Affle India Limited IPO

Overview of the Company

(i) Affle International, Singapore is the parent company of 13-year old Adtech company Affle (India) Limited which is coming up with an IPO.

They are a global technology company with a proprietary consumer intelligence platform that delivers consumer acquisitions, engagements and transactions through relevant Mobile advertising (the “Consumer Platform”).

The “Consumer Platform” aims to enhance returns on marketing spend through delivering contextual mobile ads and reducing digital ad fraud, while proactively addressing consumer privacy expectations.

(ii) As of March 31, 2019, Affle Consumer Platform had approximately 2.02 billion consumer profiles, of which approximately 571 million were in India, 582 million were in Other Emerging Markets (which comprises Southeast Asia, the Middle East, Africa, and others) and 867 million were in Developed Markets (which comprises North America, Europe, Japan, Korea, and Australia).

During Fiscal 2019, the Affle Consumer Platform accumulated over 300 billion data points, which power their prediction and recommendation algorithm.

How They Earn Revenue?

a) They Primarily earn revenue from their Consumer Platform on a cost per converted user (“CPCU”) basis, which comprises user conversions based on consumer acquisition and transaction models.

The transaction model is usually in the form of a targeted user submitting a lead acquisition form or purchasing a product or service after seeing an advertisement delivered by the Affle.

b) They also earn revenue from their Consumer Platform through awareness and engagement type advertising, which comprises cost per thousand impressions (“CPM”), cost per view (“CPV”) and cost per click (“CPC”) models.

Industry they serve

Their products are used in e-commerce, fin-tech, telecom, media, retail and FMCG companies, both directly and indirectly through their advertising agencies

Asset Light Model

Their Consumer Platform business is asset-light and scalable as shown by the fact that company’s employee benefit expenses, depreciation and amortization expenses, and other expenses have remained relatively unchanged despite significant changes in our revenue in the last three fiscal years.

Objects of the Affle India Limited IPO:

Affle India Limited IPO Details:

| Open Date: | Jul 29 2019 |

| Close Date: | Jul 31 2019 |

| Total Shares: | 6161073 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | book building |

| Issue Size: | 458 Cr. |

| Lot Size: | 20 Shares |

| Issue Price: | ₹ 740-745 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Aug 08 2019 |

Promoters And Management:

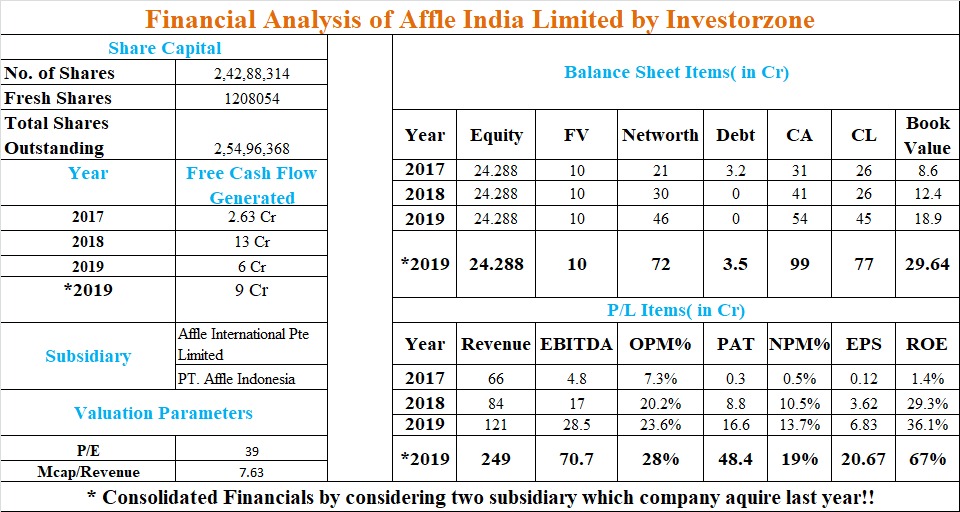

Financials of Affle India Limited IPO:

IZ View

1. The Company on standalone bases has shown excellent CAGR Growth of 35% in Revenue and 643% in PAT.

2. The company OPM % and NPM% have improved handsomely over the years.

3. The business model of the company is as such it is Asset-light and Debt-free.

4. The Valuation is tad expensive and fully priced in.

5. The company has acquired two subsidiaries in 2018-19 that is why Consolidated Financials have been prepared for this year.

