Bharat Electronics Limited Buy Back Offer Jan 2018

Bharat Electronics Ltd is engaged in manufacture and supply of strategic electronic products primarily to Defense Services. The Company was set up by the Government of India under the Ministry of Defence. Currently company is exporting LYNX II, radar warning receivers, composite communication system, night vision devices, versatile communication system (VCS), IFF Interrogator, LRF, X-Ray tube, radar fingerprinting system, ESM system, V/ultra high frequency (UHF) search receivers, shelters, printed circuit board (PCB) assembly, cable harness, components and mechanical assemblies.

The company operates from various manufacturing Unit at Banglore, Ghaziabad, Pune, Chennai, Panchkula, Hyderabad, Kotdwara, Machilipatnam, Taloja (Navi Mumbai).

Buy Back Offer Deal:

| Buyback Type: | Tender Offer |

| Buyback Record Date: | Feb 09 2018 |

| Buyback Opening Date: | Mar 05 2018 |

| Buyback Closing Date: | Mar 16 2018 |

| Buyback Offer Amount: | ₹ 372 Cr |

| Date of Board Meeting approving the proposal: | Jan 30 2018 |

| Date of Public Announcement: | Jan 30 2018 |

| Buyback Offer Size: | 5% |

| Buyback Number of Shares: | 2.03 Cr |

| FV: | 1 |

| Buyback Price: | ₹ 182.5 Per Equity Share |

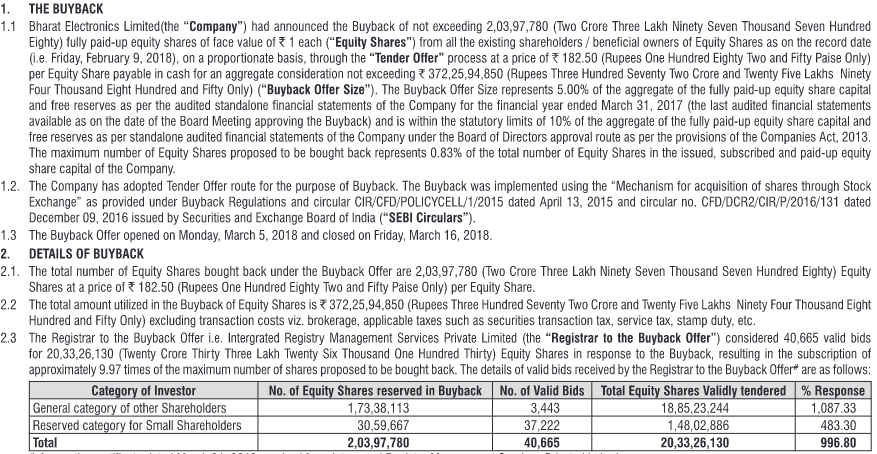

Details of Buyback:

Salient financial parameters:

| Ratios | PreBuyback* | Post Buyback* |

| Networth (in Lakhs) | 750,854 | 713,628 |

| Return on Networth (%) | 20.61% | 21.69% |

| Earnings per Share (of 1 each)@ | 6.64 | 6.69 |

| Book Value per Share () | 33.62 | 32.24 |

| P/E as per the latest audited financial results | 23.55 | 23.37 |

| Total Debt/Equity Ratio (Total Debt/Net worth) | 0.01 | 0.01 |

How to Participate in buyback?

Profit from the buyback on the bases of acceptance Ratio:

| % Share Accepted | No of Shared Accepted | Gain from Buyback |

| 33% | 390 | Rs 5460 |

| 50% | 592 | Rs 8288 |

| 75% | 887 | Rs 12418 |

| 100% | 1183 | Rs 16562 |

Recommendation:

Registrar Contact Details:

Company Contact Details:

3 Comments

Leave a Reply

You must be logged in to post a comment.

I had 2500 shares and offered 640 shares for buy-back, but only 535 shares were accepted. Can’t figure out why were my shares left out..

I had 4000 shares and offered 1591 SHARES AND WAS ACCEPTED BUT only for 345 it is reflected why ?

Is it BEL or BHEL?