Quick Heal Buyback 2019

Quick Heal Technologies Ltd. (Formerly Known as Quick Heal Technologies Pvt. Ltd.) is one of the leading IT security solutions company. Each Quick Heal product is designed to simplify IT security management across the length and depth of devices and on multiple platforms. They are customized to suit consumers, small businesses, Government establishments, and corporate houses.

Over a span of over 20 years, the company’s R&D has focused on computer and network security solutions. The current portfolio of cloud-based security and advanced machine learning enabled solutions to stop threats, attacks, and malicious traffic before it strikes. This considerably reduces system resource usage. The security solutions are indigenously developed in India. Quick Heal Antivirus Solutions, Quick Heal Scan Engine and the entire range of Quick Heal products are proprietary items of Quick Heal Technologies Ltd. (Formerly Known as Quick Heal Technologies Pvt. Ltd.)

Buy Back Offer Deal:

| Buyback Type: | Tender Offer |

| Buyback Record Date: | Apr 26 2019 |

| Buyback Opening Date: | May 20 2019 |

| Buyback Closing Date: | May 31 2019 |

| Buyback Offer Amount: | ₹ 175 Cr |

| Date of Board Meeting approving the proposal: | Mar 05 2019 |

| Date of Public Announcement: | Mar 05 2019 |

| Buyback Offer Size: | 9.02% |

| Buyback Number of Shares: | 63,63,636 |

| Price Type: | Tender Offer |

| FV: | 10 |

| Buyback Price: | ₹ 275 Per Equity Share |

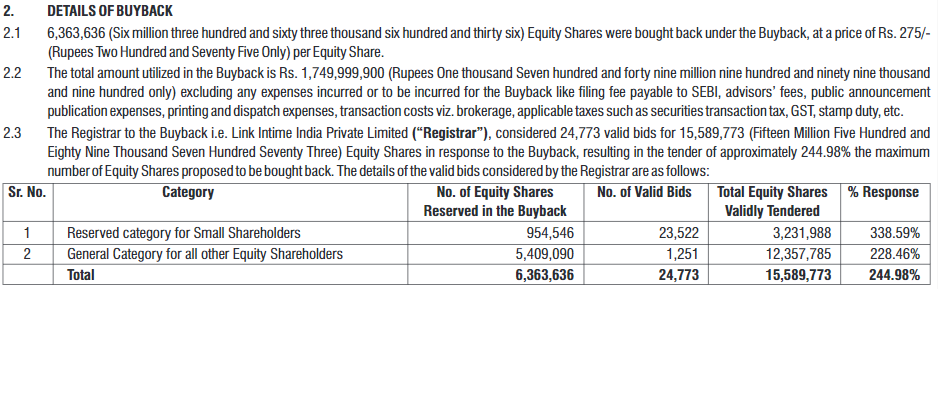

Details of Buyback:

Salient financial parameters:

| Year | Revenue(cr) | Expense(cr) | PAT(cr) | PAT% | EPS |

| 2016 | 343 | 250 | 62 | 18.1% | 10 |

| 2017 | 326 | 232 | 59 | 18.1% | 8 |

| 2018 | 346 | 219 | 78 | 22.5% | 11 |

| 9MFY19 | 227 | 154 | 60 | 26.4% | 8 |

How to Participate in buyback?

Profit from the buyback on the bases of acceptance Ratio:

| Acceptance Ratio | 33% | 50% | 75% | 100% |

| Amount Invested in Buyback | 1,62,909 | 1,62,909 | 1,62,909 | 1,62,909 |

| No. of Shares buyback | 240 | 363 | 545 | 727 |

| BuyBack Profit | 12,240 | 18,513 | 27,795 | 37,077 |

| Profit | 7.5% | 11.36% | 17.06% | 22.7% |

Recommendation:

Company Contact Details:

99 Comments

Leave a Reply

You must be logged in to post a comment.

What the heck is happening in this

It is cracking every day

Should we keep it or sell it

Should we keep the shares or sell them

If you had gone with my second strategy of buying shares just before the record date and sell on ext-date. Then buy again depending upon the entitlement. The following would have happened.

Buy on 22.04.2019, that means an investment of 727*236= 1,71,572. Sell on Ex-date i.e. 25.04.2019, the price was 223. So the loss of selling would be 727*13= 9451.

Letter of the offer was given around 14.05.2019 and entitlement was 16%. So buy 116 shares at 184 each and tender all of them. The profit on tender shares Rs. 10557.

