Star Cement Limited Buyback 2019

(i) Star Cement Limited is the largest cement manufacturer in northeast India.

(ii) The plant is spread across 200 hectares of land in the idyllic town of Lumshnong, a strategic location at Meghalaya that ensures easy availability of high-grade limestone. The brand “Star Cement” has established itself as the most accredited brand of the region on grounds of both quality and fair pricing.

(iii) Star Cement Limited is one of the most profitable cement manufacturers in North East India

(iv) Product: Star Cement’s product range includes Ordinary Portland Cement (OPC 43-Grade) and (OPC 53-Grade) and Portland Pozzolana Cement (PPC), Portland Slag Cement (PSC) and Anti Rust Cement (ARC) in line with evolving customer needs.

(v) Plant: Star Cement’s 1.0 MTPA integrated cement plant at Lumshnong (Meghalaya) is proximate to key raw material reserves of limestone, coal, and shale. The company also added 0.67 MTPA cement unit in Meghalaya, 2.0 MTPA cement unit in Sonapur (Guwahati) and 2 grinding units in West Bengal with a total capacity of 0.67 MTPA ( though trading agreement), aggregating an installed capacity of 4.3 MTPA.

(vi) Pride: Star Cement was recognized by the Meghalaya state government for its pioneering cement plant in the backward area of Lumshnong in 2005. The company is an ISO 9001:2008, ISO 14001 & OHSAS 18001 certified Company.

(vii) Penetration: Brand “Star Cement’ is one of the largest in the Northeastern region. Its output is marketed through a network of over 6000 dealers and retailers across the North East, resulting in the largest market share in North East India. Star Cement also has a network of over 6000 dealers and retailers across West Bengal and Bihar. The Company’s institutional customers comprise Larsen & Toubro, National Hydro Power Corporation, Public Works Department, Indian Railways and Ministry of Defence.

Presently Star Cement is marketing super quality clinker to different grinding units located in India, Nepal & Bhutan.

Buy Back Offer Deal:

| Buyback Type: | Tender offer |

| Buyback Record Date: | Jul 05 2019 |

| Buyback Opening Date: | Oct 22 2019 |

| Buyback Closing Date: | Nov 05 2019 |

| Buyback Offer Amount: | ₹ 102 Cr |

| Date of Board Meeting approving the proposal: | Jun 21 2019 |

| Date of Public Announcement: | Jun 21 2019 |

| Buyback Offer Size: | 1.62% |

| Buyback Number of Shares: | 68,00,000 |

| Price Type: | Tender Offer |

| FV: | 1 |

| Buyback Price: | ₹ 150 Per Equity Share |

Details of Buyback:

Salient financial parameters:

| Year | Revenue | EBITDA | PAT | EPS | RONW |

| 2017 | 1286 | 183 | 80 | 1.91 | 7.0% |

| 2018 | 1467 | 333 | 210 | 5.03 | 14.2% |

| 2019 | 1734 | 361 | 255 | 6.10 | 14.8% |

Source: Moneyconytrol

Source: MoneyconytrolHow to Participate in buyback?

Profit from the buyback on the bases of acceptance Ratio:

| Acceptance Ratio | 33% | 50% | 75% | 100% |

| Amount Invested in Buyback | 1,61,293 | 1,61,293 | 1,61,293 | 1,61,293 |

| No. of Shares buyback | 439 | 666 | 999 | 1333 |

| BuyBack Profit | 12731 | 19314 | 28971 | 38567 |

| Profit | 7.89% | 11.9% | 17.96% | 23.9% |

Recommendation:

| Category | No. of Shares reserved for Buyback | No. of Valid Applications | Total Shares Tendered | % Response |

| Retail Shareholders | 1,02,000 | 4,202.00 | 11,16,000 | 109.41% |

| General Category | 57,80,000 | 658 | 4,20,50,268 | 725.71% |

26 Comments

Leave a Reply

You must be logged in to post a comment.

