Nureca IPO

1. Nureca is basically a B2C (Business to Customer) type of company wherein they sell home healthcare and wellness product.

2. Founded in 2016, the company is promoted by Sanjay Goyal, and Aryan Goyal, who were also promoters in troubling company Nectar Life Sciences along with their father Mr. Sanjiv Goyal. However, just before the IPO i.e. in Oct-2020, both the sons have resigned from Nectar Life Sciences, gifted shares to their father and signed a family partition deed.

Read about Nectar Life Sciences here

3. Products of the Naureca

(i) Chronic Device Products – which includes products such as blood pressure monitors, pulse oximeters, thermometers, nebulizers, self monitoring glucose devices, humidifier and steamers.

(ii) Orthopedic Products – which includes rehabilitation products such as wheelchairs, walkers, lumbar and tailbone supports and physiotherapy electric massagers.

(iii) Mother and Child Products – which includes products such as breast pumps, bottle sterilizers, bottle warmers, car seats and baby carry cots.

(iv) Nutrition Supplements – which includes products such as fish oil, multivitamins, probiotics, botin, apple cider and vinegar.

(v) Lifestyle Products – which includes products such as smart scales, aroma diffusers and fitness tracker.

Naureca sells its products under the brand name of Dr. Trust., Dr. Physio and Trumom. You can check the reviews of the products on Amazon to know more about them.

4. How they sell?

Naureca sells products via third party e-commerce websites such as Flipkart, Amazon etc. retailers and distributors and through its own website dtrust.in

5. Manufacturing?

Naureca do not have any manufacturing of their own. They procure products from third-party manufacturers as per their own design and specification requirements.

6. Financial Performance

The revenue from operations on a consolidated basis was ;

3MFY21 = 30 Crores (during corona time, the demand for Oximeter, and other medical equipment’s rises manifolds as people can’t venture out for regular checkups and Oxygen needs to be monitored on daily basis for corona patient)

FY20 = ₹99 Crores

FY19 = ₹61 Crores

FY18 = ₹20 Crores

The revenue from operations has grown at a CAGR of 122.68% during Fiscal 2018 to 2020.

7. Regulations

The medical line of business in which company is selling products is highly regulated. Most of the products before selling in the market have to be passed by Indian Food and Drugs Administration. Moreover, the manufacturing facilities and processes used by the suppliers for manufacturing Nureca products should be approved by the FDA and their respective regulators.

8. Industry Analysis

a) Healthcare expenditure per Capita in India was Rs. 5460 in 2019, which places total health expenditure at 3.5% of GDP, much lower than the global average of 11%. m. In 2018, International Monetary fund had identified poor state of public health as the 12th most important hurdle for ease of doing business, ahead of

tax, crime, regulations and policy instability in the country.

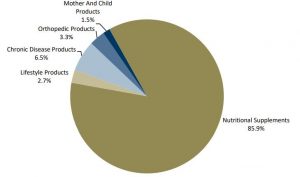

b) The Home Health Market in India and neighbouring countries is estimated at ₹ 20,757.0 Cr in 2019 and is expected to grow to ₹ 38,920.7 Cr by 2025 at a CAGR 11.0%. Nutritional Supplements Segment forms ~86% of the total Home Health Market, followed by Chronic Disease Products segment at 6.5%.

Objects of the Nureca IPO:

Nureca IPO Details:

| Open Date: | Feb 15 2021 |

| Close Date: | Feb 17 2021 |

| Total Shares: | 2500000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 100 Cr. |

| Lot Size: | 35 Shares |

| Issue Price: | ₹ 390-400 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Feb 24 2021 |

Promoters And Management:

Financials of Nureca IPO:

| Year | Revenue | EBITDA | OPM | PAT | NPM | Shares | F.V. | EPS | NW | RONW |

| 2018 | 20 | 5 | 25.00% | 3 | 15.00% | 1.00 | 10 | 3 | 2 | 150% |

| 2019 | 61 | 9 | 14.75% | 6 | 9.84% | 1.00 | 10 | 6 | 8 | 75% |

| 2020 | 99 | 9 | 9.09% | 6 | 6.06% | 1.00 | 10 | 6 | 15 | 40% |

| 6MFY21 | 120 | 50 | 41% | 36 | 30.00% | 1.00 | 10 | 36 | 51 | 70% |

Comparison With Peers:

Recommendation on Nureca IPO:

Lead Manager of Nureca IPO:

Registrar of Nureca IPO:

Discussion on Nureca IPO:

13 Comments

Leave a Reply

You must be logged in to post a comment.

Current price is 500

Pre-IPO link.

https://www1.nseindia.com/live_market/dynaContent/live_watch/pre_open_market/pre_open_market.htm

No Allotment in 3 Applications.

Nureca GMP 50

Subscription as on 17.02.2021 at 5:00 pm

1. Qualified Institutional = 3.10 x

2. Non Institutional = 31.59 x

3. Retail Individual = 166.58x

Subscription as on 17.02.2021 at 4:40 pm

1. Qualified Institutional = 3.10 x

2. Non Institutional = 31.59 x

3. Retail Individual = 166.02x

Subscription as on 17.02.2021 at 4:20 pm

1. Qualified Institutional = 3.10 x

2. Non Institutional = 31.59 x

3. Retail Individual = 164.37x

Subscription as on 17.02.2021 at 2:50 pm

1. Qualified Institutional = 2.70 x

2. Non Institutional = 9.37 x

3. Retail Individual = 137.51 x

Very small ipo

Only 7142 app for one time in retail

Apply for listing gain.

GMP update of Nureca please

Umesh sir, Aniketiaf

Just before the IPO, the company has issued 5 Lakh shares for Rs. 100 per share to the following shareholders.

1. Yash Shares and Stock Private Limited = 441000

2. Tushar Bhupatlal Sarda = 30000

3. Neha Bhall = 10000

4. Vinayak Sharma = 3000

etc.

As on filing DRHP, Nureca IPO has outstanding shares of 75 Lakh.

In the IPO, company is issuing 25 Lakh shares for raising 100 Crores.

Total Shares after IPO = 1 Cr.

Mcap = 400*1 Cr = 400 Crores.

Revenue (FY20) = 100 Crores.

Mcap/Revenue= 4x (high)