India Pesticides Limited IPO

India Pesticides Limited IPO is an R&D-driven agrochemical producer of technical with a developing Formulation business. It is among the quickest developing agrochemical organizations in India in terms of volume in Fiscal 2020. It is likewise the sole Indian producer and among the top five makers internationally for a few technical, for example, Folpet and Thiocarbamate Herbicide.

Since commencing the operations in 1984, they have diversified into manufacturing herbicide and fungicide technical and active pharmaceutical ingredients (“APIs”). They also manufacture herbicide, insecticide and fungicide Formulations.

Business Model of India Pesticides IPO

They have two distinct operating verticals, namely,

Technicals

a) They manufacture generic Technicals that are used in the manufacture of fungicides and herbicides as well as APIs with applications in dermatological products.

Certain key fungicide Technicals they manufacture include:

a1) Folpet, used to manufacture fungicides that control fungal growth at vineyards, cereals, crops and biocide in paints.

a2) Cymoxanil, used to manufacture fungicides that control downy mildews of grapes, potatoes, vegetables and several other crops.

a3) Major herbicide Technicals they manufacture include 135 Thiocarbamate herbicides that have application in field crops, such as, wheat and rice, and are used globally.

APIs

APIs are substances or a mixture of substances intended to be used in the manufacture of a drug (medicinal) product and that when used in the production of a drug becomes an active ingredient of the drug/ product.

Anti-scabies drug– Used in the treatment of scabies and peduclosis.

Anti-fungal drug – Fungicidal drug that acts on fungal hyphae and inhibits squalene epioxidase.

Formulations

They manufacture and sell various formulations of insecticides, fungicide and herbicides, growth regulators and Acaricides, which are ready-to-use products. As of September 30, 2020, they manufacture over 30 Formulations that include Takatvar, IPL Ziram-27, IPL Dollar, IPL Soldier and IPL Guru.

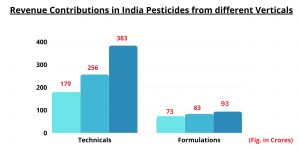

Revenue Contribution of Technicals and Formulations

Strong Focus on R&D

They have a strategic focus on R&D and the R&D capabilities include two well-equipped in-house laboratories registered with the DSIR. The efforts are led by a dedicated R&D team that comprises PhDs, masters graduates in chemistry and a biotechnological engineer. The R&D efforts have led to development of processes to manufacture three generic off-patent Technicals since Fiscal 2018 and they are currently in the process of developing processes for certain Technicals, including two fungicides, two herbicides, two insecticides and two intermediates.

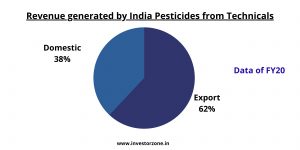

As of September 30, 2020, their technical are sent out to more than 20 nations remembering Australia and different nations for Europe, Asia, and Africa.

Clients Base of India Pesticides IPO

It has a different client base that incorporates crop security item fabricating organizations, for example, Syngenta Asia Pacific Pte. Ltd, UPL Limited, ASCENZA AGRO, S.A., Conquest Crop Protection Pty Ltd, Sharda Cropchem Limited, and Stotras Pty Ltd. Company has set up associations with the clients a large number of whom have been related with the Company for more than 10 years.

Manufacturing Units of India Pesticides IPO

They currently have two manufacturing facilities located at UPSIDC Industrial Area at Dewa Road, Lucknow and Sandila, Hardoi in Uttar Pradesh, India that are spread across over 25 acres.

As of September 30, 2020, the aggregate installed capacity of the manufacturing facilities for agro-chemical Technicals was 19,500 MT and Formulations was 6,500 MT. The manufacturing facilities are equipped with modern plant and machinery capable of producing quality Technicals and Formulations.

Products approval taken from CIBRC

As of the date of this Draft Red Herring Prospectus, they have obtained registrations and license to manufacture from the CIBRC and the Department of Agriculture, Uttar-Pradesh for 22 agro-chemical Technicals and 124 Formulations for sale in India and 27 agro-chemical Technicals and 34 Formulations for export.

