Kaveri Seed Company Limited Buyback 2019

(i) The Kaveri saga began in 1976 with the founder G.V.Bhaskar Rao a science graduate with his wife G Vanaja Devi as co-founder establishing a small seed production facility in Gatla Narsingapur village of Andhra Pradesh. In continuance of this entrepreneurial voyage, the idea sprouted as Kaveri Seeds and the company was formally incorporated in the year 1986.

(ii) Currently, Kaveri is one of the fastest-growing seed company in India with a large network of over 15,000 distributors and dealers spread across the country. With over 700 employees and a strong product line of hybrids. The company is poised to go greater heights with its renewed focus on R&D and strong intent to invest in innovation by the management to deliver all brand promises. With one of the largest anthology of crop germplasm in the country, Kaveri’s draught and disease resistant as well as high yielding hybrid and varietal portfolio include Cotton, Corn, Rice, Jowar, Bajra, as well as vegetables such as Tomato, Okra, and gourds.

(iii) Year on year Kaveri has been making great and delivering results and have been strides in its aggressive growth journey by focusing on :

a) Maintaining strong relationships with the farmers as well as channel partners Delivering value to all stakeholders.

b) Exceeding customer expectations in quality, responsiveness, and delivery Upholding a commitment to corporate citizenship by way of handholding farmers Building and retaining a diverse pool of talented employees An aggressive R&D and research focus to incessantly deliver the best of science.

Buy Back Offer Deal:

| Buyback Type: | Tender Offer |

| Buyback Record Date: | Nov 22 2019 |

| Buyback Opening Date: | Dec 31 2019 |

| Buyback Closing Date: | Jan 13 2020 |

| Buyback Offer Amount: | ₹ 196 Cr |

| Date of Board Meeting approving the proposal: | Sep 24 2019 |

| Date of Public Announcement: | Sep 24 2019 |

| Buyback Offer Size: | 4.44% |

| Buyback Number of Shares: | 28,00,000 |

| Price Type: | Tender Offer |

| FV: | 10 |

| Buyback Price: | ₹ 700 Per Equity Share |

Details of Buyback:

How to Participate in buyback?

Profit from the buyback on the bases of acceptance Ratio:

| Acceptance Ratio | 33% | 50% | 75% | 100% |

| Amount Invested in Buyback | 1,55,895 | 1,55,895 | 1,55,895 | 1,55,895 |

| No. of Shares buyback | 94 | 142 | 213 | 285 |

| BuyBack Profit | 14,382 | 21,726 | 32,589 | 43,605 |

| Profit | 9.22% | 14% | 20.9% | 28% |

Recommendation:

Registrar Contact Details:

Company Contact Details:

53 Comments

Leave a Reply

You must be logged in to post a comment.

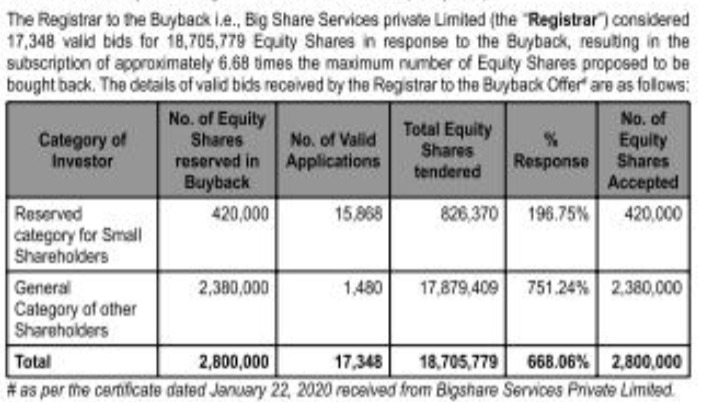

Final Acceptance Ratio in Kaveri Seeds:

https://d2un9pqbzgw43g.cloudfront.net/main/IMG-20200123-WA0019.jpg

someone help me i am new to investing i buyed Kaveri seeds share on 6th january, 2020 and applied buyback for 50 shares now today it is 21 january, 2020 i not got my money and also not got shares in demat account, please tell me what to do ??????

Abhishek Ji, first of all, to be eligible for buyback you must have shares in your demat before 22.11.2019 i.e. Record date of Buyback. So, you were not eligible for the buyback. Do not worry you will get your shares back in next 1-2 days.

