Dodla Dairy IPO

(i) Dodla Dairy is an integrated dairy company based in south India primarily deriving all of its revenue from the sale of milk and dairy-based VAPs in the branded consumer market. It is the third highest in terms of milk procurement per day with an average procurement of 1.02 million liters of raw milk per day (“MLPD”) as of 2020 and second highest in terms of market presence across all of India amongst private dairy players.

(ii) Dodla Dairy has nearly 13 processing plants across India and has 254 dairy farms. Its operations in India are primarily across the five Indian states of Andhra Pradesh, Telangana, Karnataka, Tamil Nadu, and Maharashtra & overseas operations are based in Uganda and Kenya.

(iii) Its integrated business model in India consists of procurement, processing, distribution, and marketing operations. Its

procurement operations are spread across the states of Andhra Pradesh, Telangana, Tamil Nadu, Karnataka, and Maharashtra.

(iv) Its distribution operations in Uganda are conducted through its African Subsidiary Lakeside Dairy Limited. and include distribution of milk and dairy-based VAPs as of 2020, through 22 distributors and 18 “Dodla Retail Parlours”. Its distribution operations in Kenya are conducted through its African Subsidiary Dodla Dairy Kenya Limited and include distribution of our milk and dairy-based VAPs as of 2020, through 57 distribution agents and 53 distributors.

Competitive Strengths

(i) Integrated business model

(ii) Long term relationship with dairy farmers

(iii) Stringent quality control procedures

Business Model of the Company or Supply Chain Analysis

As the company is in the business of Dairy they need to procure milk on daily basis. Let us see how they procure milk.

Sourcing of Milk

They procure raw material required for operations from the states of Andhra Pradesh, Telangana, Tamil Nadu and Karnataka and Maharashtra and consist of procurement of on an average approximately 1.02 Million litre of raw milk per day of raw milk from approximately 1,14,920 farmers across 6,878 villages through 6,624 DDCCs, 272 procurement routes, 254 dairy farms and 90 chilling Centers as of December 31st 2020.

Processing of Milk

Processing operations are spread across 13 processing plants (12 of which are owned and one is leased) located in the states of Andhra Pradesh, Telangana, Karnataka and Tamil Nadu in India with an aggregate installed capacity of 1.70 Million litres of raw milk per day, excluding two SMP plant’s in Nellore and Vedasandur which have an aggregate installed capacity of 15,000 and10,000 kgs per day respectively.

Distribution of Milk

They sell their product under the “Dodla Dairy” brand in India. They distribute milk through 40 sales offices, 3,336 distribution agents, 863 milk distributors and 449 milk product distributors.

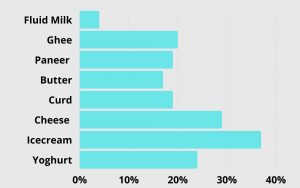

Different Margins in the products of Dodly Dairy IPO:

Business Analysis of Dodly Dairy IPO

Objects of the Dodla Dairy IPO:

Dodla Dairy IPO Details:

| Open Date: | Jun 16 2021 |

| Close Date: | Jun 18 2021 |

| Total Shares: | 12153738 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 520 Cr. |

| Lot Size: | 35 Shares |

| Issue Price: | ₹ 421-428 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Jun 28 2021 |

Promoters And Management:

Financials of Dodla Dairy IPO:

| Particulars (in Cr.) | 9MFY21 | Mar-20 | Mar-19 | Mar-18 |

| Sales | 1413 | 2,139 | 1,691 | 1,590 |

| Cost of Material Consumed | 995 | 1,583 | 1,242 | 1,274 |

| Gross Margins | 30% | 26% | 27% | 20% |

| Change in Inventories | -40 | 57 | 14 | -42 |

| Employee Benefits Expense | 66 | 91 | 76 | 64 |

| Other Expenses | 185 | 266 | 224 | 181 |

| Operating Profit | 207 | 140 | 134 | 112 |

| OPM % | 14.86% | 6.59% | 7.93% | 7.09% |

| Other Income | 3.5 | 6.28 | 7.79 | 6.54 |

| Interest | 9 | 16 | 11 | 11 |

| Depreciation | 38 | 49 | 37 | 27 |

| Profit before tax | 163 | 81 | 93 | 80 |

| Total Tax Exp. | 45 | 32 | 30 | 23 |

| Net Profit | 118 | 49 | 62 | 56 |

| NPM % | 8.35% | 2.33% | 3.71% | 3.57% |

| No. of shares | 5.94 | 5.94 | 5.94 | 5.94 |

| EPS in Rs | 19.87 | 8.25 | 10.44 | 9.43 |

Comparison With Peers:

| Peer | 3-year Revenue Growth | 3-year PAT Growth | EBITDA Margin (FY21) | ROE (FY21) | D/E | P/E | 3 Years return |

| Dodla Dairy | 16% | -7% | 15% | 28% | 0.01 | 17x | |

| Hatsun Agro | 11% | 11.00% | 14% | 24% | 1.27x | 84x | 32% |

| Heritage Foods | 7% | NA | 10% | 25% | 0.06x | 13x | -23% |

| Parag Milk | 11.67% | 4% | 7% | 2.30% | 0.40x | 62x | -34% |

Recommendation on Dodla Dairy IPO:

Lead Manager of Dodla Dairy IPO:

Registrar of Dodla Dairy IPO:

Company Address:

Discussion on Dodla Dairy IPO:

8 Comments

Leave a Reply

You must be logged in to post a comment.

Dodla hold or exit?????

It’s falling what to do?????

Hold or exit guys?????

stop loss laga loh 550 ka and hold

Apply with full-force.

Umesh sir, Can I apply 1 lot is enough for allotment or apply multiple lots must for allotment In this lottery system

Apply 1 lot only.

Gmp 125/130