Glenmark Life Sciences IPO

About Glenmark Life-Sciences IPO

(i) Glenmark Life-Science IPO is a leading API manufacturer in India, and it is a subsidiary of Glenmark Pharmaceuticals.

What is API?

It is a chemical compound that is the most important raw material to produce a finished medicine.

(ii) Glenmark Life-Science IPO is a developer and manufacturer of select high value, non-commoditized active pharmaceutical ingredients (“APIs”) in chronic therapeutic areas, including cardiovascular disease (“CVS”), central nervous system disease (“CNS”), pain management and diabetes. They also manufacture and sell APIs for gastro-intestinal disorders, anti-infectives and other therapeutic areas.

(iii) They are a research and development (“R&D”)-driven API manufacturer, focused on undertaking dedicated R&D in the existing products and in areas where they believe there is growth potential in the future. They believe that maintaining high standards of process innovation and quality in the R&D and manufacturing operations is critical to the brand and maintenance of long-term relationships with the customers.

When it is formed?

They are a wholly-owned subsidiary of the Glenmark Pharmaceuticals Limited (“Glenmark”), a research-oriented, innovation led, global pharmaceutical company, which was established in 1977 and is listed on the BSE and NSE. In 2001-2002, Glenmark launched the API manufacturing business by setting up a manufacturing facility in Kurkumbh in the state of Maharashtra, India and focused on growing this business over the next 18 years. In 2019, the API manufacturing business of Glenmark was sold and spun off.

Product Portfolio?

As of December 31, 2020, Glenmark Life-Sciences IPO had a portfolio of 120 molecules globally. They sold APIs in India and exported the APIs to multiple countries in Europe, North America, Latin America, Japan and the rest of the world (“ROW”).

As of April 7, 2021, they had filed 399 Drug Master Files (“DMFs”) and Certificates of suitability to the monographs of the European Pharmacopoeia (“CEPs”) across various major markets (i.e. United States, Europe, Japan, Russia, Brazil, South Korea, Taiwan, Canada, China and Australia).

Manufacturing Unit

They currently operate four multi-purpose manufacturing facilities which are situated on leasehold properties located at ankleshwar and Dahej in the state of Gujarat, India, and Mohol and Kurkumbh in the state of Maharashtra, India with an aggregate annual total installed capacity of 725.8 KL as of December 31, 2020.

Industry Size of APIs

The global API market was estimated to be around US$181.3 billion in 2020 and is expected to grow at a CAGR of 6.2% to reach to about US$259.3 billion by 2026.

Objects of the Glenmark Life Sciences IPO:

Glenmark Life Sciences IPO Details:

| Open Date: | Jul 27 2021 |

| Close Date: | Jul 29 2021 |

| Total Shares: | 6300000 |

| Face Value: | ₹ 2 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 1513 Cr. |

| Lot Size: | 20 Shares |

| Issue Price: | ₹ 695 - 720 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Aug 06 2021 |

Promoters And Management:

