Cyber Media Research & Services Ltd IPO

i. CMRSL is engaged in ad tech and data analytics business in an industry which is expanding rapidly. The Company has four revenue streams i.e., Digital Marketing, Programmatic Media Buying, Publisher Monetization, and Data Analytics. These together form the pillars of the digital marketing landscape, i.e. they provide proprietary solutions that enable advertisers and publishers to match the right ad with the right user. This drives higher conversions and sales for advertisers and enables publishers to earn more. The Company has been growing its offerings and customer base, and is well positioned to build multiple revenue streams in the digital landscape.

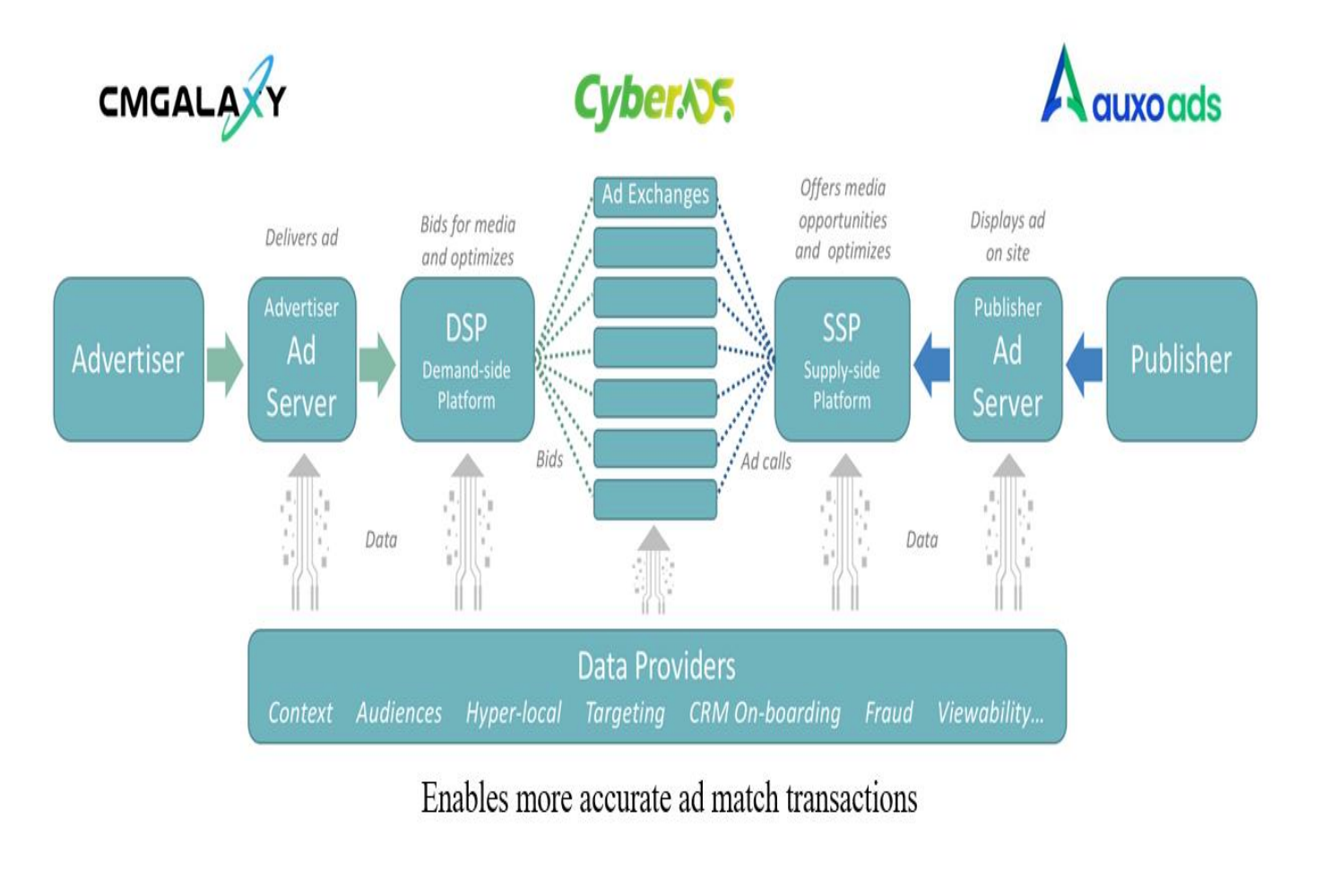

ii. Automation in this industry is driving significant changes, and data acts a critical enabler. Their algorithms leverage large sets of data, process it via our AI engines to provide the right results, therefore simplifying digital marketing. CMGalaxy, Auxo Ads and CyberAds is CMRSL’s propriety products for different stakeholders in the ecosystem.

iii. Ecosystem and Cyber Media product positioning:

iv. The CMRSL team is passionate about digital, and believe AI has an integral role to play in data-enrichment and drive better marketing experiences across devices, formats and user preferences. Leveraging first-party data we use AI to:

(i) Build precise ad match between ads and users.

(ii) Access to both demand and supply inventories, thereby reducing middle-men thereby reducing fraud and maximizing ROI.

(iii) Enrich data-sets that create a large repository of audience information continuously.

(iv) Enable customers a no-code or low-code approach to their marketing challenges.

v. Competitive Strengths

i. Customer satisfaction and revenues from long standing customer relationships

ii. Experienced Promoters and Management Expertise

iii. Scalable Business Model

Objects of the Cyber Media Research & Services Ltd IPO:

Cyber Media Research & Services Ltd IPO Details:

| Open Date: | Sep 27 2022 |

| Close Date: | Sep 29 2022 |

| Total Shares: | 780,000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Built Issue |

| Issue Size: | 14.04 Cr. |

| Lot Size: | 800 Shares |

| Issue Price: | ₹ 171-180 Per Equity Share |

| Listing At: | NSE Emerge |

| Listing Date: | Oct 10 2022 |

Promoters And Management:

Financials of Cyber Media Research & Services Ltd IPO:

| Particulars (in crores) | Mar 22 | Mar 21 | Mar 20 |

| Revenue from operations | 56 | 29 | 30 |

| Direct Expense | 47 | 23 | 24 |

| Employee Benifit Expense | 4 | 3 | 4 |

| Other Expense | 1 | 1 | 0.9 |

| Operating Profit | 4.00 | 2.00 | 1.10 |

| OPM% | 7.14% | 6.90% | 3.67% |

| Finance Cost | 0.9 | 1 | 0.7 |

| Depreciation | 0.2 | 0.1 | 0.1 |

| Other Income | 0.3 | 0.4 | 0.2 |

| Profit (Loss) before tax | 2 | 0.6 | 0.05 |

| Tax expense | 0.8 | 0.02 | -0.02 |

| Profit (Loss) for the period | 1 | 0.6 | 0.07 |

| No of Share | 0.2 | 0.2 | 0.2 |

| Earnings per share | 5 | 3 | 0.35 |

Comparison With Peers:

| Name of the Company | CMP | FV | EPS | P/E |

| Cyber Media Research & Services Limited | 180 | 10 | 5 | 36 |

| Affle India Limited | 1,276 | 2 | 17.46 | 73.1 |

| Brightcom Group Limited | 35 | 2 | 5.84 | 6.57 |

| Vertoz Advertising Limited | 127 | 10 | 5.3 | 23.9 |

Lead Manager of Cyber Media Research & Services Ltd IPO:

Registrar of Cyber Media Research & Services Ltd IPO:

Company Address:

Discussion on Cyber Media Research & Services Ltd IPO:

Leave a Reply

You must be logged in to post a comment.