MOIL is a Schedule “A” Miniratna Category-I Company. It was originally incorporated as Manganese Ore (India) Limited in the year 1962. Subsequently, a name of the Company was changed from Manganese Ore (India) Limited to MOIL Limited during the financial year 2010-11.

MOIL was originally set up in the year 1896 as Central Province Prospecting Syndicate which was later renamed as Central Provinces Manganese Ore Company Limited (CPMO), a British Company incorporated in the UK. In 1962, as a result of an agreement between the Government of India and CPMO, the assets of the latter were taken over by the Government and MOIL was formed with 51% capital held between the Govt. of India and the State Governments of Maharashtra and Madhya Pradesh and the balance 49% by CPMO. It was in 1977, the balance 49% shareholding was acquired from CPMO and MOIL became a 100% Government Company under the administrative control of the Ministry of Steel.

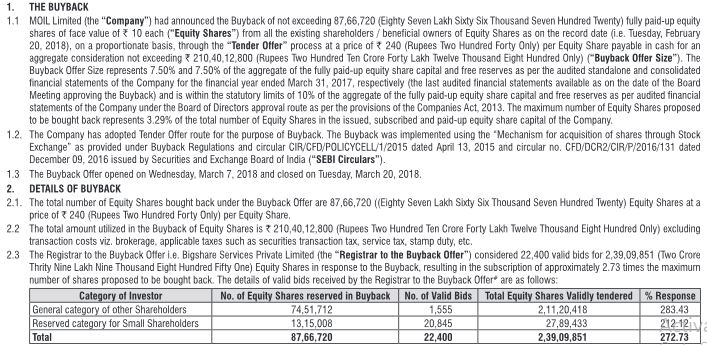

MOIL Ltd(BSE: 533286 | NSE: MOIL ) Board has approved a proposal for buyback of up to 87.66 lakh shares at Rs 240 per share, aggregating Rs 210.4 cr which is 3.29% of a total number of paid-up equity shares.

Buy Back Offer Deal:

| Buyback Type: |

Tender Offer |

| Buyback Record Date: |

Feb 20 2018 |

| Buyback Opening Date: |

Mar 07 2018 |

| Buyback Closing Date: |

Mar 20 2018 |

| Buyback Offer Amount: |

₹ 210.4 Cr |

| Date of Board Meeting approving the proposal: |

Feb 06 2018 |

| Date of Public Announcement: |

Feb 06 2018 |

| Buyback Offer Size: |

3.29% |

| Buyback Number of Shares: |

87.66 Lacs |

| FV: |

10 |

| Buyback Price: |

₹ 240 Per Equity Share |