So overall a profit is Rs.1105.

Final Analysis of Quick Heal ( Return Analysis)

1. Buyback Announcement date: 05.03.2019—– Share Price was 224.

2. 727 Shares bought at Rs. 224 means an investment of 1,62,909.

3. Retail Acceptance Ratio was 29%. i.e. out of 727 shares, 210 shares have been buyback by the company. Profit on Accepted Shares= 10,710

4. The final unaccepted Shares were given back on 12.06.2019. The share price on 13.06.2019 was 178. So loss on unaccepted shares were 23,782.

5. Overall we can say a loss of 13072.

Why qyickheal is going down and down

Quickheal is Volatile and the acceptance in buyback for people who entered just for buyback was only 28%. Now it will remain much below the Cost price of retailers and will test patience of everyone who bought just for buyback. Similar thing happened in Redington the stock corrected from 120 to 65 and then after 6-7 months got some upmove. Moreover, Quickheal had a disastrous Quarterly results last quarter with profit down which also led to some correction.

For me AR is only 20.66%.How?As per offer letter I hold 150 shares on record date and entitlement of 24. I sold all the shares 2 days after record date. Later bought 70 shares and tendered all of them. Only 31 accepted

how many was supposed to be accepted?

Scenario-II( Buy when company Fixes Record Date for Buy Back and sell on Ex-date. Then wait for minimum entitlement to be announced in Letter of an offer to buy that many shares and tender them)

1. On 16.04.2019 the company Fixes 26.04.2019 as Record Date for Buy Back of Equity Shares.

2. Shares price on 17.04.2019( next day when you buy from the market) was Rs. 222.

3. 727 Shares bought on 17.04.2019 means an investment of 1,61,454.

4. Sell all 727 shares on 25.04.2019(Ex.date). The share price was 223. It fell from 239 to 223. Please see the price graph below. That means a profit of 727*(223-222)=727.

https://d2un9pqbzgw43g.cloudfront.net/main/quick-heal.png

5. Now 06.05.2019 company has informed to exchanges regarding dates of buyback opening and have said to dispatch letter of offer on or before 13.05.2019. The minimum Entitlement was 16.52%. So you must have bought 116 shares on 14.05.2019 at Rs. 185 and tender all shares thereby getting a profit of 116*(275-185)= 10,440.

Hi,

Have you tried the scenario 2. I am seeing this for the first time so asking.

Thanks,

Vishal

Yes, i have tried same in FDC. Bought shares around 196 and sell on ex-date at 184. Now waiting for Letter of offer to know the entitlement. Then will buy accordingly and participate in the buyback.

Why to buy on 14.05

You can buy any day between start to end which is 20 to 31

Yes, you can buy Venkat Jii, I am taking a 14.05.2019 as the date of reference when all Shareholders must have known their entitlement. So from here onwards, the buyer may come and the price will go up. Therefore, it is advised to buy as soon as you come to know about minimum entitlement.

Excellent

Is there any place where we can get the updates about all good / profitable Corp actions like buyback , divided..

Or any WhatsApp group.

I have few ideas, other also might have few.

So that we can share our thoughts.

For eg, Buy Wipro put, sell Wipro call, go long on equity for Wipro buyback.

To get No loss

Venkat Bro we create a page for every buyback and in the comments section, we can discuss our views and strategies.

is this possible with Zerodha account as we under stand that it sucks the shares on same day from account,in this case no shares available on record date

Final Analysis of Quick Heal Technologies 2019

Scenario-I( buy on date of announcement and sell unaccepted shares on settlement date )

1. Buyback Announcement date: 05.03.2019—– Share Price was 224.

2. 727 Shares bought at Rs. 224 means an investment of 1,62,848.

3. Retail Acceptance Ratio is 28.6%. i.e. out of 727 shares, 207 shares have been buyback by the company. Profit on Accepted Shares=10557

4. The final Accepted Shares were taken back on 11.06.2019. Share price on 11.06.2019 is 177. So loss on unaccepted shares is 520*47= 24,440

5. Overall we can say a loss of 13883.

AR = 28.6%. Amt will be credited tomorrow.

Thanks. Can you please educate us from where you got this input ?

Sorry.. Just saw my email .. It’s there in the contract note 😁

By 12 june settlement will be done.

Any update ?

Approx. 2.5 times subscribed for both categories.

So we should expect the minimum acceptance or something else ?

Approx final AR? When will shares be returned back? Price has dropped to 185. Sh uld we hold for getting price back to 220 or sell at 185 when shares are returned?

