Rategain Travel Technologies Limited IPO

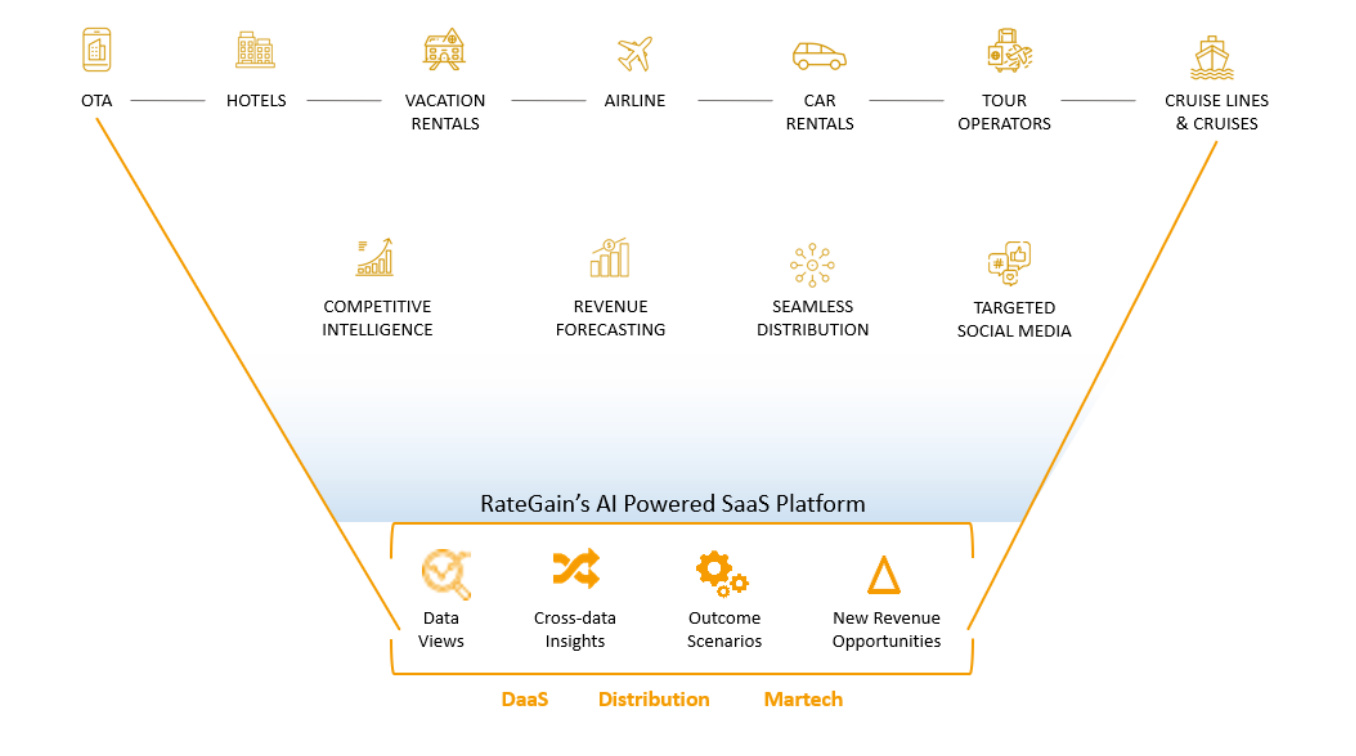

i. The company’s mission is to be the leading revenue maximization platform for the hospitality and travel industry. They offer an integrated technology platform powered by artificial intelligence enabling our customers to increase their revenue through customer acquisition, retention and wallet share expansion

ii. They are among the leading distribution technology companies globally and are the largest Software as a Service (“SaaS”) company in the hospitality and travel industry in India. They offer travel and hospitality solutions across a wide spectrum of verticals including hotels, airlines, online travel agents (“OTAs”), meta-search companies, vacation rentals, package providers, car rentals, rail, travel management companies, cruises and ferries. They are one of the largest aggregators of data points in the world for the hospitality and travel industry.

iii. They offer a suite of inter-connected products that manage the revenue creation value chain for our customers by leveraging our big-data capabilities and integration with other technology platforms helping hospitality and travel providers acquire more guests, retain them via personalized guest experiences and seek to maximize their margins.

iv. Rategain Travel delivers travel and hospitality technology solutions through the SaaS platform through 3 business units

1. Data as a Service (DaaS)

2. Distribution, and

3. Marketing Technology (MarTech).

v. The business serves over 1400 customers including 8 Global Fortune 500 Companies. Six Continents Hotels, InterContinental Hotels Group, Kessler Collection, Lemon Tree Hotels, Oyo Hotels, and Homes Pvt Ltd are some of the marquee customers served by the company.

Competitive Strengths

i. Marquee global customers with long-term relationships

ii. Innovative AI driven industry relevant SaaS solutions

iii. Diverse and comprehensive portfolio

Objects of the Rategain Travel Technologies Limited IPO:

Rategain Travel Technologies Limited IPO Details:

| Open Date: | Dec 07 2021 |

| Close Date: | Dec 09 2021 |

| Total Shares: | 31429176 |

| Face Value: | ₹ 1 Per Equity Share |

| Issue Type: | Book Built Issue |

| Issue Size: | 1,335.74 Cr. |

| Lot Size: | 35 Shares |

| Issue Price: | ₹ 405 - 425 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Dec 17 2021 |

Promoters And Management:

Financials of Rategain Travel Technologies Limited IPO:

| Particulars (in Millions) | Mar 21 | Mar 20 |

| Revenue | 2,508 | 3,987 |

| Employee benefits expense | 1,512 | 2,058 |

| Impairment of goodwill | 537 | |

| Other expenses | 933 | 1,642 |

| Operating profit | 62 | -250 |

| OPM % | 2% | -6% |

| Other Income | 132 | 588 |

| Finance Cost | 82 | 89 |

| Depreciation | 358 | 426 |

| Profit Before tax | -246 | -177 |

| Profit After Tax | -279 | -128 |

| EPS | -3.09 | -2.27 |

Comparison With Peers:

Recommendation on Rategain Travel Technologies Limited IPO:

Lead Manager of Rategain Travel Technologies Limited IPO:

Registrar of Rategain Travel Technologies Limited IPO:

Company Address:

Discussion on Rategain Travel Technologies Limited IPO:

1 Comment

Leave a Reply

You must be logged in to post a comment.

avoid.