Ultra Wiring Connectivity Systems Limited IPO

A) The business of the Company

(i) Haryana based Ultra Wiring Connectivity Systems Limited was incorporated in 2005. Ultra Wiring Connectivity Systems Limited is engaged in the business of manufacturing of Couplers, Connectors and Allied products for automobiles.

(ii) The Company has a Manufacturing Plant situated near Delhi at HSIDC Industrial Area, Faridabad. The Company owned a Godown in Pune and an under-construction unit in ‘Industrial Model Town’ of Faridabad.

(iii) The Company is registered as ‘Small Scale Industries (SSI) unit’ with MSME. For improving the quality, Company is also certified as IATF 16949: 2016 by M/s TUV SUD. Empowered with experienced Die & Tool Makers, they follow all necessary Connectors design procedures at par with International Standards. During each Tool Making procedure, they make sure that each Connector structure actually adheres to the International quality guidelines depending on the type of application. At their Tool Room section, they are equipped with 2-D & 3-D facilities for designing of both Mould and Connectors.

(iv) Presently, the Manufacturing Plant is equipped with 26 Fully Automatic – PLC Controlled Injection Moulding Machines supported by a well-equipped Tool-Room, where components are manufactured as per Japanese Standard JASO –D 616-2011 & ISO – 8092. The plant has a total capacity of 120-135 lacs couplers per month on 24 hours 3 shift basis presently, being producing 100-110 lacs couplers per month.

B) Clients of the Company

(i) The company is supplying Couplers to almost all the automobile manufacturers in India. They are approved source for Tata Motors, Bajaj Auto Ltd., Maruti Udyog Ltd, TVS Motors, Kinetic Engg, etc.

(ii) The company is supplying Connectors to many valued customers all over India manufacturing wiring harnesses, switches, lights, etc. for Auto-industries such as Tyco Electronics Ltd., Tata Yazaki Autocomp / Yazaki India Ltd, Minda Group of Industries, Lumax Group of Industries, Fiem Industries Ltd and also exporting to M/s Thai Summit Harmess, Thailand and Fujikura Automotive, Paraguary (SA) etc .

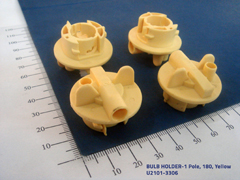

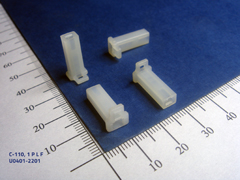

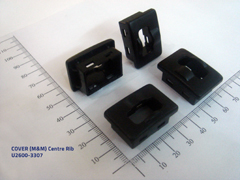

C) Feel of the Products of the Company

D) Awards and Recognition

(i) Best Supplier Award received from Yazaki India for the year 2006-07.

(ii) Best Supplier Award received from Yazaki India for the year 2009.

(iii) Best Supplier Award received from Tata Auto Components Ltd. For the

year 2009.

(iv) Best Supplier Award received from MINDA for the year 2009-10.

Objects of the Ultra Wiring Connectivity Systems Limited IPO:

Ultra Wiring Connectivity Systems Limited IPO Details:

| Open Date: | Oct 12 2018 |

| Close Date: | Oct 17 2018 |

| Total Shares: | 1,376,000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Fixed Price Issue IPO |

| Issue Size: | 4.82 Cr. |

| Lot Size: | 4000 Shares |

| Issue Price: | ₹ 35 Per Equity Share |

| Listing At: | NSE Emerge |

| Listing Date: | Oct 26 2018 |

Promoters And Management:

Capital Structure:

| (i) Authorized Share Capital 55,00,000 Equity shares at FV@10) | 5.5 Cr |

| (ii) Issued, Subscribed,& Paid-up Share Capital Before Issue (38,27,571 Equity Shares at FV@10) | 3.827571 Cr |

| (iii) Present Issue ( 13,76,000 Equity Shares at FV@10) | 1.376 Cr |

| (iv) Reservation for Market Maker (76000 Shares at FV@10) | 7.6 Lakh |

| (v) Reservation for QIB& HNI (6,52,000 Equity Shares at FV@10) | 50% |

| (vi) Reservation for Retail( 6,52,000 Equity Shares at FV@10) | 50% |

| (vii) Paid Up Share Capital after the issue | 5.203 Cr |

| Sr.no | Name of the promoter | No. of shares | Average cost of equity shares |

| 1 | Mr. Sanjay Mathur | 1304600 | 4.61 |

| 2 | Mrs. Archana Mathur | 2522916 | 0.91 |

Financials of Ultra Wiring Connectivity Systems Limited IPO:

| 1. Assets and Liabilities Key Parameters | ||||||||

| Year | Asset(lacs) | Liabilities(lacs) | Net Worth(lacs) | Book Value | Debt(lacs) | D/E (<2) | RONW | Receivable days |

| FY14 | 1,214.19 | 904.11 | 310.08 | 89.10 | 261.00 | 0.84 | 9% | 198 |

| FY15 | 1,256.83 | 908.18 | 348.65 | 100.19 | 306.00 | 0.88 | 11% | 184 |

| FY16 | 1,383.64 | 978.46 | 405.18 | 116.43 | 297.00 | 0.73 | 14% | 193 |

| FY17 | 1,525.09 | 1,045.71 | 479.38 | 137.75 | 351.00 | 0.73 | 16% | 209 |

| 11MFY18 | 1,841.81 | 1,258.22 | 583.59 | 15.25 | 330.00 | 0.57 | 18% | 236 |

| Post Issue | 1065.19 | 20.47 | 0.31 | 10% | ||||

| 2. Profit n Loss Key Parameters | ||||||

| Year | Revenue(lacs) | PAT(lacs) | EBITDA Margins | Profit Margins | Outstanding Shares(lacs) | EPS |

| FY14 | 1,125.91 | 27.46 | 7.3% | 2.4% | 3.48 | 7.89 |

| FY15 | 1,234.12 | 39.93 | 8.4% | 3.2% | 3.48 | 11.47 |

| FY16 | 1,393.77 | 56.54 | 8.7% | 4.1% | 3.48 | 16.25 |

| FY17 | 1,518.20 | 74.83 | 10.3% | 4.9% | 3.48 | 21.50 |

| 11MFY18 | 1,626.78 | 104.21 | 12.1% | 6.4% | 38.276 | 2.72 |

| Post Issue | 52.036 | 2.00 | ||||

| 3. Cash Flow Statement(all figures in lacs) | |||||

| Particulars | FY18 | FY17 | FY16 | FY15 | FY14 |

| (i) Net Cash Generated from Operation | 152.63 | -32.28 | 92.81 | 10.2 | 59.39 |

| (ii) Net Cash Generated from Investment | -81.54 | -57.31 | -35.23 | -37.11 | -152.47 |

| (iii) Net Cash Generated from Financing Activity | -40.49 | 46.45 | -23.19 | 13.44 | 96.58 |

| (iv) Total[ (i)+(ii)+(iii) ] | 30.6 | -43.14 | 34.39 | -13.47 | 3.5 |

| (v) Cash and Cash Equivalents at the Beginning of the Year | 5.62 | 48.75 | 14.36 | 27.84 | 24.33 |

| (vi) Cash and Cash Equivalents at the end of the Year | 36.22 | 5.61 | 48.75 | 14.37 | 27.83 |

| Year | Revenue( lacs) | Receivables(lacs) | Receivables/Revenues |

| 2014 | 1,125.91 | 610.68 | 54% |

| 2015 | 1,234.12 | 620.95 | 50% |

| 2016 | 1,393.77 | 737.03 | 53% |

| 2017 | 1,518.20 | 867.51 | 57% |

| 11M2018 | 1,626.78 | 1,053.39 | 65% |

| Year | Outstanding < 6 months(lacs) | Outstanding > 6 months(lacs) |

| 2014 | 569.88 | 40.8 |

| 2015 | 620.95 | 0 |

| 2016 | 630.29 | 106.74 |

| 2017 | 679.09 | 188.42 |

| 11M2018 | 984.19 | 69.2 |

Comparison With Peers:

Recommendation on Ultra Wiring Connectivity Systems Limited IPO:

Lead Manager of Ultra Wiring Connectivity Systems Limited IPO:

Registrar of Ultra Wiring Connectivity Systems Limited IPO:

Company Address:

Bid Details of Ultra Wiring Connectivity Systems Limited IPO as on

17-Oct-2018 17:00:00 IST

| Category | No.of shares offered | No. of shares bid |

|---|---|---|

| 652,000 | 1,376,000 | |

| 652,000 | 1,148,000 | |

| 72,000 | 72,000 | |

| 1,376,000 | 2,596,000 |

| QIBs | No |

| QIBs+HNIs Subscription | 2.11X |

| Retail Subscription | 1.76X |

| Total Subscription | 1.94X |

Discussion on Ultra Wiring Connectivity Systems Limited IPO:

12 Comments

Leave a Reply

You must be logged in to post a comment.

I think Pantomath is best LM for SME

Yes. Absolutely correct.

Listing in discount. This is the problem. SME with No Support from LM is facing this heat.

Applied 3 allotted 1 and sold at 1500 to my broker.

Yes… An allotment is Out… Listing Should be positive….

Allotment Out on Bigshare

Very good ipo must apply

Can u throw some light to substantiate your view?

Pura week Nifty 9800 ke target Dene waalo ,

Raat Me Dow Jones dikha ke darane waalo ,

#Friday ko Big Gap Down Below 10000 Kehne walo ,

Janta #Maaf #Nahi Karegi

😄😄

EPS story based on FY18 Financials(Pre-Issue)

1. PAT= 118 Lakh

2. Outstanding Shares= 38.286 Laks

3. EPS=3.08

4. P/E=11.36

EPS story based on FY18 Financials(Post-Issue)

1. PAT= 118 Lakh

2. Outstanding Shares= 52.036 Laks

3. EPS=2.26

4. P/E=15.28

Conclusion: The Issue is reasonably priced.

The Promoters of the company Mrs. Archana Mathur and Mr. Sanjay Mathur are also running sole proprietorship firm in the name of:

A> Ultra Auto Components

(i) Proprietor of M/s Ultra Auto Components- Mrs. Archana Mathur

(ii) Profit- 14 lakh(2015), 16 lakh(2016) and 27 lakh(2017).

(iii) Business- The firm is engaged in manufacturing of blade fuse, mini fuse and micro fuse which are mainly used in automobiles.

B> M/s Ultra Harness Industries

(i) The proprietor of M/s Ultra Auto Components- Mr. Sanjay Mathur

(ii) Profit- 20 lakh(2015), 33 lakh(2016) and 50 lakh(2017).

(iii) Business- The firm is engaged in manufacturing of plastic components for the automobile industry.

Although management has clarified that the business of the proprietorships firms is different from the business of Ultra wiring Connectivity Limited. However, in future nothing can be guaranteed that they will not change their business line in similar to the business of the Ultra Wiring.

The Company caters to Automobile Sector. The Growth of the company directly depends upon the growth of this sector. Let us understand how this sector is performing.

(i) The Indian auto-components industry can be broadly classified into the organized and unorganized sectors. The organized sector caters to the Original Equipment Manufacturers (OEMs) and consists of high-value precision instruments while the unorganized sector comprises low-valued products and caters mostly to the aftermarket category.

(ii) The total value of India’s automotive aftermarket stood at Rs 56,098 Crore (US$ 8.4 billion) in FY 2016-17.

(iii) The Indian automotive aftermarket is expected to grow at a CAGR of 10% and reach Rs 75,705 crore (US$ 13 billion) by the year 2019-20, according to the Automotive Component Manufacturers Association of India (ACMA).