182 accepted out of 200

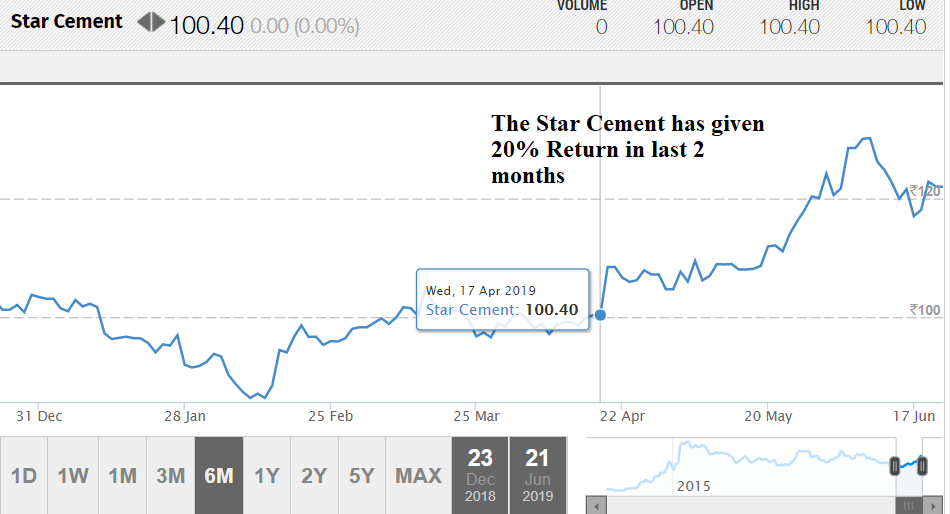

1. At the time of the announcement of the buyback , the price of share was 121.

2. Total 1333 shares bought at 121 per share.

3. Sold all 1333 shares two days before the record date i.e. 03.07.2019. The price on 03.07.2019 was 123. Profit per share would be 1333*2= 2666.

4. As per the letter of offer, 30% is the minimum entitlement. So buy 30% of 1333 i.e. 399 shares at C.M.P of 94.40 on 18.10.2019.

5. Profit would be 399*(150-94.40)= 22184.

6. Total Profit = 22184+2666 = 24,850.

Hi Sir, How could you sell the share 2 days before record date and still eligible for buyback? generally they say T+1 day criteria for the record date.. In this case, my assumption here stock should have been sold on or after 4th July 2019 to meet up T+1 criteria. Please correct me if I am wrong.

Where it is written that T+1 is the criterion?

Hi Sir, It’s not written anywhere. General assumption I have for buyback offer- number of stocks available in demat account at the end of record date are eligible for this offer. I use to sell the stocks a day before record date, so that it will be debited from my demat account only after record date.

Can we sell the stock 2 days before buyback record date and still eligible for the buyback offer?

Letter of Offer.

https://www.bseindia.com/xml-data/corpfiling/AttachHis/6636aaa0-5890-4bba-ad5f-6edeef89c8bd.pdf

This month 22 the buyback session will start for star cement.

Out of 67 shares only 19 they taking

And one of my friends 50 out of only 14 they taking

Means only 35 %thet taking from us…

Buyback announced. 58 shares out of 200

182 accepted out of 200

@market wizard please share if u have any update on offer date

Any update on offer date????

Any hopes for idea share price to be improved?

Looks difficult. The debt is mounting YoY. They have pledged all there shares to Private Banks.

What does that mean?

That means they need a lot of money to run its business. They are not generating enough revenue to run their operation. So they are pledging shares to get some cash. During pledging, if the company is unable to pay then Pledge shares can be sold in the market.

Pledging all their shares to private banks, can reduce their losses and recover share price?

The govt must have exempted the companies for which the buyback record date is already announced. I have Wipro 600 shares, and now will most likely lose 20%.

*Attention Please:* As Per New Guidelines Of Today Budget The Company Has To Pay 20% Tax Of Total Size Of Buy Back Offer Means If The Total Size Of Buy Back Is 5000 Crore Then Company Has To Pay To The Government Rs.1000 Crore @ 20% Tax. It Will Be Implement/applicable Immediate Effect. Now There Are Full Chances Of Cancellation Of Buy Back Except Wipro Because As Per Law Once The Record Date Passed Then That Buy Back Offer Legally Can Not Be Withdraw/cancel. Only SEBI Can Be Cancelled With Some Solid Reasons Or Facts. It’s A Very Bad News For Market Investors. In Future Maximum Companies Will Avoid To Offer Buy Back.

Buyback will now become at par option for promoters. Arbitrage gone? Buyback not an beneficial option for promoters

Hi MW,

Please share your view on Star Cement buyback.

Actually, it is a small buyback. I would suggest participating in a big size buyback especially if you are new to buyback. Else buy around 1st July and sell everything on ex-date. Then wait for a letter of offer to announce. Try to buy Star Cement around 110 levels.

Why in some companies buyback record date announcement doesn’t require shareholders approval like Star cement

But took month in Wipro.plz explain

Because size of buyback is less than only 10% of Equity Capital and Reserves. In such cases only board approval is required for buyback. In case, the size of the issue is more than 10% and less than 25%(Max. permitted in a buyback) a Special Resolution is required which is passed either in EGM or through AGM or Postal Ballot and hence such issues take much longer to announce record Date.

Look at BSE it said it will consider buyback in AGM on 15th July. They made such announcement in May itself and hence a pretty long wait for Record Date.

Ok understood thanks

Any idea for star cement buy back ???