Likhitha Infrastructure IPO

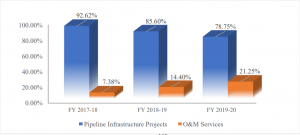

1. Likhitha Infrastructure is an Oil & Gas pipeline infrastructure service provider in India. Its business comprises of;

a) Laying of pipeline networks along with the construction of associated facilities.

b) Operations & Maintenance services to the City Gas Distribution (“CGD”) Companies in India.

2. The Company was founded by the Promoter, Mr. Srinivasa Rao Gaddipati, in the year 1998 and has been engaged in the same line of business for over two decades. Over the years, they have diversified the gamut of services being provided by the Company from CrossCountry Pipeline Projects (CCP); City Gas Distribution (CGD) Projects to providing Operation & Maintenance (O&M) Services to CGD Companies.

3. They have a presence in more than 16 states and 2 Union Territories in India. The company has successfully laid over 600 Kms. of Oil and Gas pipelines including steel and Medium-Density Polyethylene (“MDPE”) network in the last 5 years.

4. They have recently executed 10.75” OD x 69 Kms Petroleum Product Pipeline for the first-ever Trans-National Cross-Country Pipeline of South-East Asia connecting India to Nepal, in the Year 2019, for the supply of petroleum products.

5. The company has a total Order Book of Rs. 662 Crores as of July 31, 2020. Out of which, Pipeline Infrastructure consists of 615 Crores and 46 Crores in O&M.

Objects of the Likhitha Infrastructure IPO:

Likhitha Infrastructure IPO Details:

| Open Date: | Sep 29 2020 |

| Close Date: | Oct 07 2020 |

| Total Shares: | 5,100,000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 61 Cr. |

| Lot Size: | 125 Shares |

| Issue Price: | ₹ 116-120 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Oct 12 2020 |

Promoters And Management:

Financials of Likhitha Infrastructure IPO:

| Particulars(in Lakh) | Mar-18 | Mar-19 | Mar-20 |

| Revenue | 8,707 | 13,948 | 16,123 |

| Cost of Material | 1,943 | 4,142 | 3,713 |

| Construction expenses | 3,952 | 5,389 | 6,503 |

| Change in Inventory | -245 | -1,712 | -477 |

| Employee Cost | 1,622 | 2,622 | 2,904 |

| Other Expense | 316 | 575 | 513 |

| EBITDA | 1,119 | 2,932 | 2,967 |

| OPM | 13% | 21% | 18% |

| Other Income | 152 | 106 | 155 |

| Interest Cost | 84 | 168 | 136 |

| Depreciation | 93 | 298 | 309 |

| Profit before tax | 1,094 | 2,572 | 2,677 |

| Tax | 376 | 744 | 688 |

| Net Profit | 718 | 1,828 | 1,989 |

| NPM | 8.2% | 13.1% | 12.3% |

| Shares | 197.25 | 197.25 | 197.25 |

| EPS in Rs | 3.6 | 9.3 | 10.1 |

Comparison With Peers:

Recommendation on Likhitha Infrastructure IPO:

Lead Manager of Likhitha Infrastructure IPO:

Registrar of Likhitha Infrastructure IPO:

Discussion on Likhitha Infrastructure IPO:

11 Comments

Leave a Reply

You must be logged in to post a comment.

Should we invest

retail subscription was high..u have mentioned only 2 times …what do u suggest now..looks like an avoid

avoid

Lithika has changed the qib and HNI quota.

Qib 1%

HNI 64%

Retail 35%

Due to poor response of QIB-

The issue has been extended.

IPO OF *LIKHITHA INFRA EXTENDED TILL 7TH OCTOBER* WITH REVISED PRICE BAND OF RS 116/- TO RS 120/-

Likhita:

QIB: 0.02 Times

HNI: 0.85 Times

Retail: 2.47 Times

Total 1.00 Times

This looks like a clear avoid

What do u say me

Mw

Quota

(a) Retail = 35%

(b) HNI = 15%

(c)QIB = 50%

Avoid. Until we good a good HNI response. Small company and questionable management activities as shown in Related party transactions.

Tomorrow I will study this company and update you guys.