Weizmann Forex Limited BuyBack offer June 2018

(i) Weizmann Forex is a part of the INR 45 billion Weizmann Group, with business interests in textile manufacturing and exports, hydro and wind-power generation, as well as foreign exchange transactions and inward money transfer.

Weizmann began its forex operations in 1993 with just four branches and over the years, have grown exponentially to become a leading player in the foreign exchange and remittance market.

(ii) The company has a pan-India network of over three hundred locations. The considerable size, together with meticulous track-record on compliance, has resulted in Weizmann Forex being upgraded by the Reserve Bank of India from Full Fledged Money Changer to the status of Authorized Dealer – Category II.

(iii) Weizmann Forex focused on customer satisfaction striving towards the highest international standards in the wide range of products and services we offer

1. Foreign Currency Demand Draft (DD) and Telegraphic Transfer (TT)

2. Co-branded International Pre-Paid Travel cards, Travellers’ Cheques

3. Import and Export of Foreign Currency

4. Western Union In-bound Money Transfer

5. Facilitating remittances for trade-related imports through Western Union Business Solutions

6. Western Union Domestic Money Transfer

7. Mobile and DTH Recharge

8. Travel Insurance

9. Tours and Travel, including International and Domestic Air Tickets, and Customised Holiday Packages.

Buy Back Offer Deal:

| Buyback Type: | Tender Offer |

| Buyback Record Date: | Aug 16 2018 |

| Buyback Opening Date: | Oct 03 2018 |

| Buyback Closing Date: | Oct 16 2018 |

| Buyback Offer Amount: | ₹ 30.64 Cr |

| Date of Board Meeting approving the proposal: | Jun 04 2018 |

| Date of Public Announcement: | Jun 04 2018 |

| Buyback Offer Size: | 3.77% |

| Buyback Number of Shares: | 436,467 |

| FV: | 10 |

| Buyback Price: | ₹ 702 Per Equity Share |

Details of Buyback:

How to Participate in buyback?

Profit from the buyback on the bases of acceptance Ratio:

| Weizmann Forex Limited Buyback offer calculation for investment of Rs 2,00,000 @ 508.7 per share | ||

| % Share Accepted | No of Shared Accepted | Gain from Buyback Offer |

| 33% | 129 | Rs 25,026 |

| 50% | 194 | Rs 38,121 |

| 75% | 294 | Rs 57,181 |

| 100% | 393 | Rs 76,242 |

Recommendation:

Registrar Contact Details:

Company Contact Details:

16 Comments

Leave a Reply

You must be logged in to post a comment.

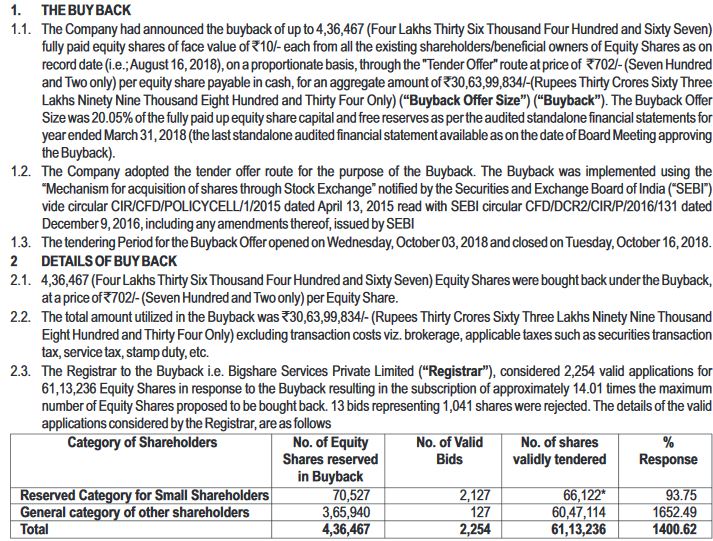

For retail Category, the total number of Shares reserved were 70527 and total number of shares tendered were 66122. So 100% Shares are accepted. Check the link below.

https://d2un9pqbzgw43g.cloudfront.net/main/1541049743282.pdf

I have a little doubt here. As total buyback no. of shares are 436,467. While bidding subscription details shows retail portion subscribed for 30,66,648 shares. So, acceptance ratio should be 436467/3066648 (Approx. 16-17%).

You are confused with Individual and Retail Category.

Individual Category means any Individual holding shares from 0 to n.

if n in Weizman case is 393( 200000/507), then it will be treated as Retail Category.

If n> 393 then it will be treated under the General category.

General category includes( Individuals holding shares worth > Rs. 2 lakh, Promoters, MFs Institutions etc..)

Hope it is clear now.

Thank you for the clarification. Now it is clear.

How calculate above data

What you want Krishnat bro? What is the thing u didn’t understand?

I want know how we decided retail shareholder. In first case 200000/702 or in second case closing price on record divide to 200000

In general how decide retail category in any share .Now I have just dial shares on 450 RS and quantity 250 .now just dial buyback price 800 per share so 200000/800=250 shares. Or on record date closing price was 485 then number share increase then tell me how to decide retail category in any buyback offer

It is calculated on price based on Record Date.

If the price of Just Dial on Record date was 485 then , to be eligible under Retail category is divide 200000/485=412.. So anybody holding below 412 will be entitled under Retail category..

393 and 200000/507 ple clerify me

Pure 80K profit for 2 lakh Application

100%,Accepatance Ratio in Weizman for retail.

The buyback is proposed to be made from all Equity shareholders as on Record Date of 18.08.2018 on

a proportional basis through the ‘Tender Offer’ route.

The Financial performance of FY18 is summarized below

1. Revenue growth of 28% as compared to the last year.

2. PAT growth of 47% as compared to the last year.

3. The EPS for FY18 was at 28.

4. The P/E stands at 19 Current Market Price of 536.

Record date for the purpose of Buyback of Equity Shares. is 18 August 2018.