Wonder Fibromats Limited IPO

(i) They are a fully integrated end-to-end product and solution suite to the original sellers of the fans wherein they provide start to end solutions for fan sellers including sourcing, manufacturing, quality testing and packaging. They manufacture and supply fans to many well-known companies in India, which in turn distribute these products under their own brands.

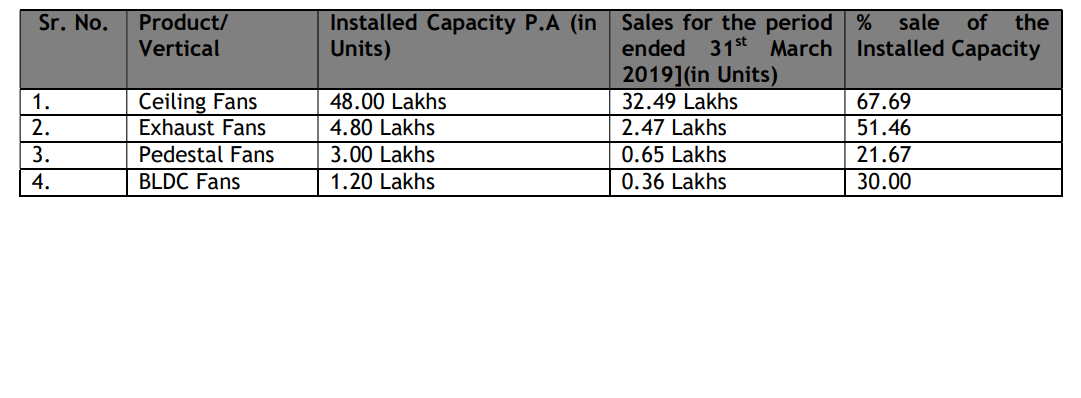

(ii) The Company is engaged in the manufacturing of Ceiling fans, Exhaust, pedestal, and Brushless DC (BLDC) fans. All the parts & components of the fans are tested stringently at their in-house quality management lab to ensure their flawless performance. Moreover, various R&D activities are conducted by professionals to remain abreast of the latest market requirements and competition.

Their state-of-the-art manufacturing facility is strategically located at Raipur Industrial Area, Bhagwanpur, Roorkee.

(iii) Range of fans is available in different designs, colors and has superior gloss finishes that add grace to the decor of the surroundings. They also manufacture these fans as per the specification of the clients which include well-known companies which are selling under their own brands in India.

(iv) Installed Capacity and its Utilization.

Objects of the Wonder Fibromats Limited IPO:

Wonder Fibromats Limited IPO Details:

| Open Date: | Jul 22 2019 |

| Close Date: | Jul 29 2019 |

| Total Shares: | 22,24,000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | fixed type |

| Issue Size: | 20.0160 Cr. |

| Lot Size: | 1600 Shares |

| Issue Price: | ₹ 89 Per Equity Share |

| Listing At: | NSE Emerge |

| Listing Date: | Aug 08 2019 |

Promoters And Management:

Comparison With Peers:

Recommendation on Wonder Fibromats Limited IPO:

Lead Manager of Wonder Fibromats Limited IPO:

Registrar of Wonder Fibromats Limited IPO:

Company Address:

Bid Details of Wonder Fibromats Limited IPO as on

29-Jul-2019 17:00:00 IST

| Category | No.of shares offered | No. of shares bid |

|---|---|---|

| 1,056,000 | 2,316,800 | |

| 1,056,000 | 353,600 | |

| 112,000 | 112,000 | |

| 2,224,000 | 2,782,400 |

| QIBs | Yes |

| QIBs+HNIs Subscription | 2.19X |

| Retail Subscription | 0.33X |

| Total Subscription | 1.26X |

Discussion on Wonder Fibromats Limited IPO:

4 Comments

Leave a Reply

You must be logged in to post a comment.

Wonder Fibro —- Attn Members : BRLM to the Wonder Fibromats Limited issue, has informed the Exchange that the issue closure date has been extended upto 29 July,2019.Post issue modification date has been revised to 30 July,2019.Price has been revised from 90/- to Rs. 89/- per share

Avoid

The Company proposed to set up a manufacturing facility at Hyderabad.

They have proposed to utilize Rs. 440.00 Lakhs out of Issue proceeds to meet the expenditure towards Acquisition of Land, Site Development and Other Civil Work.

Following are the details of our proposed Manufacturing Plant.

Presuming 300 operating days in a year and single Shift (12 Hours)- working basis, the installed production capacity of the unit would be the manufacturing of 24,00,000 fans per annum, which would likely to be increased in the subsequent years. Actual utilization is expected to be 50% in Ist year, 70 % in IInd year, 85 % in IIIrd year and approx 95% and above in further years.

(i) The Promoters Shri Harsh Anand, Shri Yogesh Anand, and Shri Yogesh Sahni have vast Experience of over 40 years in Manufacturing, making fans for 35 years.

(ii) OEM Suppliers to India’s leading Brands. Brands are associated with us for our Quality conscious approach with committed suppliers. We are in the OEM business for 25 years.

(iii) Made 62 Lakh fans in 2017-18 with a group turnover of Rs. 525 Crore.

(iv) The plan is to produce 1 crore fans per year in 3 years.

(v) They make ceiling fans, heavy-duty exhaust fans, light-duty exhaust fans, farata fans. They also make critical components in their factories for better control over quality.

(vi) Modern manufacturing plants across India. All the plants have state of the art machinery