A B Infrabuild Limited IPO

(i) AB Infrabuild Limited formerly known as AB Infrabuild Private Limited (A B Enterprises) came into existence in 1999 by a visionary Mr. Amit Bholananth Mishra. The Company got incorporated as Private Limited in the year 2011 with Registrar of Companies.

(ii) They provide various services such as civil and structural work, new station infrastructure, redevelopment of old stations, new railway lines, gauge conversion, track linking, track formation, etc. We engage in activities like building steel grinder bridges, the building of Railway Infrastructure and Road Contracts (BOT & Turnkey basis).

(iii) The Company has 100% revenue from Government Contracts in case of Infra and the Company has 100% Revenue from Private Companies in case of RMC & Others.

Objects of the A B Infrabuild Limited IPO:

A B Infrabuild Limited IPO Details:

| Open Date: | Jun 28 2019 |

| Close Date: | Jul 03 2019 |

| Total Shares: | 4,428,000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Fixed Price IPO |

| Issue Size: | 12.84 Cr. |

| Lot Size: | 4000 Shares |

| Issue Price: | ₹ 29 Per Equity Share |

| Listing At: | NSE Emerge |

| Listing Date: | Jul 12 2019 |

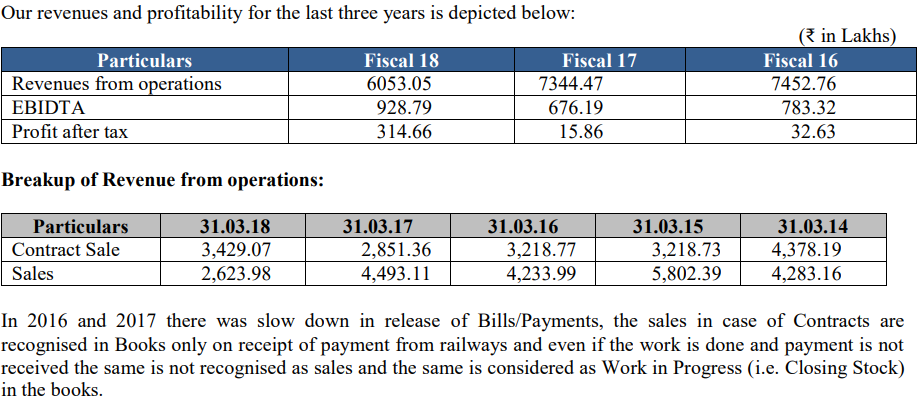

Financials of A B Infrabuild Limited IPO:

Comparison With Peers:

Recommendation on A B Infrabuild Limited IPO:

Lead Manager of A B Infrabuild Limited IPO:

Registrar of A B Infrabuild Limited IPO:

Bid Details of A B Infrabuild Limited IPO as on

03-Jul-2019 18:00:00 IST

| Category | No.of shares offered | No. of shares bid |

|---|---|---|

| 2,102,000 | 2,528,000 | |

| 2,102,000 | 1,552,000 | |

| 224,000 | 224,000 | |

| 4,428,000 | 4,304,000 |

| QIBs | No |

| QIBs+HNIs Subscription | 1.20X |

| Retail Subscription | 0.74X |

| Total Subscription | 0.97X |

Discussion on A B Infrabuild Limited IPO:

2 Comments

Leave a Reply

You must be logged in to post a comment.

Please avoid SMEs until market conditions improves.

Should we apply?