FDC Ltd Buyback Offer Feb 2018

FDC Ltd(“Fairdeal Corporation”) is engaged in manufacturing and marketing of Oral Rehydration Salts (ORS) and Ophthalmics. The company has also set-up globally approved, multi-location manufacturing facilities for Active Pharmaceuticals Ingredients (APIs) as well as Finished Dosage Forms. These facilities are located at Roha, Waluj and Sinnar in Maharashtra, Verna in Goa and Baddi in Himachal Pradesh. FDC markets more than 300 products in India and exports many of these to over 50 countries.

Buy Back Offer Deal:

| Buyback Type: | Tender Offer |

| Buyback Record Date: | Feb 27 2018 |

| Buyback Opening Date: | Mar 12 2018 |

| Buyback Closing Date: | Mar 23 2018 |

| Buyback Offer Amount: | ₹ 120.05 Cr |

| Date of Board Meeting approving the proposal: | Feb 07 2018 |

| Date of Public Announcement: | Feb 07 2018 |

| Buyback Number of Shares: | 3.43 lacs |

| FV: | 1 |

| Buyback Price: | ₹ 350 Per Equity Share |

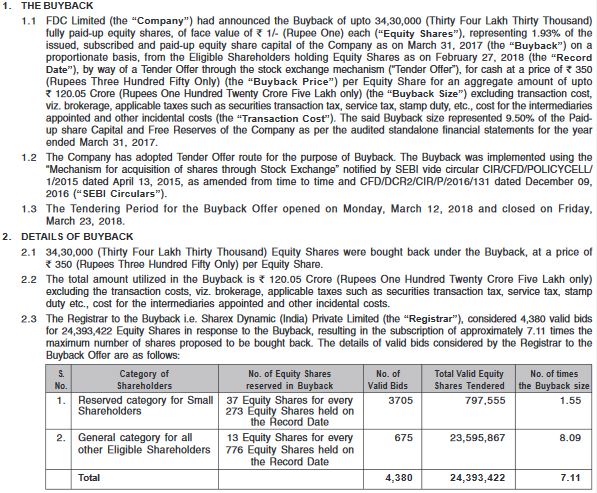

Details of Buyback:

The Board of Directors of the Company, at its meeting held on February 07, 2018 had, subject to the approval of statutory, regulatory or governmental authorities as may be required under applicable laws, approved a buyback of 34,30,000 Equity Shares of the Company for an aggregate amount not exceeding Rs. 120.05 Crore (Rupees One Hundred Twenty Crore Five Lakh only) (the “Buyback Size”) excluding transaction cost, viz. brokerage, applicable taxes such as securities transaction tax, service tax, stamp duty, etc., the cost for the intermediaries appointed and other incidental costs (“Transaction Cost”) (representing 9.50% of the Paid-up share capital and free reserves as on March 31, 2017) at a price of Rs. 350 (Rupees Three Hundred Fifty only) (the “Buyback Price”) per Equity Share from the existing Members / Shareholders holding equity shares of the Company on a proportionate basis through the “Tender Offer” route as prescribed under the SEBI Buyback

Salient financial parameters:

| Ratios | PreBuyback* | Post Buyback* |

| Networth (in Lakhs) | 1,263.41 | 1143.36 |

| Return on Networth (%) | 14.79 | 16.34 |

| Earnings per Share (`) @ | 10.52 | 10.73 |

| Book Value per Share# (`) | 71.04 | 65.56 |

| P/E as per the latest audited financial results$ | 21.67 | 21.26 |

| Total Debt/Equity Ratio (Total Debt/Net worth)# | 0.0006 | 0.0007 |

Source of funds for the Buyback:

Assuming full acceptance, the funds that would be utilized by the Company for the purpose of the Buyback would be Rs. 120.05 Crores (Rupees One Hundred Twenty Crore Five Lakhs only) (excluding transaction cost, viz. brokerage, applicable taxes such as securities transaction tax, service tax, stamp duty, etc).

Shareholding Pattern Pre and Post buyback:

| Category of Shareholder | Pre Buyback | Post Buyback# | ||

| No. of Shares | % | No. of Shares | % | |

| Promoters and persons acting in Concert (Collectively “the Promoters”) | 12,25,12,656 | 68.89 | 12,04,60,301 | 69.07 |

| Foreign Investors (Including Non Resident Indians, FIIs and Foreign Mutual Funds) | 5,53,20,428 | 31.11 | 5,39,42,783 | 30.93 |

| Total | 17,78,33,084 | 100.00 | 17,44,03,084 | 100.00 |

How to Participate in buyback?

1. Firstly to be eligible for the buyback the investor should have shares of FDC Ltd in demat or physical form as on record date 27 Feb 2018.

2. Once you have shares in demat, you can participate in the buyback process which is opening from 12 March 18 to 27 March 2018 by selling your shares through your broker on NSE or BSE.

3. Then on 04 April 2018, the payment will be given to you for accepted shares and unaccepted shares will be returned to your demat account.

Profit from the buyback on the bases of acceptance Ratio:

FDC Ltd Buyback offer calculation for an investment of Rs 2,00,000 @270 per share

(a) Categories in Buyback:

(i) Reserved category- For Small Shareholders who holds Shares worth upto Rs. 2 Lacs before the Record date.

(ii) General category - For all Shareholders other than Small Shareholders.

| % Share Accepted | No of Shared Accepted | Gain from Buyback Offer |

|---|---|---|

| 33% | 245 | Rs 19600 |

| 50% | 370 | Rs 29600 |

| 75% | 556 | Rs 44480 |

| 100% | 741 | Rs 59280 |

| Category | Entitlement Ratio of Buyback Per Equity Shares | Entitlement Ratio of Buyback in % |

|---|---|---|

| Reserved Category | 37 Equity Shares out of every 273 Equity Shares | 13.55% |

| General Category | 13 Equity Shares out of every 776 Equity Shares | 1.68% |

Recommendation:

Rating: 4/10

Fair: 1-5

Good: 5-7

Excellent: 7-10

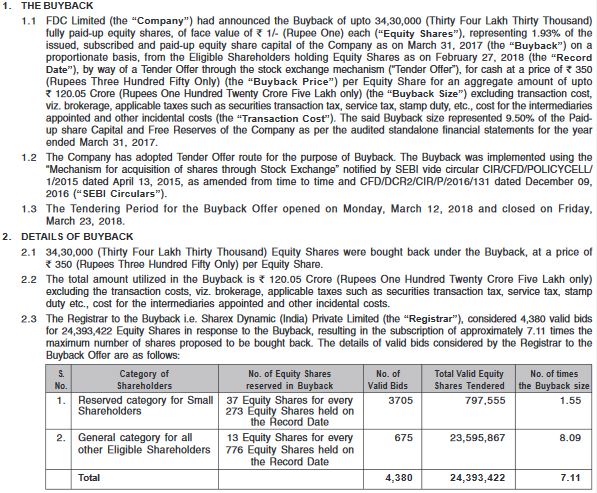

Final Acceptance Ratio

Registrar Contact Details:

Sharex Dynamic (India) Pvt. Ltd.

Unit-1, Luthra Industrial Premises,

1st Floor, Safed Pool,

Andheri Kurla Road, Mumbai - 400072

Website: www.sharexindia.com

Company Contact Details:

B-8, MIDC Industrial Estate, Waluj,

Aurangabad District, MH -431136

Website : www.fdcindia.com

Leave a Reply

You must be logged in to post a comment.