Synergy Green Industries Limited IPO

(i) Synergy Green Industries Limited (SGIL), was incorporated in the year 2010 is engaged in the business of foundry i.e. Manufacturing of Castings, Industrial Castings, Turbine Castings, Metal Castings, Steel Castings and Windmill Parts. The Company Started as a green filed foundry project in 2011 and entered in commercial operation in June 2012.

(ii) The Company provides casting to two industries:

a) Wind Industries

b) Non-Wind Industries(Mining, Pumps & Plastic Injection parts )

So we can say that the growth of the company depends upon the performance of the above two industries. Let us see how these industries have performed over the years and what are the challenges faced by the industries.

Wind Industries

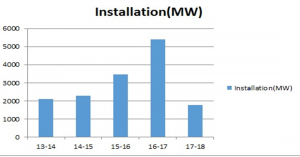

During 2017-18 Indian wind installations dipped by 2/3rd to 1762 MW. This drop was mainly on account of transformation from the feed-in tariff system to reverse bidding method. New reverse bidding era brought down the unit KWH power tariff by 50% to below Rs 2.50. Excepting USA & China, the majority of countries have implemented reverse bidding system for renewable power. That is why we have seen how Wind Energy companies such as Inox Wind and Suzlon have not performed well. In fact, Inox Wind is one of the clients of Synergy Green Industries. However, management is confident that introduction of the reverse bidding process, the government’s priority towards renewable to protect environment & reduce foreign currency outflow through oil imports, and supported by GST reform, Indian wind industry is projected to attain 10 GW of annual installation within the short period of two years.

Non-wind Industries

Apart from Wind Turbine Industry, company is also producing castings to Mining, Pumps & Plastic Injection parts. Looking at India’s growth story, these industries are also offering huge growth opportunities for large castings. During FY 2017-18, non-wind segment contributed 24% of revenue and expected to reach 33% during the next two years.

(iii) Opportunities in the Market

(a) Each MW of wind turbine requires 15 MT of castings and global wind casting demand is around 7,50,000 MT. Indian wind casting demand is likely to reach 1,50,000 with 10 GW of annual installations. With the global export of wind turbine assemblies from India, total casting demand is likely to exceed 2,00,000 MT.

(b)The company established as a leading wind turbine casting manufacturer in the country with supplies to all leading wind turbine manufacturers in the world. Considering India and global demand, there is a great opportunity for the company to capture 10% of the global market share and offers >30% CAGR for the next 5 years period.

(iv) Client Base

The Company has maintained a long-standing relationship with its major customers such as like M/s Vestas, Denmark , M/s Gamesa, M/s GE Renewable and M/s Enercon Germany, M/s ZF and M/s Siemens.

Objects of the Synergy Green Industries Limited IPO:

Synergy Green Industries Limited IPO Details:

| Open Date: | Sep 04 2018 |

| Close Date: | Sep 11 2018 |

| Total Shares: | 3,780,000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Fixed Price Issue IPO |

| Issue Size: | 26.46 Cr. |

| Lot Size: | 2000 Shares |

| Issue Price: | ₹ 70 Per Equity Share |

| Listing At: | BSE SME |

| Listing Date: | Sep 21 2018 |

Promoters And Management:

Financials of Synergy Green Industries Limited IPO:

| Particulars | For the year/period ended (in Rs. Lakhs) | |||||

|---|---|---|---|---|---|---|

| 31-Mac-18 | 31-Mar-17 | 31-Mar-16 | 31-Mar-15 | 31-Mar-14 | 31-Mar-13 | |

| Total Assets | 10,835.50 | 9,178.72 | 8,253.32 | 6,885.80 | 6,514.79 | 5,959.28 |

| Total Revenue | 10312.99 | 12,067.19 | 8,259.66 | 6,384.93 | 3,723.83 | 954.44 |

| Profit After Tax | 466.42 | 485.96 | 155.21 | (685.06) | (901.51) | (905.28) |

Comparison With Peers:

Recommendation on Synergy Green Industries Limited IPO:

Lead Manager of Synergy Green Industries Limited IPO:

Registrar of Synergy Green Industries Limited IPO:

Company Address:

Bid Details of Synergy Green Industries Limited IPO as on

11 Sep 2018 | 11:58:03 PM

| Category | No.of shares offered | No. of shares bid |

|---|---|---|

| 1,794,000 | 3,400,000 | |

| 1,794,000 | 640,000 | |

| 192,000 | 192,000 | |

| 3,780,000 | 4,232,000 |

| QIBs | Yes |

| QIBs+HNIs Subscription | 1.90X |

| Retail Subscription | 0.36X |

| Total Subscription | 1.13X |

Discussion on Synergy Green Industries Limited IPO:

6 Comments

Leave a Reply

You must be logged in to post a comment.

Synergy Green Industries Ltd (World Class Plant) No.1 in Efficiency in India ..

Potential to become India’s No.1 in Casting, Currently does single cast of 17 MT +

Order Book 350 Cr +

From World Leaders Vestas Denmark, Siemens Germany, ZF Germany..

FY20 EBIDTA 55-58 Cr

Pre money 72 Cr

Mcap on listing 98 Cr

Roce 40%+

WC 22 days

Asset turn 3 times +

Debt only Rs.17 Cr

Funds raised in IPO Rs.26.4 Cr

MIT Endowment Fund bought 14 Lakh Shares,

Old Bridge – Kenneth Andrade bought 2 Lakh Shares in IPO @ Rs.70/-

Listing today on BSE SME Exchange.

SYNERGY GREEN extended to 11th

The company has a negative net worth since inception in 2013 due to heavy losses occurred till 2015.

Debt Story as on FY18

(a) Long-term Debt= 27 Cr

(b) Short-Term Debt= 9 Cr

(c) Shareholder’s Equity= 8.97 Cr( Company has negative Reserves of 12 Cr)

(d) D/E= 4.01

Conclusion: The Company has a huge D/E on books as on FY18.

The PAT in the year 2017-18 has gone down to 4.6 Cr as compared to 4.85 last year mainly due to due to a steep increase in raw material prices.

P/E as on FY18(before the issue)

a) PAT= 4.6 Cr

b) Outstanding Shares[ Equity Shares-1.03 Cr and Prefrenece Shares-0.1071 Cr]= 1.41 Cr

c) EPS= 4.46( Only Equity Shares are considered)

d) P/E= 15.69

P/E as on FY18(before the issue)

a) PAT= 4.6 Cr

b) Outstanding Shares[ Equity Shares-1.413 Cr and Prefrenece Shares-0.1071 Cr]= 1.52 Cr

c) EPS= 3.255 ( Only Equity Shares are considered)

d) P/E= 21.50

The company provides casting to the companies working in the Wind and Non-Wind Energy sector. The Wind Energy sector has contributed 75% of the company revenue in 2017-18. The companies which are working in the Wind Industry sector such as Inox Wind and Suzlon have not performed well lately. The management is confident that the coming years would be good for the company but I would suggest waiting for at least 1-2 quarters to see how the company performs than we can think of investment.