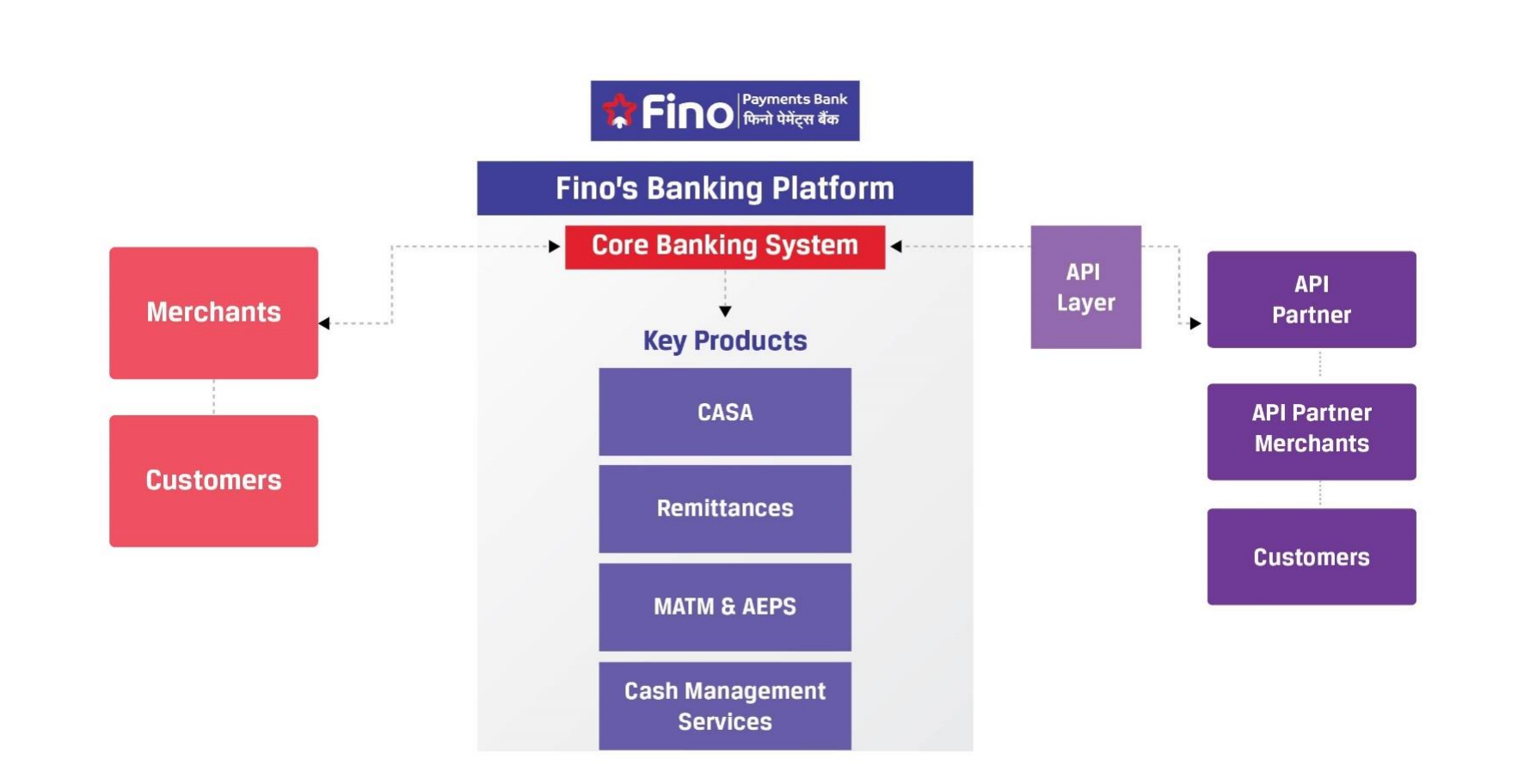

They operate an asset light business model that principally relies on fee and commission based income generated from the merchant network and strategic commercial relationships. Each merchant serves the banking and financial needs of its community, which in turn forms the backbone of the assisted-digital ecosystem, referred to as the “phygital” delivery model (i.e., a combination of physical and digital). The merchant’s use of technology and the use of analytics on the data that they capture enhances the merchant’s ability to cross sell the third party products that they also offer, to the existing customers, thereby increasing the potential revenue and opportunity to further customize the products and services offering. Such a merchant-led distribution model requires minimal capital expenditure cost because the on-boarding and setup capital expenditure costs are borne by the merchant, and accordingly, allows for operating leverage and efficient expansion in a timely manner. Through the “phygital” delivery model the merchants on-board customers and facilitate transactions, ensuring the network grows and the products and services are more accessible to a broader range of customers throughout India, giving Fino-Paytech Bank what they believe to be is a significant advantage compared to the competitors.

They have a strong leadership position within the Indian fintech industry, for instance

a) were ranked third among banks in facilitating digital transactions, as of February 2020 by the Ministry of Electronic & Information Technology;

b) had the largest network of micro-ATMs, as of March, 2021.

c) had the third highest deposit growth rate in financial year 2021.

Some of its products are :

• Current accounts and Savings accounts (CASA),

• Issuance of debit card and related transactions,

• Facilitating domestic remittances,

• Open banking functionality (through their Application Programming Interface),

• Withdrawing and depositing cash (via micro-ATM or Aadhaar Enabled Payment System (AePS) and

• Cash Management Services (CMS).

Competitive Strengths:

i. Unique DTP (Distribution, Technology, Partnership) network helps in better customer servicing

ii. Focus on technology development and in-house technological expertise

iii. Customer-centric and innovative business model

iv. Highly experienced management team

v. Vision of socially inclusiveness and empowerment

Objects of the Fino Payments Bank Limited IPO:

Fino Payments Bank Limited IPO Details:

| Open Date: | Oct 29 2021 |

| Close Date: | Nov 02 2021 |

| Total Shares: | 20802305 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Built Issue |

| Issue Size: | 1200 Cr. |

| Lot Size: | 25 Shares |

| Issue Price: | ₹ 560-577 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Nov 12 2021 |

Promoters And Management:

Financials of Fino Payments Bank Limited IPO:

| Particulars (in Cr) | Mar 21 | Mar 20 | Mar 19 |

| Interest Income | 20 | 18 | 19 |

| Other Income | 770 | 673 | 351 |

| Interest Expended | 9.5 | 9.8 | 5.5 |

| Operating Expense | 756 | 712 | 427 |

| Provisions and Contingencies | 4 | 1 | 0.9 |

| Net Profit/Loss for the year | 20 | -32 | -63 |

| EPS | 2.62 | -4 | -8 |

Comparison With Peers:

Recommendation on Fino Payments Bank Limited IPO:

Lead Manager of Fino Payments Bank Limited IPO:

Registrar of Fino Payments Bank Limited IPO:

Company Address:

Discussion on Fino Payments Bank Limited IPO:

7 Comments

Leave a Reply

You must be logged in to post a comment.

Fino-Payment is India’s first profitable Payment bank to be listed in India….

If you compare with Paytm Payment Bank, it has clocked a revenue of Rs.2000 Crores last year…..

Total Outstanding Shares = 78,014,996

They are expecting Rs.5000 Crores Mcap for Fino-Payment bank….

So, Price band would be around 620-650 per share….

Sir may I know about GMP

Not yet started…

Ok Sir

its 17% sir yesterday