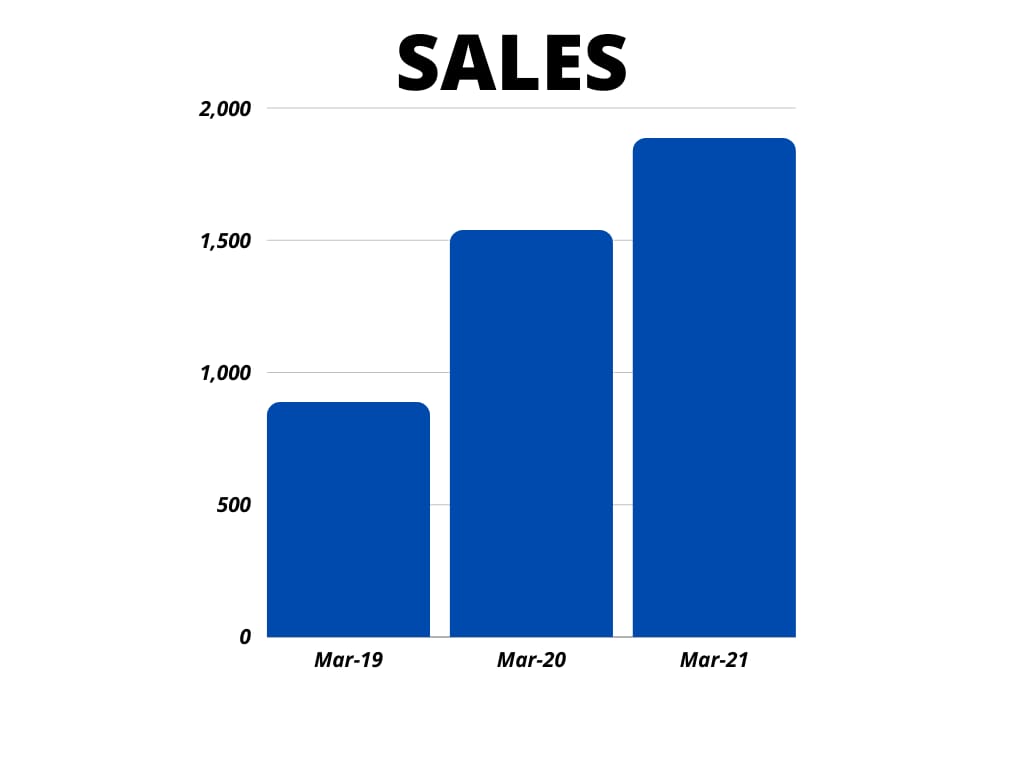

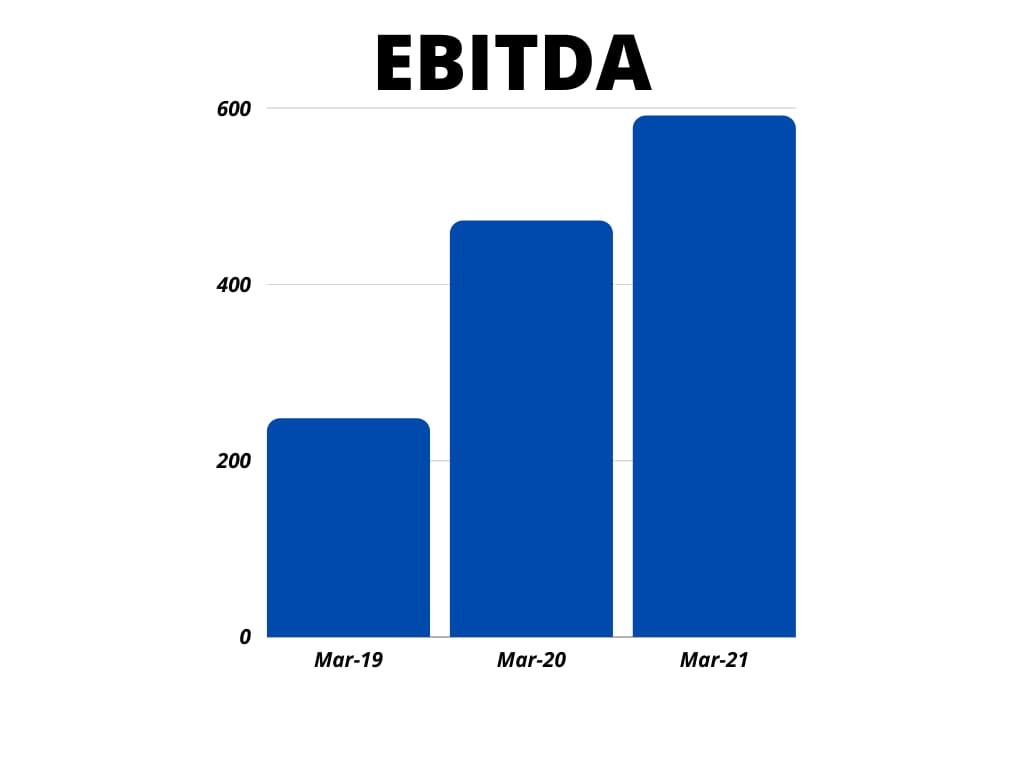

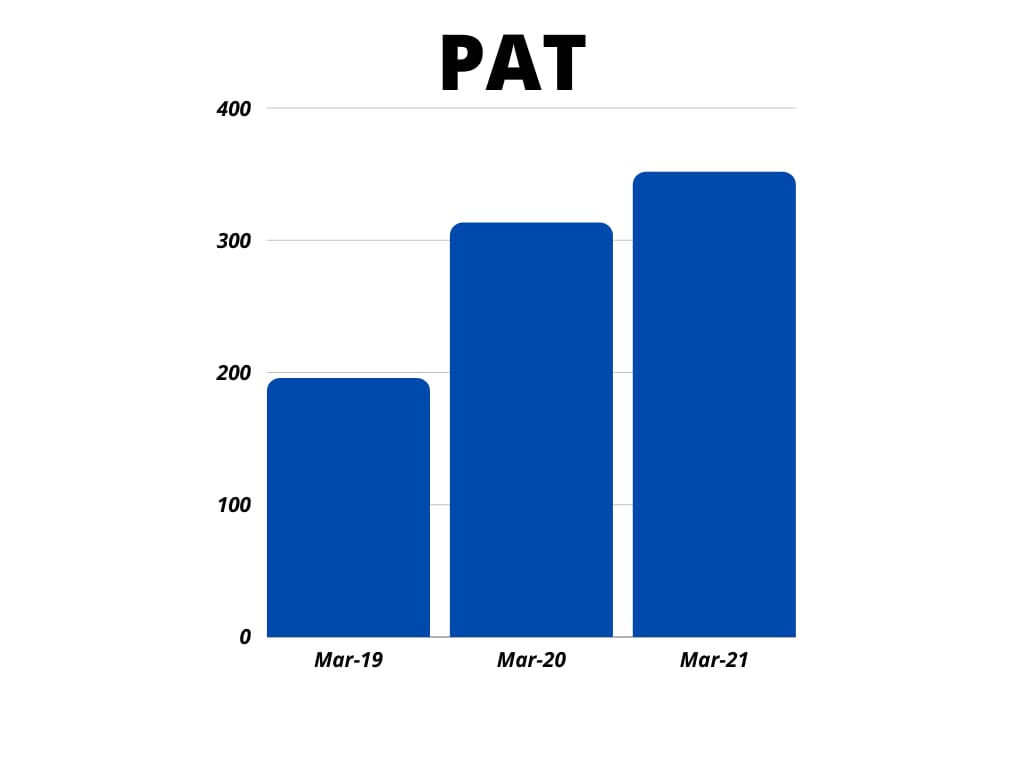

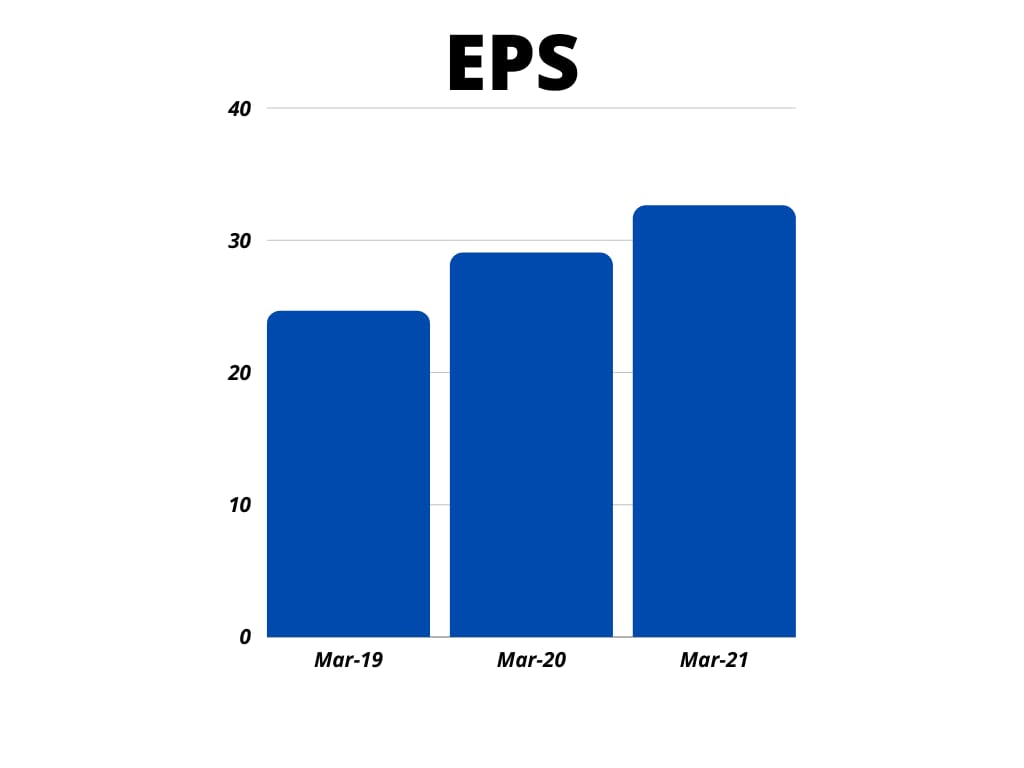

Financials of Glenmark Life Sciences IPO:

| Particulars (in Cr.) | Mar-21 | Mar-20 | Mar-19 |

| Sales | 1885.17 | 1537.31 | 886.42 |

| Cost of Material Consumed | 976.20 | 695.10 | 653.89 |

| Change in Inventories | -70.70 | -4.64 | -301.59 |

| Employee Benefits Expense | 149.13 | 142.28 | 106.28 |

| Other Expenses | 239.46 | 232.62 | 180.12 |

| Operating Profit | 591.08 | 471.95 | 247.72 |

| OPM % | 31.35% | 30.70% | 27.95% |

| Other Income | 0.81 | 11.99 | 0.44 |

| Interest | 87.55 | 33.52 | 0.61 |

| Depreciation | 33.39 | 29.37 | 19.26 |

| Profit before tax | 470.94 | 421.07 | 228.30 |