Competitive Strengths of India Pesticides IPO

(i) Strong R&D and product development capabilities.

(ii) Diversified portfolio of niche and quality specialized products.

(iii) Long-term relationship with key customers.

(iv) Strong sourcing capabilities and extensive distribution network.

Risk in the Business

(i) They are engaged in the manufacture of Technicals and Formulations and these products are required to obtain regulatory pre-approval. As per Section 9 of the Insecticides Act, any person desiring to 28 import or manufacture any insecticide may apply to the registration committee, i.e. CIBRC, for registration of such insecticide and there is a separate registration for each insecticide.

So, if they won’t get approval for new products then launching them in the market would be difficult.

(ii) The agro-chemicals industry is characterised by technological advancements, introduction of innovative products, price fluctuations and intense competition. The laws and regulations applicable to the products, and the customers’ product and service needs, change from time to time, and regulatory changes may render the products and technologies non-compliant or obsolete.

(iii) As they are dependent on Agriculture sector, any adverse conditions early in the season, especially drought conditions, can result in significantly lower than normal plantings of crops and therefore lower demand for crop protection products.

(iv) They use third party transportation providers for the supply of the raw materials and delivery of the products to domestic customers. So, they are not a vertical integrated company.

Objects of the India Pesticides Limited IPO:

India Pesticides Limited IPO Details:

| Open Date: | Jun 23 2021 |

| Close Date: | Jun 25 2021 |

| Total Shares: | 27027027 |

| Face Value: | ₹ 1 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 800 Cr. |

| Lot Size: | 50 Shares |

| Issue Price: | ₹ 290-296 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Jul 05 2021 |

Promoters And Management:

Financials of India Pesticides Limited IPO:

| Particulars (in Cr.) | Mar-21 | Mar-20 | Mar-19 |

| Sales | 648 | 479 | 340 |

| Cost of Material Consumed | 330 | 256 | 194 |

| Change in Inventories | -19 | -3 | -7 |

| Employee Benefits Expense | 22 | 16 | 13 |

| Other Expenses | 132 | 116 | 74 |

| Operating Profit | 183 | 93 | 65 |

| OPM % | 28.21% | 19.51% | 19.16% |

| Other Income | 6 | 10 | 5 |

| Interest | 3 | 5 | 5 |

| Depreciation | 6 | 5 | 3 |

| Profit before tax | 179 | 93 | 61 |

| Total Tax Exps | 45 | 22 | 17 |

| Net Profit | 134 | 70 | 43 |

| NPM % | 20.73% | 14.76% | 12.89% |

| No. of shares | 11.18 | 3.18 | 3.18 |

| EPS in Rs | 12 | 6 | 4 |

Comparison With Peers:

| Peers | Sales (FY21) | 3-year Revenue Growth | 3-year PAT Growth | OPM (FY21) | ROE (FY21) | D/E | P/E |

| UPL | 38000 Cr | 33% | 38% | 22% | 14.00% | 1.71x | 21x |

| PI Industries | 4577 Cr | 27% | 34% | 22% | 14% | 0.048x | 58x |

| Sumitomo Chemical | 2643 Cr | 9% | 43% | 18% | 23% | 0 | 54x |

| Rallis India | 2429 Cr | 11% | 22% | 13% | 14.50% | 0 | 31x |

| Dhanuka Agritech Limited | 1387 Cr | 17% | 36% | 19% | 26.00% | 0 | 21x |

| Bharat Rasayan | 1093 Cr | 5% | 17% | 20% | 23.00% | 0 | 34x |

| India Pesticides | 648 Cr | 36% | 100% | 28% | 34% | 0.00 | 24x |

Recommendation on India Pesticides Limited IPO:

Lead Manager of India Pesticides Limited IPO:

Registrar of India Pesticides Limited IPO:

Company Address:

Discussion on India Pesticides Limited IPO:

1 Comment

Leave a Reply

You must be logged in to post a comment.

apply or not?