SBL Infratech Limited IPO

i. SBL Infratech Limited was started in 2015 into the business of Real Estate Brokerage. In 2016, it successfully launched & executed the Shubh Niwa’s project in Neemrana, Rajasthan where they acquired rural land, got it converted to residential, and sold it after plotting. In 2017, it has successfully launched the DayalVihar project in Neemrana, Rajasthan.

ii. It has a vision to grow into one of the most trusted brand names in the Real Estate sector. The company believes in focusing on bespoke services for its existing and new clients with complete focus and attention. This is also reflected in their work ethos where they aggressively allocate resources to new clients while ensuring the exemplary quality of execution.

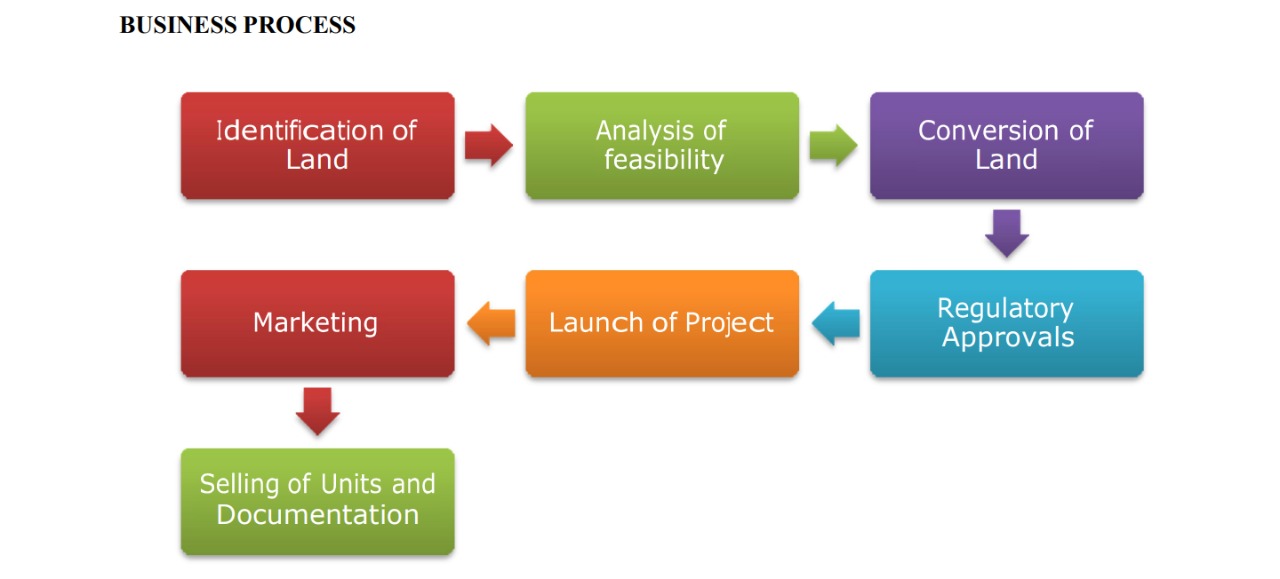

Business strategy

i. Focus on cost management

ii. Focus on cordial relationship

iii. Experienced Promoter and Management Expertise

Objects of the SBL Infratech Limited IPO:

SBL Infratech Limited IPO Details:

| Open Date: | Sep 16 2021 |

| Close Date: | Sep 20 2021 |

| Total Shares: | 213,600 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Fixed Price Issue IPO |

| Issue Size: | 2.37 Cr. |

| Lot Size: | 1200 Shares |

| Issue Price: | ₹ 111 Per Equity Share |

| Listing At: | BSE SME |

Promoters And Management:

Financials of SBL Infratech Limited IPO:

| Particulars (in Lakhs) | 2021 | 2020 | 2019 |

| Revenue from operations | 40.42 | 148.67 | 19.70 |

| Direct Expense | 4.70 | 50.60 | |

| Employee Benefit Expense | 18.79 | 53.78 | 11.26 |

| Other expenses | 13.83 | 29.26 | 7.89 |

| Operating Profit | 3.10 | 15.03 | 0.55 |

| OPM% | 7.67% | 10.11% | 2.79% |

| Finance costs | 0.09 | - | - |

| Depreciation and amortisation | 0.73 | 0.62 | 0.04 |

| Profit before tax | 2.27 | 14.40 | 0.51 |

| Profit for the year | 1.68 | 10.66 | 0.38 |

Lead Manager of SBL Infratech Limited IPO:

Registrar of SBL Infratech Limited IPO:

Company Address:

Discussion on SBL Infratech Limited IPO:

1 Comment

Leave a Reply

You must be logged in to post a comment.

Avoid