Could be btwn 30 to 35%

No. of Equity Shares held by me on Record Date being April 26, 2019

500

Entitlement for Buyback Offer in terms of no. of Equity Share

82

Now is I have only 300 share in my demate.

If I tender only 300 than how many share accepted by quick heal.

If I buy another 200 share today and tender 500 share than how many accepted.

Please reply Market Wizard sir.

82 share confirm they buyback. u can tender 300 or 500 share but rest of the acceptance not guaranteed. My suggestion is current market price is low. u can buy 200 and hold until buyback close and dividend paid. sell whatever left around 220/share after that.

why not update of quick heal buy back date it is open on 20th may 2019 &closed 31 may 2019

Done brother. Some technical issues were there on the website.

quick heal buy back open on 20may closeon 31 may2019 buy back %7out 45

Hi,

I didn’t get a mail regarding my entitlement. I bought the shares on 22nd April. What should I infer from this? Am I not eligible for the buyback?

you can also check at

https://www.linkintime.co.in/Offer/Default.aspx

Thank You, entitled 3 out of 20.

Everyone estimated approx 50-60% acceptance ratio

What went wrong

Nothing is wrong. It is just that buybacks are too crowded. The more the people buy for buyback arbitrage the lesser it becomes attractive for all others. estimates are just estimates actuals will always surprise anyone because no one can predict future.

Why it is going down and down

Entitlement:

1. Retail 20 out of every 121 Shares ( 16.5%)

2. General 45 Equity Shares for every 539 Shares. (8.34%)

This needs to be rated 3/10 or even less?

👍

Buyback will open on 20th -31st May19. We will come to know acceptance ratio by 13may19. Very fast process!!

What should I do now

Rte has crashed below 200

Should I keep it or sell half of it

Aashish don’t sell now. Already oversold from 240 to 198 in 4 days (18% approx). I sold 50% @ 226. Holding remaining for tendering. Quarterly Result will be declared soon. Sell around 220 to 225 if you bought for buyback purpose only. there may be euphoria before result

The price was crashed due to selling pressure before the record date.

As 5 to 10% correction could be expected in case of hung government, it makes sense be cautious by selling. In fact, price crash indicates that large number of investors have done so to handle unwarranted post buyback uncertainty.

Risk has been increased with price crash in last two days.

Hello everyone, Today is the last day to buy. Any recommendations? Can this crash (like Mote Carlo)

Hello mw

Your views on this

It is good to participate? Any one

as per mw earlier

Company is good fundamentally

And we could participate

I will read some more reviews and then update

Record date for Quick heal technologies buyback is 26th April 2019

Source ?

Just wait for the announcement from Company.

Result of postal ballot???

Any news or updates regarding bb. Why all members are silent. Your views my dear MW.

Any new update

Any update / Announcement on record date?

No

Any updates on Mindtree buyback?

No news yet.

Mindtree buyback decision adjourned till any future date

I would suggest not to burn fingers in this

Very rrisky work cultures totally different

Could destroy shareholders value

There will be additional risk of buyback not happening as postal ballot is very time consuming process and approval of 66% is required

Also there is no guarantee that l&t will accept all the shares tendered in open offer

Currently there is not much upside left barely 3 %

I don’t think that is worth the risk

Fresh message so, everyone can refer it:

Just noticed the info from QuickHeal that they informed exchange regarding “dispatch of postal ballot” started from 14th March till 12th April, where the result is on evening 15th April 2019. Reference link https://www.bseindia.com/stockinfo/annpdfopen.aspx?pname=71165462-7859-4c87-a779-4fee0a7af9aa

Please advise on Eclerx buyback.

Avoid eclerx

Please clear why

Difference bhi bahut hai

company bhi good hai

Pehle buyback bhi good the

Does anyone know when will quickheal announce buyback? Also, is it worth investing given current price and will the price fall drastically after the buyback?

Aarthi drugs is considering proposal for buy back

Eclerx Buyback meeting on 14/02

techno electric ka buy back kab he?

Dates not announced yet. Please stay tuned to at http://www.investorzone.in for more updates.

Rec and nalco declared divinded..but no diffrence between future price and market price..can anyone tell why no diffrence?

Future price have to be low till record date is 12th march…

Since corporate action is more than 5℅ of closing price of day of announcement, all open position in futures and options will be adjusted with the amount of Corporate Action. Cash and future diff only in case when there is no adjustment in future and option

ioc and nalco declared divinded..but no diffrence between future price and market price..can anyone tell why no diffrence?

