Remus Pharmaceuticals Limited IPO

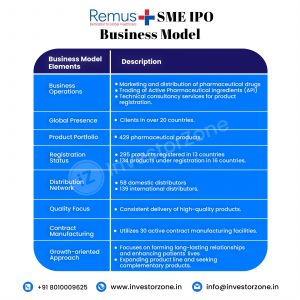

i. Remus Pharmaceuticals is engaged in marketing & distribution of finished formulations of pharmaceutical drugs. The company also deals in API (Active Pharmaceutical Ingredient). They also provide technical consultancy services to various distributors for preparation of reports on the dossiers of the products to be registered by them in various countries.

ii. The Company is majorly engrossed in the pharmaceutical business involving marketing, trading and distribution of wide range of pharmaceutical finished formulations and products. Depending upon business requirments, they get finished pharmacuetical formulations manufactured on loan license or contract manufacturing. Such manufacturing is on principle to principle basis. The company has presence through registered and/or under registration products in countries namely Bhutan, Bolivia, Chile, Costa Rica, Cuba, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Jamaica, Kuwait, Madagascar, Malaysia, Hong kong, Myanmar, Panama, Trinidad and Tobago, Uzbekistan, Venezuela, Vietnam.

iii. They deal in drug forms like Capsules, Cream, Eye Drops, Gel, Infusion, Inhalation, Inhaler, Injection, Nail Lacquer, Nasal Solution, Nasal Spray, Nebuliser, Ointment, Ophthalmic, Oral Gel, Oral Solution, Oral Suspension, Sachet, Suspension, Tablet.

iv. Their product portfolio consists of 429 products. They operate under different brand names across the globe. The company has 295 products registered in total 13 countries and total 134 products are under process of registration in 16 countries, which shall boost the growth of thecompany.

v. They have business to business supply agreements with 58 domestic distributors and 139 international distributors for distribution and/or contract manufacturing supply.

vi. Their Core business can be divided in following categories:

a) Marketing and Distribution of approved finished formulations in various countries

b) Trading of Active Pharmaceutical Ingredients

c) Technical Consultancy on preparation of reports on pharmaceutical dossiers

Competitive Strengths

1. Experienced Promoters and Management Team

2. Wide range of Products

3. Strategic Location of Contract Manufacturing Facilities

4. Diversified business operations and revenue base

Objects of the Remus Pharmaceuticals Limited IPO:

Remus Pharmaceuticals Limited IPO Details:

| Open Date: | May 17 2023 |

| Close Date: | May 19 2023 |

| Total Shares: | 388,000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Built Issue IPO |

| Issue Size: | 47.69 Cr. |

| Lot Size: | 100 Shares |

| Issue Price: | ₹ 1150-1229 Per Equity Share |

| Listing At: | NSE Emerge |

| Listing Date: | May 29 2023 |

Promoters And Management:

Financials of Remus Pharmaceuticals Limited IPO:

| Particulars (in Lakh) | 2020 | 2021 | 2022 |

| Equity Share Capital | ₹1 | ₹1 | ₹100 |

| Reserves | ₹201 | ₹304 | ₹543 |

| Borrowings | ₹36 | ₹28 | ₹19 |

| Trade Payables | ₹131 | ₹516 | ₹467 |

| Other Liability | ₹161 | ₹256 | ₹462 |

| Total Liability | ₹530 | ₹1,105 | ₹1,591 |

| Fixed Assets Block | ₹50 | ₹39 | ₹31 |

| CWIP | ₹0 | ₹0 | ₹0 |

| Investments | ₹0 | ₹7 | ₹307 |

| Other Assets | ₹4 | ₹309 | ₹484 |

| Total Non-Current Assets | ₹54 | ₹355 | ₹822 |

| Receivables | ₹163 | ₹360 | ₹292 |

| Inventory | ₹44 | ₹115 | ₹159 |

| Cash and Cash Balance | ₹120 | ₹83 | ₹115 |

| Other Assets | ₹150 | ₹192 | ₹204 |

| Total Current Assets | ₹477 | ₹750 | ₹770 |

| Total Assets | ₹530 | ₹1,105 | ₹1,591 |

| Particulars (In Lakh) | 2020 | 2021 | 2022 |

| Sales | ₹1,192 | ₹1,842 | ₹2,472 |

| Sales Growth | 0.00% | 54.53% | 34.20% |

| COGS | ₹704 | ₹1,150 | ₹1,227 |

| COGS % of Sales | 59.06% | 62.43% | 49.64% |

| Gross Profit | ₹488 | ₹692 | ₹1,245 |

| Gross Margins | 40.94% | 37.57% | 50.36% |

| Employee Benefit & Other Expenses | ₹449 | ₹617 | ₹838 |

| S&G Sales % | 37.67% | 33.50% | 33.90% |

| EBITDA | ₹39 | ₹75 | ₹407 |

| EBITDA Margins | 3.27% | 4.07% | 16.46% |

| Interest Cost | ₹4 | ₹4 | ₹9 |

| Interest %of Sales | 0.34% | 0.22% | 0.36% |

| Depreciation | ₹11 | ₹18 | ₹15 |

| Dep %of Sales | 0.92% | 0.98% | 0.61% |

| EBIT Margins | 2.35% | 3.09% | 15.86% |

| Other Income | ₹85 | ₹81 | ₹72 |

| Earnings Before Tax | ₹109 | ₹134 | ₹455 |

| EBT % Sales | 9.14% | 7.27% | 18.41% |

| Tax | ₹28 | ₹33 | ₹116 |

| Effective Tax Rate | 25.69% | 24.63% | 25.49% |

| PAT | ₹81 | ₹101 | ₹339 |

| NPM | 6.80% | 5.48% | 13.71% |

| No. of Equity Shares | 0.1 | 0.1 | 10 |

| Earning Per Share | ₹8.12 | ₹10.26 | ₹33.86 |

| EPS Growth % | 0.00% | 26.35% | 230.02% |

| Dividend Per Share | ₹0 | ₹0 | ₹0 |

| Dividend Payout Ratio | 0.00% | 0.00% | 0.00% |

| Retained Earnings | 100% | 100% | 100% |

| Particulars (Lakh) | 2020 | 2021 | 2022 |

| Cash From Operating Activity | ₹130 | ₹284 | ₹504 |

| Cash from Investing Activity | -₹56 | -₹309 | -₹455 |

| Cash from Financing Activity | ₹6 | -₹12 | -₹17 |

| Net Cash Flow | ₹120 | ₹83 | ₹115 |

Comparison With Peers:

| Name of the Company | Revenue(Cr) | Profit(Cr) | EPS | P/E | CMP | MCap |

| Remus Pharmaceuticals | 43 | 8.5 | 57.82 | 21.27 | 1,230 | 181.18 |

| Trident Lifeline Limited | 31.69 | 6.01 | 5.23 | 25.90 | 135 | 156 |

| Vaishali Pharma Limited | 68.84 | 6.36 | 6.03 | 23.6 | 142 | 150 |

| Chandra Bhagat Pharma Limited | 95.2 | 0.73 | 0.97 | 124 | 131 | 98.8 |

Recommendation on Remus Pharmaceuticals Limited IPO:

Lead Manager of Remus Pharmaceuticals Limited IPO:

Registrar of Remus Pharmaceuticals Limited IPO:

Company Address:

Discussion on Remus Pharmaceuticals Limited IPO:

2 Comments

Leave a Reply

You must be logged in to post a comment.

Intresting part in the cash flow statement of 9Mfy23.

They generated cash of ~5 cr from operations, 9.28 Cr is raised from loans, and 4.25 cr from issue of shares…

So, ~18 cr is raised.

Out of ~2 cr went to capex side and ~17 cr went to purchase of securities.

Need to check where they have done investment.

Mostly that investment has gone to:

1. Our company has been allotted 1447760 equity shares of Ratnatris Pharmacueticals Private Limited, upon conversion of Compulsory Convertible Debentures (CCD), constituting 43.55% of the total paid up capital of Ratnatris Pharmacueticals Private Limited vide board resolution dated april 01, 2023.

2. Our company has issued Bank Gaurantee of ₹ 38.10 crores in favour of Ratnatris Pharmaceuticals Private Limited.

3. Our company has issued Bank Gaurantee of ₹ 56.25 crores in favour of Ratnagene Liefesciences Private Limited.

The financials of Ratnatris Pharmacueticals Private Limited, are very bad. See link below.

https://d2un9pqbzgw43g.cloudfront.net/main/WhatsApp-Image-2023-05-15-at-08.55.09.jpeg

Debt as on 31.03.2022 is ~90 Crores and with EBITDA negative, they are not able to pay even the interest cost with the operations

So, IPO looks very risky.

Pricing looks on higher side.

Though growth has been phenomenal from ~11 Cr in Fy20 to ~44 Cr Annualised FY23 numbers. CAGR growth of 58%.

Cash-flow from operations – 5.32+ 5+ 2.83+ 1.30 = ~14 Cr

Capex done in last 4 years = ~6 Cr

So, generated free cash flow of ~8 Cr