Balrampur Chini Mills Limited Buyback Feb 2018

Balrampur Chini Mills Ltd is one of India’s largest integrated sugar manufacturing companies.The company also have Alcohol and generation and selling of power business.The company has 10 Sugar factories located in U.P.

Buy Back Offer Deal:

| Buyback Type: | Tender Offer |

| Buyback Record Date: | Mar 06 2018 |

| Buyback Opening Date: | Mar 12 2018 |

| Buyback Closing Date: | Mar 23 2018 |

| Buyback Offer Amount: | ₹ 99 Cr |

| Date of Board Meeting approving the proposal: | Feb 21 2018 |

| Date of Public Announcement: | Feb 21 2018 |

| Buyback Offer Size: | 2.81% |

| Buyback Number of Shares: | 66 Lacs |

| FV: | 1 |

| Buyback Price: | ₹ 150 Per Equity Share |

Details of Buyback:

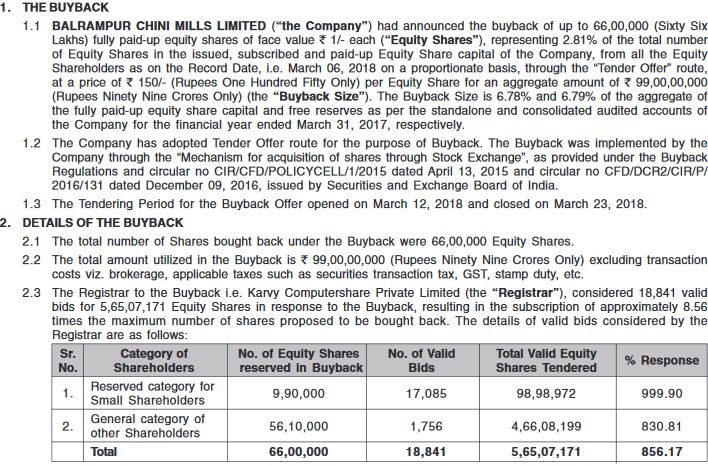

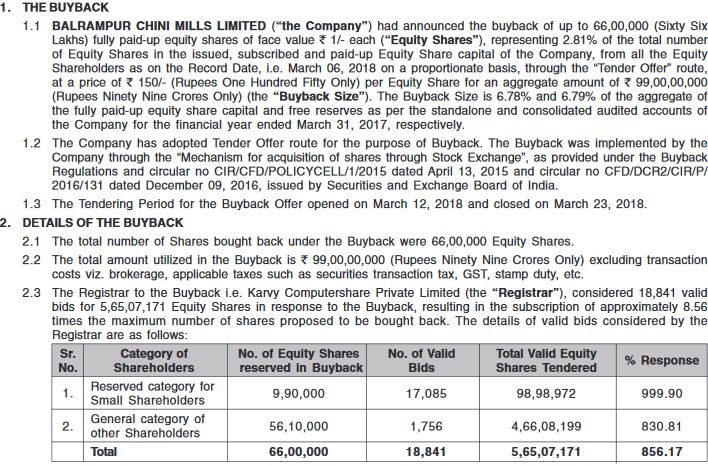

Balrampur Chini Mills Limited has announced the buyback of up to 66,00,000 fully paid-up Equity Shares of face value of 1/- each from all the Equity Shareholders of the Company as on the Record Date, on a proportionate basis, through the Tender Offer route, subject to compliance with the provisions of Sections 68, 69, 70 and other applicable provisions, if any, of the Companies Act, the Buyback Regulations, the LODR Regulations and applicable rules and regulations as specified by RBI, amongst others, at the Buyback Price of 150/- per Equity Share payable in cash, for an aggregate maximum amount of 99,00,00,000 (Rupees Ninety Nine Crores Only), which is 6.78% and 6.79% of the aggregate of the fully paid-up equity share capital and free reserves as per the standalone and consolidated audited accounts of the Company for the financial year ended March 31, 2017, respectively (the last audited financial statements available as on the date of the Board Meeting approving the Buyback) and is within the statutory limits of 10% of the aggregate of the fully paid-up equity share capital and free reserves as per the last standalone audited financial statements of the Company. The maximum number of Equity Shares proposed to be brought back represents 2.81% of the total number of Equity Shares in the total paid up equity share capital of the Company as at March 31, 2017.