6. The Company unlike tech startups not burning investors money but generating free cash which is a healthy sign for the business.

IZ View

1. The Company on standalone bases has shown excellent CAGR Growth of 35% in Revenue and 643% in PAT.

2. The company OPM % and NPM% have improved handsomely over the years.

3. The business model of the company is as such it is Asset-light and Debt-free.

4. The Valuation is tad expensive and fully priced in.

5. The company has acquired two subsidiaries in 2018-19 that is why Consolidated Financials have been prepared for this year.

6. The Company unlike tech startups not burning investors money but generating free cash which is a healthy sign for the business.Comparison With Peers:

Recommendation on Affle India Limited IPO:

Lead Manager of Affle India Limited IPO:

Registrar of Affle India Limited IPO:

Discussion on Affle India Limited IPO:

61 Comments

Leave a Reply

You must be logged in to post a comment.

Fund of affle India ipo is not unblocked till today who applied through bhim UPI. When will it unblocked? Anyone has idea about this please reply. Tq

lost heavy.. bought at 940

brother, who told you to buy at 940? It was very risky to buy at 940 when HNI costing was 960. Lot of HNI sold in the morning when they realize that they are not even able to get their costing and staring at a huge loss which triggered the sell-off. When such a scenario happens where HNI is not even able to get their cost, it is better to buy near IPO price if at all it comes and luckily it came today.

Hi,

I too brought at 940 and actually i have seeen touching 958 but couldnt sell.what is the best price to exit ?

Now this stock has become a long term friend of you. It will take some time to go pass 940 levels. Stay invested. The best price to exit was when you have bought the share. 940-960 was the selling range and 750-790 was the buying range.

Agar aapne stock trading ke liye liya tha toh 900 ka stop loss lagana tha.

Hi

How do we know 960 was HNI price? Now it is decreasing further..shall i exit at 770 levels?

HNI mostly borrow fund from the Banks and apply in IPO for listing gain. There costing in Affle was 215. So 745+215=960, this is the costing for HNI. Anything above would be their profit. So if IPO does not list above 960, the HNIs mostly come to sell so as to reduce the loss. If it goes below 750 then further deep fall may happen.

what is the best price to exit ? i have made some good profit alreaady.

Thank god the price is coming near to your buying price.

yeah it came near my buy price but i sold earlier and didn’t enter later on. am newbie, still learning

thank you for advices and your analysis market wizard

bumper listing…200 per share…appx profit 4k

***************My advice on Affle Listing today************************

The expected listing above 950. In my view, those who applied only for listing gain than anything above 30% from issue price should be the exit point. Though many are saying in the market that it might go above 1100 today. However, I as an individual believe if we get 30% in IPO in just 6 days we should embrace with both hands.

Or if anyone wants to take the risk and want to earn more than 30% then put stop loss at 950 and trade.

Those who book profit above 950 on my recommendation are real winners. The share price is now 861 at 10:38 am.

Hi

Brought 110 shares at 940.share is now trading at 818 will it touch 940 today again? Shall i hold or sell ??

Hold it

I am lucky because no allotment.

I don’t know why I am not getting allotment anytime

Here luck matters the most! because it’s a lottery based!

Karvi still not showing allotment.

From where did u get allotment details?

All are checking their bank debit message.

Allotted 1 lot against 3 lot application

Lucky. Mine got nothing.

Allotment out ..

All the best to all the member got allotment

When allotment?

around 6 aug

Indian stock market crashed near one year low

Will someone who has applied for 10 lots get confirmed 1 lot allotment atleast ?

Any allotment will be pure luck in this IPO…

The allotment is always lottery-based.

subscribed 86 times…huge response from investors

Attn. Members: Please note that the Bid Uploading Session for IPO of AFFLE INDIA LIMITED (AFFLE) for Retail category has been extended upto 7.30 pm.

in the current market scenario ..what will be the listing gain % on affle..???…And should we on day 1 or??

subscription numbers of today and yesterday are not showing any great figures, can anyone suggest is it worth going for this ipo for listing gains.

