Ideaforge Technology Limited IPO

i. Ideaforge Technologies is a company that designs and manufactures world-class drones for mapping, security, and surveillance applications. It serves in the B2B space in the Aerospace, Maritime and Defense Tech market segments.

ii. It has a vertically integrated business model that includes in-house R&D, design, manufacturing, software, services and training operations3. It also provides end-to-end UAV solutions and services to the industrial and commercial sectors.

Some of the products of Ideaforge Technologies are:

i. NETRA Pro: A compact and lightweight VTOL UAV for surveillance and reconnaissance missions. It has a flight time of up to 60 minutes and a range of up to 5 km.

ii. NETRA v2: A rugged and versatile VTOL UAV for day and night surveillance and mapping. It has a flight time of up to 90 minutes and a range of up to 10 km.

iii. Q Series: A family of high-performance VTOL UAVs for long-range and high-altitude operations. They have flight times of up to 180 minutes and ranges of up to 20 km.

iv. SWITCH: A fixed-wing VTOL UAV for mapping and surveying large areas. It has a flight time of up to 120 minutes and a range of up to 15 km.

v. NETRA HYBRID: A hybrid VTOL UAV that combines the advantages of fixed-wing and rotary-wing platforms. It has a flight time of up to 150 minutes and a range of up to 50 km.

vi. Batteries: A range of high-performance lithium polymer batteries for powering the UAVs. They have capacities of up to 22 Ah and voltages of up to 22.2.

vii. Communication Systems: A range of secure and reliable communication systems for controlling and transmitting data from UAVs. They have frequencies of up to 2.4 GHz and bandwidths of up to 10 Mbps.

viii. Drone-related Software and Solutions: A range of software and solutions for planning, executing, analyzing, and managing UAV missions. They include flight control software, mission planning software, data processing software, fleet management software, etc.

Competitve Strengths

i. Diversified product portfolio with a robust technology stack and track record of successful outcomes in critical use cases.