Where can we check the acceptance ratio?

In my case:

ER=53/280

AR=69/100

Retail Acceptance Ratio= 46.5%

Thanks sir🙂

How much acceptance ratio. Please tell

Buy back closed yesterday. Any analysis as to what could be the AR? This is just by curiosity.

Dear MW..I purposely buy 1 share of Kavery seeds for tendering in buyback. Can I tender that 1 share in the buyback window period.I.e from 31st DEC. What will be the probability of such shares for acceptance in buyback ?

Dear Mw Any reason behind this spurt in the share today?

please advise why I have not received any buyback email.

I have 50 shares for long time

Please don’t worry. You can still participate in the buyback. Some time due to email id not properly updated with Registrar, such an issue may come.

Thank you very much for your reply. I always receive dividend email though.

And just one more thing wanted to know that how would i know that out of 50 how many shares am I eligible to participate in buyback.

Thank you.

You can down load your tendered form from Bigshare website.

Thanks. downloaded form.

I am entitled for 8 shares. 🙂

My entitlement is 53/280. What would be expected AR?

Sir I have 1993 shares @535/. of kaveri seeds.I have recd mail that 77 shares are entitle for buyback.

.what should i do ?

Tender 100 Shares in Buyback and sell remaining in market if you have bought shares just for buyback.

how can 77 shares only are entitled out of 1993 shares ?

Kaveri seeds buy back retail entitlement 16 out of 83 . Around 19 %

I had 4 shares. I didn’t get any for buyback 🙁 Unfair

When buyback offer opening???

opening on- 31.12.2019

closing on- 13.01.2020

Dec mahine me to lene wale hai ki nahi malum nahi, abi tak inaka mail conformation aya nahi

When buyback open any idea??

Just now I talked to Bigshare. I am informed that SEBI Approval is awaited.

What happened to buyback of Eris Life Sciences?

When can we expect buy back to open?

Kaveri has already filed Letter of Offer with SEBI. Probably by mid Dec 2019 the offer should open.

Dear MW@ Is it worth to apply this Buyback?

Any idea about AR of buy back in 2017-2018 & 2018-2019? Just want to know to have rough idea about expected AR of current buy back.

In 2017-18 the prevailing market price during Tender period was more than the buyback price which was 675 those days. In 2018-19 market price was above 625 closer to tendering period. This year Kaveri is out of FnO and you can see Market price today and acceptance might be lower than 60%. Though things depend on how many people have lapped up the stock just for buyback.

Is the expected AR still 12-15%?

Just a few days back stock was beaten to 460. The bump in price is due to buyback, AR of 10-15% does not mean much if the stock cannot sustain 500 plus levels post completion of buyback. This trade to buy just for buyback may not be profitable at current price.

Thank you sir

record date announced as 22.11.2019

If i buy 1share itz surely confirm for buyback process??

Yes. Record date is yet to be announced.

Voting result will be declared after 3.11.2019. I think record date may also be declared on the same day.

Anyone tried unlisted zone?? I want to buy some unlisted script but is it trusted ? Anyone share experiences

Yes ! you can trust these people. My many friends has done trade with them. They are truly professional.

You can start buying *1 Share* of Kaveri Seeds for buyback. CMP is 503 and bbprice is 700 so Rs. 200 (-brokerage) guaranteed profit.

@Marketwizard, Can you explain why only 1 share ? Why shouldn’t i buy more ?

Yes, you can buy more. However, this one share strategy works when there is large arbitration available between current market price and buyback price. The current market gap is 474 and the buyback price is 700. So if you have say 10 accounts, then buy 1 share from each account. In case 1 share is accepted, you will get a profit of 10*(226)=2260.

Note:

Please contact your broker and ask how much they charge brokerage for Buyback. For Zerdoha,

₹20 plus GST will be charged for buyback /takeover/delisting orders placed through Console.

₹100 plus GST will be charged for the orders placed manually.

Pl suggest buying price

Anything below 500 is a fairly good price.

Expected AR as of now is 12-15%.

Buy back price 700 through tender route

I have 900 kaveri seed shares@ 540. Sell or hold?

Wait for few days then it will cross 540 then sell it. AR IS less I think..

Hi, is it advisable to buy before the announcement

no.