G R Infraprojects Limited IPO

(i) G R Infraprojects Limited is an integrated road EPC company with experience in design and construction of various road/highway projects across 15 States in India and recently they have entered into Railway projects as well.

(ii) Business Vertical of the G R Infra IPO

a) Civil construction activities, under which we provide EPC services.

b) Development of roads, highways on a Build Operate Transfer (“BOT”) basis, including under annuity and Hybrid Annuity Model (“HAM”).

c) Manufacturing activities, under which they process bitumen, manufacture thermoplastic road-marking paint, electric poles and road signage and fabricate and galvanize metal crash barriers.

(iii) The Company was incorporated in December 1995 and executed their first projects for the Public Works Department, Rajasthan in 1997 with a Bid Project Cost of ₹ 2.65 Cr, whereas the project recently awarded by NHAI, i.e. Vadodara Mumbai Expressway project in the state of Maharashtra on HAM basis, to the GR Infra IPO in 2020 involves a Bid Project Cost of ₹ 2747 Crores.

(iv) Projects Detail

a) Since 2006, executed over 100 road construction projects.

b) Out of BOT projects, they have one operational road project which has been constructed and developed by us on a BOT.

c) 14 road projects which have been awarded to them under the HAM, out of which five projects are currently operational, four projects are under construction and construction is yet to commence on five of these projects.

EPC Project:

For the projects under EPC and construction services basis, the scope of the services typically includes design and engineering of the project, procurement of raw materials, project execution at site with overall project management up to the commissioning of these projects.

BOT Projects:

For BOT projects, in addition to construction and development of the project, we are also required to operate and manage the project during the concession period.

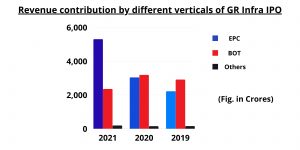

Revenue Contribution by Business Verticals

Order Book Size

As on 31.03.2021, they have an order book of ~19000 Crores.

a) The Order Book primarily comprised EPC and HAM projects in the road sector across the states of Uttar Pradesh, Madhya Pradesh, Maharashtra, Gujarat, Chattisgarh, Rajasthan, Andhra Pradesh, Bihar, Manipur, Odisha and Himachal Pradesh.

b) It also includes railway projects in Andhra Pradesh and Madhya Pradesh and an optical fibre project spread across the states of Bihar, Odisha, West Bengal, Andaman and Nicobar Islands, Jharkhand and Sikkim.

Objects of the G R Infraprojects Limited IPO:

G R Infraprojects Limited IPO Details:

| Open Date: | Jul 07 2021 |

| Close Date: | Jul 09 2021 |

| Total Shares: | 11,50,87,04 |

| Face Value: | ₹ 5 Per Equity Share |

| Issue Type: | Book Building |

| Issue Size: | 960 Cr. |

| Lot Size: | 17 Shares |

| Issue Price: | ₹ 825-837 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Jul 19 2021 |

Promoters And Management:

Financials of G R Infraprojects Limited IPO:

| Particulars (in Cr.) | Mar-21 | Mar-20 | Mar-19 |

| Sales | 7844 | 6372 | 5282 |

| Cost of Material Consumed | 111 | 106 | 113 |

| Civil Construction Costs | 5313 | 4151 | 3461 |

| Change in Inventories | -4.37 | -2.30 | 0.33 |

| Employee Benefits Expense | 457 | 449 | 349 |

| Other Expenses | 116 | 82 | 74 |

| Operating Profit | 1849 | 1586 | 1283 |

| OPM % | 23.58% | 24.89% | 24.29% |

| Other Income | 62 | 51 | 42 |

| Interest | 361 | 294 | 169 |

| Depreciation | 226 | 188 | 148 |

| Profit before tax | 1,324 | 1,154 | 1,007 |

| Total Tax Exps | 371 | 353 | 291 |

| Net Profit | 953 | 800 | 716 |

| NPM % | 12.15% | 12.57% | 13.57% |

| No. of shares | 9.67 | 9.67 | 9.67 |

| EPS in Rs | 98 | 82 | 73 |

Comparison With Peers:

| Name of the company | Sales | 3-year Revenue Growth | 3-year PAT Growth | OPM (FY21) | D/E | ROE (FY21) | ROCE(FY21) | Debtor days | P/E |

| KNR Constructions | 2904 | 12% | 23% | 24% | 0.37x | 21.00% | 21% | 42 | 17 |

| PNC Infratech | 5788 | 24% | 19% | 24% | 1.23x | 17% | 18% | 25 | 14 |

| HG Infra Engineering | 2602 | 14% | 37% | 18% | 0.64x | 23% | 26% | 82 | 11 |

| Dilip Buildcon | 10168 | 4% | -30% | 21% | 3x | 8.00% | 14% | 42 | 33 |

| Ashoka Buildcon | 4992 | 1% | 150% | 31% | 10x | 57.00% | 21% | 66 | 11 |

| IRB | 5299 | -11% | -63% | 44% | 2.7x | 1.78% | 10% | 23 | 48 |

| GR Infra | 7844 | 22% | 15% | 24% | 0.97x | 24% | 26% | 24 | 8.5 |

Recommendation on G R Infraprojects Limited IPO:

Lead Manager of G R Infraprojects Limited IPO:

Registrar of G R Infraprojects Limited IPO:

Company Address:

Discussion on G R Infraprojects Limited IPO:

8 Comments

Leave a Reply

You must be logged in to post a comment.

No allotment for me.

Debit of money started …

Here it shows listing is on 15th on other websites it shows its on 19th

19th…

It is a pure-OFS, company will not receive anything.

Should we apply।।। Allotment ratio??

Yes. Please apply.

There are 3 ways under which road projects are distributed.

1. EPC Model – In this model, the NHAI gives the upfront fees. Under this they will not have to maintain the roads. They construct and transfer the roads to NHAI.

2. BOT Model- In this model, the road companies have to put their money initially and after completion of construction, they earn revenue by toll for certain period of time. Under, this they will have to maintain the roads as well.

3. HAM Model – In this model, the NHAI provides 40% of the project cost upfront and rest 60% paid as annuity for certain period of time. Under, this they will have to maintain the roads as well.