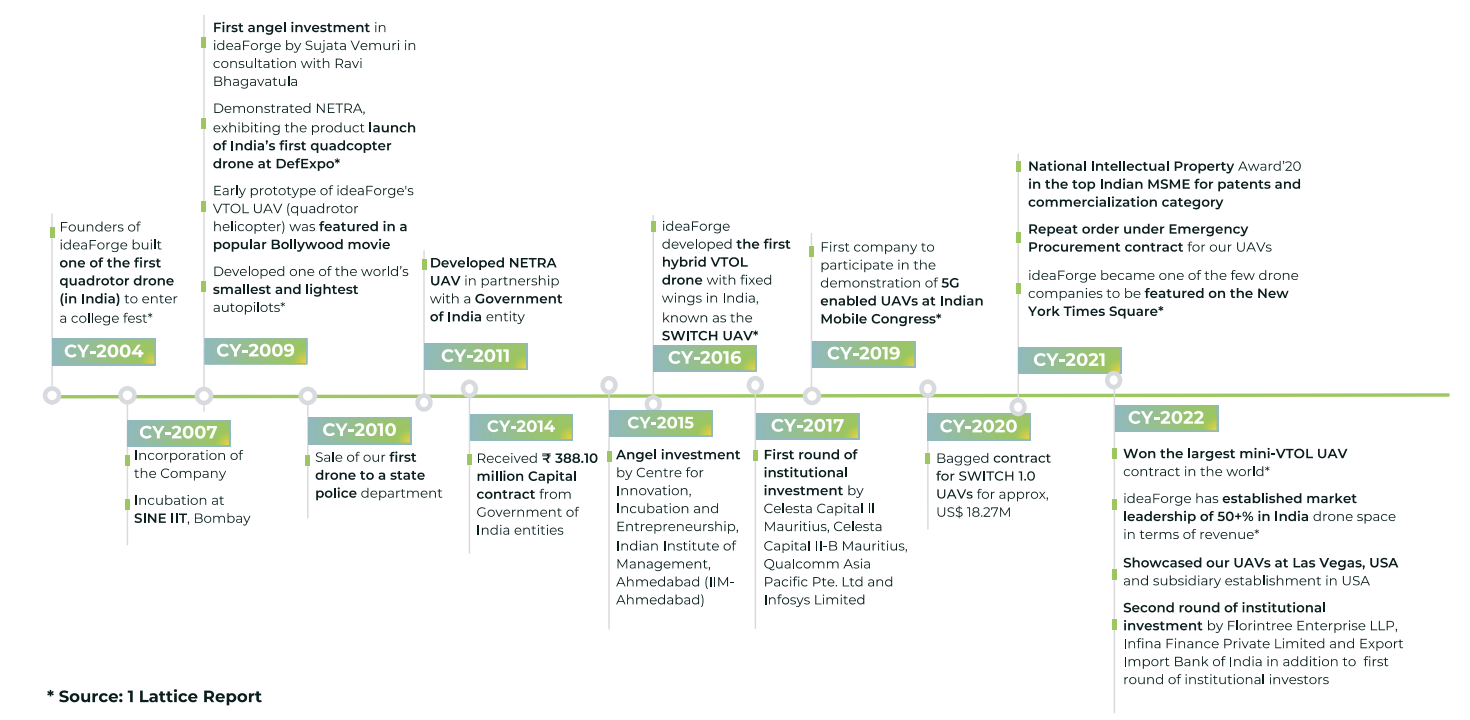

ii. Pioneer and the pre-eminent market leader in the Indian UAS industry, with a first-mover advantage

iii. Strong relationships with a diverse customer base

iv. Significant product development capabilities powering our software and solutions and product differentiators

Objects of the Ideaforge Technology Limited IPO:

Ideaforge Technology Limited IPO Details:

| Open Date: | Jun 26 2023 |

| Close Date: | Jun 30 2023 |

| Total Shares: | 8437500 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 567 Cr. |

| Lot Size: | 22 Shares |

| Issue Price: | ₹ 638 to ₹672 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Jul 07 2023 |

Promoters And Management:

Financials of Ideaforge Technology Limited IPO:

| Particular (In Crore) | Mar-21 | Mar-22 | Mar-23 |

| Equity Share Capital | 0.089 | 0.089 | 21.337 |

| Reserves | 60 | 163 | 303 |

| Borrowings | 51 | 6 | 87 |

| Trade Payables | 5 | 7 | 14 |

| Other Liabilities | 9 | 46 | 63 |

| Total Liabilities | 64 | 59 | 163 |

| Net Block | 1 | 2 | 8 |

| Capital Work in Progress | 0 | 0 | 3 |

| Investments | 0 | 0 | 1 |

| Other Assets | 41 | 76 | 92 |

| Total NC Assets | 42 | 79 | 104 |

| Receivables | 24 | 20 | 58 |

| Inventory | 23 | 49 | 105 |

| Cash & Bank | 5 | 30 | 5 |

| Other Assets | 29 | 44 | 217 |

| Face value | 10 | 10 | 10 |

| Particular (In Crore) | Mar-21 | Mar-22 | Mar-23 |

| Sales | 35 | 159 | 186 |

| Raw Material Cost | 22 | 51 | 96 |

| Change in Inventory | -4 | -10 | -37 |

| Employee Cost | 19 | 27 | 51 |

| Other Expenses | 8 | 18 | 29 |

| Other Income | 2 | 2 | 10 |

| EBITDA | -9 | 75 | 57 |

| EBITDA Margin | -26.65% | 47.12% | 30.91% |

| Depreciation | 4 | 7 | 12 |

| Interest | 2 | 18 | 5 |

| Profit before tax | -15 | 50 | 41 |

| Tax | 0.12 | 6 | 9 |

| Net profit | -15 | 44 | 32 |

| Particular (In Crore) | Mar-21 | Mar-22 | Mar-23 |

| Cash From Operating Activity | |||

| Profit From Operation | -5 | 80 | 78 |

| Receivable | -13 | 3 | -38 |

| Inventory | -13 | -25 | -56 |

| Payable | 4 | 3 | 7 |

| Other WC Items | -4 | 14 | -38 |

| Working Capital Changes | -26 | -6 | -125 |

| Direct Taxes | 0.05 | -7 | -6 |

| Net Cash Inflow from Operating Activity | -31 | 67 | -53 |

| Cash from Investing Activity | |||

| Fixed assets purchased | -9 | -13 | -33 |

| Fixed assets sold | 0 | 0.02 | 0 |

| Investments purchased | -11 | -9 | -9 |

| Dividends received | 0.14 | 0 | 0 |

| Other investing items | 13 | -8 | -107 |

| Net cash inflow from investing activities | -7 | -31 | -149 |

| Cash from Financing Activity | |||

| Proceeds from shares | 0 | 0 | 103 |

| Proceeds from borrowings | 0 | 15 | 0 |

| Repayment of borrowings | 0 | -15 | 0 |

| Intrest paid fin | -1 | -7 | -4 |

| Other financing items | 44 | -3 | 78 |

| Net Cash Flow | 5 | 25 | -26 |

Comparison With Peers:

| Name of the Company | Revenue (In Crore) | PAT (In Crore) | EPS ( in Rs) | P/E | CMP | Mcap (In Crore) |

| IdeaForge Technology Limited | 186 | 31.9 | 7.68 | 87.5 | 672 | 2800 |

| MTAR Technologies Limited | 573 | 104 | 33.84 | 59.8 | 2025 | 6229 |

| Data Patterns India Limited | 453 | 124 | 22.15 | 86.2 | 1,910 | 10,693 |

| Astra Microwave Products | 816 | 70 | 8.06 | 50.4 | 371 | 3,520 |

Recommendation on Ideaforge Technology Limited IPO:

Lead Manager of Ideaforge Technology Limited IPO:

Registrar of Ideaforge Technology Limited IPO:

Company Address:

Discussion on Ideaforge Technology Limited IPO:

10 Comments

Leave a Reply

You must be logged in to post a comment.

*Listing Ideaforge Technology Limited* on 7 july

*NSE Symbol:- IDEAFORGE*

*BSE CODE:- 543932*

*ISIN NO:- INE349Y01013*

Subscribed more than 100 times. Lottery type allotment? . May not get any. Cyent…. subscribed more than 67 times. Atleast no loss is guaranteed in both.

Expert advice solicited about the others coming up on 30/4/23 and subsequent days.

Applied for one lot each. Oversubscription this afternoon (2nd day) was reported to be more than 13 times.

Apply only for listing gain

Agree with you Umesh ji. Hype and valuation are high. Likely to be over subscribed multiple times and if so might be listed on premium. Thinking to apply for one lot each.

Yes apply.

Following funds have invested in the Idea Forge Pre-IPO on 7th June 2023

1. 178,515 equity shares were allotted to ONE Special Opportunities Fund – Series 9 (formerly IIFL Special Opportunities Fund – Series 9).

2. 44,700 equity shares were allotted to ONE Special Opportunities Fund – Series 10 (formerly IIFL Special Opportunities Fund – Series 10).

3. 223,214 equity shares were allotted to TATA AIG General Insurance Company Limited.

4. 223,214 equity shares were allotted to Think Investments PCC.

5. 223,214 equity shares were allotted to Motilal Oswal Midcap Fund.

Under the guise of excessive drone hype, Idea Forge is being traded at a price-to-earnings (P/E) ratio of 87x, while its peer, Data Pattern, has seen its P/E ratio rise from 48x to 86x in the past five months. Similarly, MTAR is valued at a P/E ratio of 60x, and Astra Micro at 51x. Additionally, the mention of an Offer for Sale (OFS) suggests that the seller intends to capitalize on the drone industry’s upward momentum.

Subscribed more than 100 times. Lottery type allotment? . May not get any. Cyent…. subscribed more than 67 times. Atleast no loss is guaranteed in both.