When they declared? Where is it appearing to you??

Name: – Quick Heal Technologies Ltd Buy-Back Details

Record Date: – –

Opening Date:- –

Closing Date:- –

Buyback Amount:- ₹ 175 Cr

Buyback Number of Share:- 63,63,636

Buy-Back Price:- ₹ 275

Current Market Price: ₹ 224

Max Shares to Invest: 727 Shares

Profit per share = ₹ 275 – ₹ 224 = ₹ 51 / Per share

Now see Acceptance Ratio Analysis

If Acceptance Ratio 33%

Amount Invested (727 x 224) = ₹ 1,62,848

No of share Buy-Back = 240

Buy-Back Profit = ₹ 12235

If Acceptance Ratio 50%

Amount Invested (727 x 224) = ₹ 1,62,848

No of share Buy-Back = 364

Buy-Back Profit = ₹ 18538

If Acceptance Ratio 75%

Amount Invested (727 x 224) = ₹ 1,62,848

No of share Buy-Back = 545

Buy-Back Profit = ₹ 27807

If Acceptance Ratio 100%

Amount Invested (727 x 224) = ₹ 1,62,848

No of share Buy-Back = 727

Buy-Back Profit = ₹ 37077

Holding Period may be from 2 to 3 Months

Subject to Selling the rest stocks which was not accepted in Buyback selling at Cost price.

consult your financial advisor before making any investment decisions

I had very bad experience with Alembic, so I will not try to invest in small companies for buyback purpose.

Dear MW, although small but effective pls add Mazda Ltd also bb@550 CMP 370.

But, I hope its an open offer and not Tender route…..

Mr. Wizard any comments on this?

will the company take shareholders approval? if they wait to take approval, record date will be far-off, otherwise record date will be near.

Yes, Shareholder Approval is required.

In case the buyback size (% of Paid-Up Equity and Free -reserves ) is less than 10% then no approval of Shareholder is required.

In Quick heal the Paid-Up Equity and free Reserves is close to 750 Cr and Buyback size is 175 Cr. So it is close to 23% size. Hence shareholder approval is required.

P.S. The Buyback size can’t be more than 25% of Paid-Up Equity and free Reserve

Yeah, just noticed the info from QuickHeal that they informed exchange regarding “dispatch of postal ballot” started from 14th March till 12th April, where the result is on evening 15th April 2019.

Reference link https://www.bseindia.com/stockinfo/annpdfopen.aspx?pname=71165462-7859-4c87-a779-4fee0a7af9aa.pdf

Looks very good opportunity.

Record Date?

Is there any chance of cancellation like pcj

What is record date

Record date not announced yet.

Should we buy now of wait for price drop?

Buy 30%, wait for a price between 215-220 to buy more.

Total Shares Reserved for Retailers= 9,54,545

Shares up to 2 lakh = 76,22,597

So Entitlement would be= 12.5%

As per Annual Report 2017-18, the total number of Shareholders holding shares between 1-5000 are 34,06,389 Shares.

So Entitlement would be = 28%

Final AR may be above 40%.

1-5000 share is 34 lakhs but for retail category it should be below 800 shares..so in retail er will be high and ar will be 100%.

Please suggest buy hold or sell and if buy what will be the target.

Total buyback ————- 6363636 shares (9.02% of the total paid up equity share capital)

Reserved for retail ——- 954545

Total buyback amount — Rs. 175 Crore

Buyback price ————– 275

Route ————————– Tender offer

What should be the target for next month.

Quickheal Buyback

Quickheal current price 225

Buyback price 275

Tender Route

Please suggest buy hold or sell and if buy what will be the target.

Dear MW,

Kindly put some light on Mazda Ltd buyback meeting on 6.03.19…thanks

Dear MW,

If after announcement do you see an upside on the shares on account of buyback.

any idea of the offer price ?

Total Reserves as on 31.03.2018 = 120 Cr.

The buyback size won’t be more than 30-40 Cr.

If we consider the buyback price in the range of 350-400, then no.of shares the company will be buyback won’t be more than 10 lakh.

Accordingly, the retail quota would not be more than 2 lakh.

As per Shareholding quota as on 31.12.2018, the Individual share capital up to Rs. 2 Lacs is 11,67,130 so Entitlement won’t be more than 20%.

Please avoid buyback which is less than 100 Cr.

Buyback size would be small.