Salient financial parameters:

| Parameter | Standalone | Consolidated | ||

| PreBuyback* | Post Buyback* | PreBuyback* | Post Buyback* | |

| Networth (in Lakhs) | 1,45,935.66 | 1,36,035.66 | 1,45,761.43 | 1,35,861.43 |

| Return on Networth (%) | 40.59 | 43.54 | 40.68 | 43.65 |

| Earnings per Share (`) @ | 25.20 | 25.93 | 25.23 | 25.96 |

| Book Value per Share# (`) | 62.10 | 59.56 | 62.02 | 59.48 |

| P/E as per the latest audited financial results$ | 4.54 | 4.41 | 4.53 | 4.40 |

| Total Debt/Equity Ratio (Total Debt/Net worth)# | 1.22 | 1.31 | 1.22 | 1.31 |

Source of funds for the Buyback:

Assuming full acceptance, the funds that would be utilized by the Company for the purpose of the Buyback would be 99,00,00,000 (Rupees Ninety Nine Crores Only). The funds for the Buyback will be sourced from a liquidation of current liquid investments. The Company shall transfer from its free reserve/securities premium account a sum equal to the nominal value of the equity shares bought back through the Buyback to the Capital Redemption Reserve Account and the details of such transfer shall be disclosed in its subsequent audited balance Sheet. The Company does not intend to raise additional debt for the explicit purposes of the Buyback. Thus, funds from banks and financial institutions will not be used for the Buyback.

Shareholding Pattern Pre and Post buyback:

| Category of Shareholder | Pre Buyback | Post Buyback# | ||

| No. of Shares | % | No. of Shares | % | |

| Promoters and persons acting in Concert (Collectively “the Promoters”) | 96,220,796 | 40.94 | 93,658,443 | 41.00 |

| Foreign Investors (Including Non Resident Indians, FIIs and Foreign Mutual Funds) | 49,309,685 | 20.98 | 134,769,884 | 59.00 |

| Financial Institutions/Banks & Mutual Funds promoted by Banks/Institutions | 23,386,364 | 9.95 | ||

| Others (Public, Public Bodies Corporate etc.) | 66,111,482 | 28.13 | ||

| Total | 23,50,28,327 | 100 | 22,84,28,327 | 100.00 |

How to Participate in buyback?

1. Firstly to be eligible for the buyback the investor should have shares of Balrampur Chini Mills Limited in demat or physical form as on record date 06 March 2018.

2. Once you have shares in demat, you can participate in the buyback process which is opening from 12 March 18 to 23 March 2018 by selling your shares through your broker on NSE or BSE.

3. Then on 12 April 2018, the payment will be given to you for accepted shares and unaccepted shares will be returned to your demat account.

Profit from the buyback on the bases of acceptance Ratio:

Balrampur Chini Mills Ltd Buyback offer calculation for an investment of Rs 2,00,000 @114 per share

(a) Categories in Buyback:

(i) Reserved category- For Small Shareholders who hold Shares worth up to Rs. 2 Lacs before the Record date.

(ii) General category - For all Shareholders other than Small Shareholders.

| % Share Accepted | No of Shared Accepted | Gain from Buyback Offer |

|---|---|---|

| 33% | 579 | Rs 20844 |

| 50% | 877 | Rs 31572 |

| 75% | 1316 | Rs 47376 |

| 100% | 1754 | Rs 63144 |

| Category | Entitlement Ratio of Buyback Per Equity Shares | Entitlement Ratio of Buyback in % |

|---|---|---|

| Reserved Category | 8 Equity Shares out of every 197 Equity Shares | 4.06% |

| General Category | 9 Equity Shares out of every 338 Equity Shares | 2.66% |

Recommendation:

Rating: 4/10

Fair: 1-5

Good: 5-7

Excellent: 7-10

Final Acceptance Ratio

Registrar Contact Details:

Karvy Computershare Private Limited

Karvy Selenium Tow-B,Pl-31&32

Gachibowli, Nanakramguda,

Hyderabad-500032

Company Contact Details:

FMC Fortuna 2nd Floor,

234/3A A J C Bose Road,

West Bengal-700020

Leave a Reply

You must be logged in to post a comment.