G M Poly BSE SME IPO

(i) They started the operations in the year 2003 in the name of G. M. Polyplast Private Limited. They are engaged in the business of manufacturing of H.I.P.S, A.B.S & P.E.T sheets, along with sheets they also manufacture the raw material used to manufacture the sheets called granules.

(ii) The Company is known in the industry for manufacturing and supplying of high-grade Sheets and Granules in India.

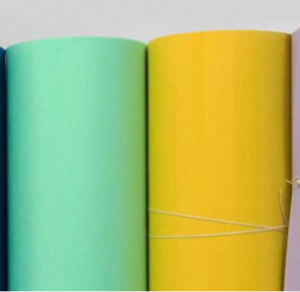

(iii) The product range includes Acrylonitrile Butadiene Styrene (ABS) Plastic Sheets, High Impact Polystyrene (HIPS) Sheets, PET (Polyethylene Terephthalate) Sheets / Rolls, Amorphous Polyethylene Terephthalate (A-PET) Sheet, Recycled Polyethylene Terephthalate (R-PET) Sheet, HDPE (High-Density Polyethylene) Sheets / Rolls, PP (Polypoplyne) Sheets / Rolls, Electrostatic discharge materials (ESD materials).

Products

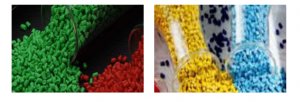

1. Granules

2. ABS Sheets

3. HIPS Sheets

Manufacturing Unit

They have a manufacturing unit located at Dadra & Nagar Haveli having a total area of approximately 50,000 sq. ft.

How they sell their Products?

a) They sell products through distributors and retailers.

b) They provide product samples along with catalog to distributors for reaching out to the wholesale and retail shops in the domestic market.

c) The distribution channel currently covers states of Maharashtra, Gujrat, Kerala, Tamil Nadu, West Bengal, Dadra & Nagar Haveli, Puducherry, Uttar Pradesh, Delhi, Madhya Pradesh, Haryana, Telangana, Karnataka, Uttar Pradesh, Goa, Karnataka, Chhattisgarh, and they also supply to other countries such as UAE, Israel, Jordan, and Hong Kong.

Objects of the G M Poly BSE SME IPO:

G M Poly BSE SME IPO Details:

| Open Date: | Sep 30 2020 |

| Close Date: | Oct 06 2020 |

| Total Shares: | 508,800 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Fixed Issue |

| Issue Size: | 8.09 Cr. |

| Lot Size: | 800 Shares |

| Issue Price: | ₹ 159 Per Equity Share |

| Listing At: | BSE SME |

| Listing Date: | Oct 14 2020 |

Promoters And Management:

Financials of G M Poly BSE SME IPO:

| Particulars(in Lakh) | Mar-18 | Mar-19 | Mar-20 |

| Revenue | 5,546 | 6,811 | 6,314 |

| Cost of Material Consumed | 5,077 | 6,073 | 5,483 |

| Change in Inventory | -34 | 42 | 28 |

| Employee Cost | 78 | 119 | 146 |

| Other Expense | 224 | 311 | 281 |

| EBITDA | 201 | 266 | 376 |

| OPM | 3.62% | 3.91% | 5.96% |

| Other Income | 4 | 22 | 28 |

| Interest Cost | 30 | 36 | 23 |

| Depreciation | 46 | 58 | 63 |

| Profit before tax | 129 | 194 | 318 |

| Tax | 37 | 51 | 89 |

| Net Profit | 92 | 143 | 229 |

| NPM | 1.7% | 2.1% | 3.6% |

| Shares | 19.20 | 19.20 | 19.20 |

| EPS in Rs | 4.8 | 7.4 | 11.9 |

| Key Parameters | |||

| RONW | 22% | 26% | 29% |

| ROCE | 39% | 31% | 53% |

| CFO/EBITDA | 121% | 59% | 78% |

Comparison With Peers:

Recommendation on G M Poly BSE SME IPO:

Lead Manager of G M Poly BSE SME IPO:

Registrar of G M Poly BSE SME IPO:

Discussion on G M Poly BSE SME IPO:

3 Comments

Leave a Reply

You must be logged in to post a comment.

Apply

Pakka sirji??

The company is good but we never know in SMEs. So, if HNI gets a good subscription, then apply.