Can anyone please tell me the steps to apply through new procedure..??

https://youtu.be/UJ394m2Q3rg

30% Gain possible in this IPO.

Can I apply the same using asba..??

no

Yes..

Upi is optional payment mode not mandatory

Affle IPO – *Market Estimates of oversubscription*:

RII = 3.25L Forms = 10.55X Applic. wise (Avg allotment of ~1.90 shares per lot)

NII = 10,000K Crs. = ~145X

Interest cost @8%p.a. for 7days = 114.30paise for 1X

Thus, for NII the costing = 145 X 114.30paise = Rs.166 per share (GMP)

And, for RII the costing = 166 X 1.90 = Rs. ~315/- (Kostak)

Affle IPO – *GMP Expected*

GMP 190/-

Kostak 400/-

Apply in Affle India with full force!!!

Affle ipo

Prm : 140-145

Sub to : 2250

Upi sub to : 2500

Int : 250

Upi appli int : 300

https://www.indianweb2.com/2019/07/26/sebi-mandates-retail-investors-ipo-make-payments-via-upi/

My broker edelweiss didn’t have any knowledge regarding this new upi way to apply for affle India. Didn’t know how to deal with the same.

135/140

Any body can apply ASBA

I don’t think that UPI will be compulsory for this issue as BHIM app is not working properly….

I have savings account with SBI and DMAT account is with Zerodha. Can I apply through SBI online NetBanking ASBA using the Zerodha DMAT beneficiary account?

I don’t (want to) have a 3 in 1 account as Zerodha is my preferred broker for all equity related transactions.

Dear All,

There is rumours in the market that ASBA facility extended for 3 months. *Kindly do not trust on this rumours.*

*Pls note UPI ID is mandatory for all the Retail Investors who wants to submit the applications to the registered brokers.*

Hi.. Can you please explain how to do the same and what are the new procedure to apply for ipo

Please go through this:

https://investorzone.in/how-to-apply-ipo-through-upi-25-07-2019/

Sir it’s not a mandatory to apply with upi.

It’s a additional payment mode.

You also apply with asba facility

AFFLE. 155–165.

Management talk of Affle

https://www.pscp.tv/w/1MnxnvdPpndxO

Affle holding which is selling shares in the IPO has made a handsome return in the last 7 years.

They purchased shares in 2012, 2013, and 2015 at Rs.10 each.

(i) 7,356,790 Equity Shares allotted to Affle Holdings.

(ii) 416,326 Equity Shares allotted to Affle Holdings.

(iii) 1,221,350 Equity Shares allotted to Affle Holdings.

(iv) 554,813 Equity Shares allotted to Affle Holdings.

(v) 2,256,906 Equity Shares allotted to Affle Holdings,

Now they are selling 4,953,020 shares in the IPO @745 each.

According to Frost & Sullivan,

1. Affle is the leading ad tech solution provider in India.

2. As at March 31, 2019, Affle Consumer Platform had approximately 571 million consumer profiles in India.

3. They provide services across the value chain in digital advertising, spanning the areas of DMP, DSP/SSP, fraud detection and ad network and they are one of the very few companies that have products spanning the entire value chain.

4. Further, they have increased their breadth of service offerings, especially to e-commerce and mobile app-driven companies, following the acquisition of Vizury Commerce Business and RevX Platform.

. *Affle (India) Limited*

Issue Open:- 29/07/ 2019

Issue Close:- 31/07/ 2019

Allotment Date:- 06/08/ 2019

Listing Date:- 08/08/ 2019

Price Band ₹740 – ₹745

Min. Order Quantity 20 Shares

Min. Investment ₹ 14,900/=

Listing At BSE, NSE

Issue Allocation QIB:75%, NII:15%, RII:10%.

The threat in the business

1. The legal, regulatory and judicial environment that evolves around data protection and other matters is constantly evolving and can be subject to significant change.

2. This could significantly restrict Affle India ability to collect, process, use, transfer and pool data collected from and about consumers and devices.

3. Stringent Laws in Right to Privacy may affect company’s operation.

They deliver ads on mobile phones. They study the user behavior, their consent, track user browsing history via cookies and provide this data to Advertisement companies. Ad companies then send promotional messages to these potential customers and when they open it, download their app, or buy products, the Affle will get their commission.

Looks a wonderful company to invest on prima facie.