Vedant Fashions Limited IPO (Manyavar IPO)

i. Vedant Fashions is the largest company in India in the men’s Indian wedding and celebration wear segment in terms of revenue, OPBDIT, and profit after tax for the Financial Year 2020. Company focus on spreading India’s vibrant culture, traditions and heritage through the aspirational yet value for money brands at a diverse range of price point.

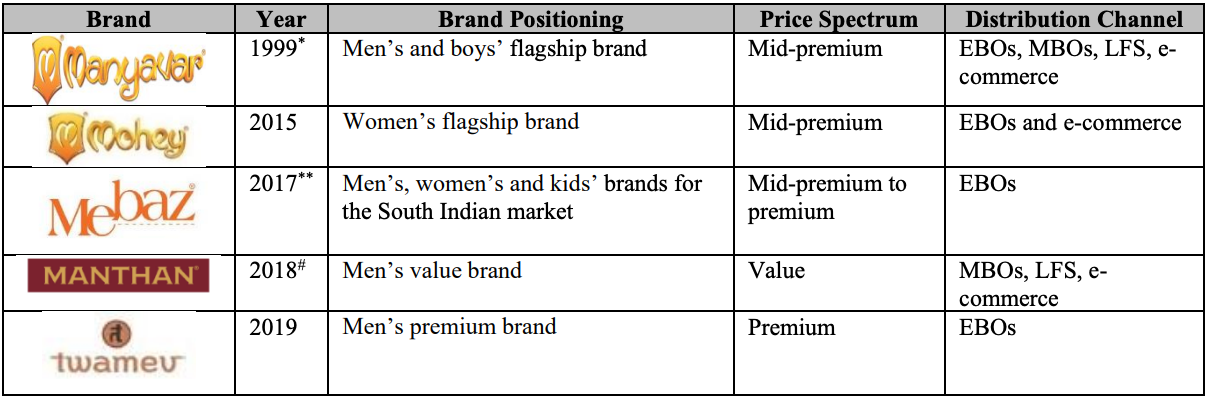

ii. Vedant Fashions is focused on further enhancing its leadership position in the organized Indian wedding and celebration wear market and establishing their dominance in the premium and value segments of the men’s Indian wedding and celebration wear market through their brands, Twamev and Manthan, respectively, and in the women’s Indian wedding and celebration wear market through its brand, Mohey, launched in 2015

iii. Company had a retail footprint of 1.1 million square feet covering 525 EBOs (including 55 shopin-shops) spanning across 207 cities and towns in India, and 12 EBOs overseas across the United States, Canada and the UAE, which are countries with a large Indian diaspora. In addition to its offline retail presence, Their consumers also have the option of placing orders through their website (www.manyavar.com), or mobile application, and through leading lateral e-commerce platforms.

Competitive Strengths

i. Market leader in the Indian celebration wear market with a diverse portfolio of brands catering to the aspirations of the entire family.

ii. Large and growing Indian wedding and celebration wear market is driven by increased spending on such wear. • Differentiated business model combining the strengths of retailing with branded consumer play.

iii. Omni-channel network with the seamless integration of the online and offline channels.

iv. Experienced and professional founder-led leadership team.

Objects of the Vedant Fashions Limited IPO (Manyavar IPO):

Vedant Fashions Limited IPO (Manyavar IPO) Details:

| Open Date: | Feb 04 2022 |

| Close Date: | Feb 08 2022 |

| Total Shares: | 36,364,838 |

| Face Value: | ₹ 1 Per Equity Share |

| Issue Type: | Book Built Issue |

| Issue Size: | 3,149.19 Cr. |

| Lot Size: | 17 Shares |

| Issue Price: | ₹ 824-866 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Feb 16 2022 |

Promoters And Management:

Financials of Vedant Fashions Limited IPO (Manyavar IPO):

| Particulars (in Lakhs) | Sep-21 | Mar-21 | Mar-20 | Mar-19 |

| Sales | 35,984 | 56,482 | 91,555 | 80,074 |

| Cost of Material Consumed | 4,868 | 6,557 | 10,750 | 8,623 |

| Purchases of Stock-In-Trade | 5,821 | 7,076 | 16,824 | 13,674 |

| Changes in Inventories | -1,639 | 1,000 | -2,452 | -38 |

| Employee Benefits Expense | 2,303 | 3,811 | 5,330 | 4,721 |

| Other Expenses | 8,593 | 13,731 | 21,728 | 19,513 |

| Operating Profit | 16,038 | 24,307 | 39,375 | 33,581 |

| OPM % | 44.57% | 43.03% | 43.01% | 41.94% |

| Other Income | 2,745 | 6,020 | 3,243 | 1,906 |

| Interest | 1,224 | 2,582 | 2,561 | 1,963 |

| Depreciation | 4,312 | 9,553 | 8,873 | 6,430 |

| Profit before tax | 13,247 | 18,192 | 31,184 | 27,094 |

| Total Tax Exps | 3,407 | 4,901 | 7,520 | 9,451 |

| Net Profit | 9,841 | 13,290 | 23,664 | 17,643 |

| NPM % | 27.35% | 23.53% | 25.85% | 22.03% |

| No. of shares | 2,427 | 2,427 | 2,427 | 2,427 |

| EPS in Rs | 4.01 | 5.36 | 9.45 | 7.04 |

Comparison With Peers:

Recommendation on Vedant Fashions Limited IPO (Manyavar IPO):

Lead Manager of Vedant Fashions Limited IPO (Manyavar IPO):

Registrar of Vedant Fashions Limited IPO (Manyavar IPO):

Company Address:

Discussion on Vedant Fashions Limited IPO (Manyavar IPO):

3 Comments

Leave a Reply

You must be logged in to post a comment.

Company is good but asking valuation is too high…

Valuation.

1. Total Outstanding Shares = 242,694,774

2. IPO Price = 866

3. Mcap = ~21000 Crores….

4. PAT (FY22) = ~200 Crores

5. EPS = 8.26

6. P/E = 104 ( Very high)….

sir what about GMP?