One 97 Communication Limited (Paytm) Buyback 2022

i. One 97 Communications was started in 2000, which launched Paytm in 2009, as a “mobile-first” digital payments platform to enable cashless payments for Indians, giving them the power to make payments from their mobile phones.

ii. It offers consumers a wide selection of payment options on the Paytm app, which include

(i) Paytm Payment Instruments, which allows to use digital wallets, sub-wallets, bank accounts, buy-now-pay-later, and wealth management accounts.

(ii) Major third-party instruments, such as debit and credit cards and net banking.

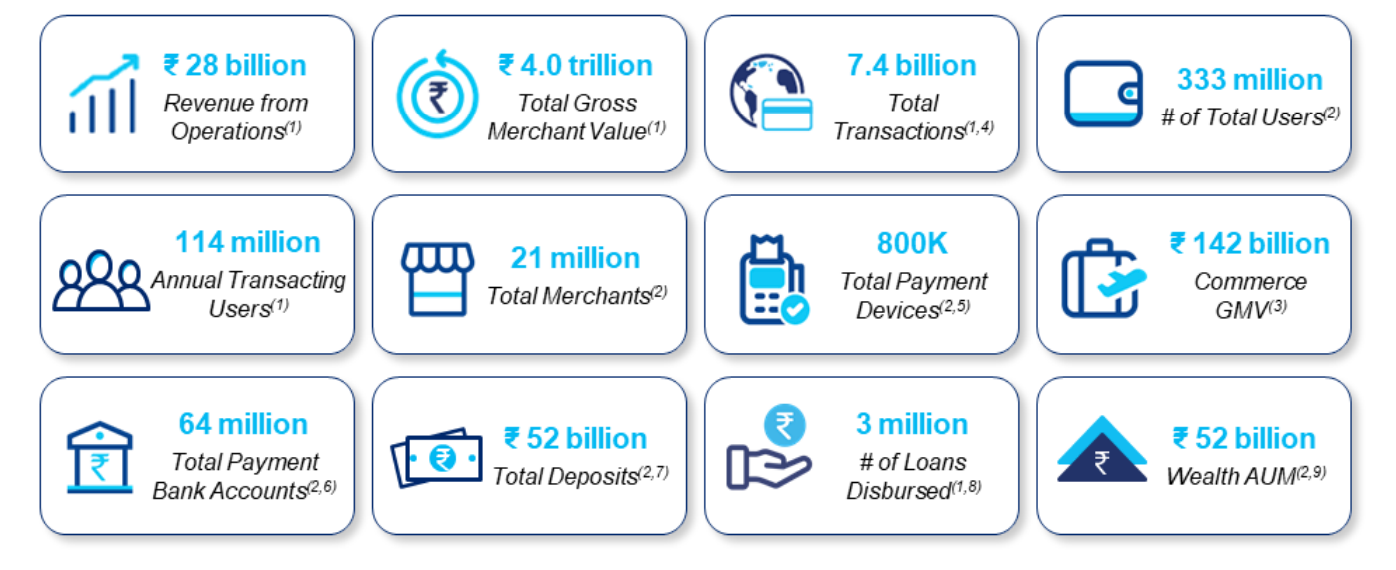

iii. The company’s ecosystem serves 333 million consumers and over 21 million merchants.

Competitive Strengths

i. Trusted brand, scale and reach

ii. Deep insights of Indian consumers and merchants

iii. Leadership and our distinctive culture

Buy Back Offer Deal:

| Buyback Type: | Open Market |

| Buyback Opening Date: | Dec 21 2022 |

| Buyback Closing Date: | Feb 13 2023 |

| Buyback Offer Amount: | ₹ 850 Cr |

| Date of Board Meeting approving the proposal: | Dec 13 2022 |

| Date of Public Announcement: | Dec 13 2022 |

| Buyback Offer Size: | 6.67% |

| Buyback Number of Shares: | 1,04,93,827 |

| Price Type: | Open Market |

| FV: | 1 |

| Buyback Price: | ₹ 810 Per Equity Share |

Details of Buyback:

Salient financial parameters:

| Particulars ( in Cr) | Mar 2016 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 |

| Sales + | 855 | 3,224 | 3,279 | 2,801 | 4,972 |

| Expenses + | 2,523 | 7,592 | 5,964 | 4,640 | 7,356 |

| Operating Profit | -1,668 | -4,368 | -2,685 | -1,838 | -2,384 |

| OPM % | -195% | -135% | -82% | -66% | -48% |

| Other Income + | 164 | 280 | -45 | 356 | 288 |

| Interest | 1 | 38 | 54 | 38 | 42 |

| Depreciation | 28 | 112 | 174 | 178 | 247 |

| Profit before tax | -1,534 | -4,237 | -2,958 | -1,698 | -2,385 |

| Tax % | 0% | 0% | 1% | 0% | 0% |

| Net Profit | -1,535 | -4,231 | -2,942 | -1,701 | -2,396 |

| EPS in Rs | -331.99 | -726.78 | -470.27 | -280.42 | -36.9 |

How to Participate in buyback?

Profit from the buyback on the bases of acceptance Ratio:

9 Comments

Leave a Reply

You must be logged in to post a comment.

Sumit ji,

The price of the Cosmo first is declining drastically. Do you have any idea/ information regarding the price. Thank you.

Hello SRK Ji, Cosmo First was not Ok for me… But the reason of fall seems to be the record date 13/12/2022. I think it may raise near to the the actual buyback…

For me 31% public holding was a show stopper…

Thanks

Sumit ji,

Somehow I have forgotten the Record Date. Thank you for your kind views. All the best.

Sir,

I am under the impression that the Record Date is 14/12/2022. I may be wrong. Please confirm. Thank you.

This buyback is just to support the price.

Sir,

Thank you very much for your kind views. Please continue to help the readers with your valuable suggestions regarding all the Buybacks. God blesses you with all the best.

Loss making company can come up with a buyback to the size of 10% of Net-worth.

Buyback is through the Open Market. No use.

If they are running into losses, then buyback is possible?