| Total Tax Exps | 119.36 | 107.97 | 32.71 |

| Net Profit | 351.58 | 313.10 | 195.59 |

| NPM % | 18.65% | 20.37% | 22.07% |

| No. of shares | 10.78 | 10.78 | 10.78 |

| EPS in Rs | 32.61 | 29.04 | 24.64 |

Comparison With Peers:

| Name of the company | 5-year Revenue Growth | 5 year PAT Growth | EBITDA Margin (FY20) | ROE (FY20) | Debt to Equity | P/E | 3 Years Return |

| Glenmark Life Sciences Ltd. (3 Years) | 29% | 22% | 31% | 46.75% | 0.00 | - | - |

| Divis Laboratories Ltd | 11% | 13% | 41% | 23.90% | 0 | 64.32 | 63.96% |

| Laurus Labs Ltd | 20% | 39% | 32% | 45.16% | 0.57 | 36.24 | 95.28% |

| Shilpa Medicare Ltd | 3% | 7% | 20% | 10.53% | 0.49 | 34.66 | 20.09% |

| Aarti Drugs Ltd | 13% | 28% | 20% | 35.81% | 0.33 | 23.79 | 76.77% |

| Solara Active Pharma Sciences Ltd (3 Years) | 5% | 54% | 24% | 17.17% | 0.33 | 27.07 | 115.09% |

Recommendation on Glenmark Life Sciences IPO:

Lead Manager of Glenmark Life Sciences IPO:

Registrar of Glenmark Life Sciences IPO:

Company Address:

Discussion on Glenmark Life Sciences IPO:

4 Comments

Leave a Reply

You must be logged in to post a comment.

Allotment out on app

0/1

That was due to ~965 Crores of loan that was outstanding on the company to promoters when Glenmark Lifesciences business was separated. Now, as on 31.06.2021, the total debt left was 800 Crores. The company will pay back 800 Crores from the IPO proceeds. Same was mentioned in the Objectives of the IPO.

Apply in this IPO

In financial it shows intrest payment of 87.55 cr and in comparison with peers it shows D/E =0

Am I missing something?