Aarti Drugs Limited Buyback Offer 2019

Aarti Drugs Limited is engaged in manufacturing of Pharmaceuticals products. The Company has established a strong presence in the Anti-diarrhea, Anti-inflammatory therapeutic groups. With its manufacturing facilities at Tarapur and Sarigam, the Company manufactures Vitamins, Anti-arthritis, Anti-fungal, Antibiotics, ACE inhibitors, besides its range in, anti-diabetic, anticholinergic, sedatives and anti-depressant drugs. The Company is a part of the Alchemie Group of Companies.

Buy Back Offer Deal:

| Buyback Type: | Tender Offer |

| Buyback Record Date: | Mar 29 2019 |

| Buyback Opening Date: | May 03 2019 |

| Buyback Closing Date: | May 16 2019 |

| Buyback Offer Amount: | ₹ 25.389 Cr |

| Date of Board Meeting approving the proposal: | Mar 15 2019 |

| Date of Public Announcement: | Mar 15 2019 |

| Buyback Offer Size: | 5.29% |

| Buyback Number of Shares: | 282100 |

| Price Type: | Tender Offer |

| FV: | 10 |

| Buyback Price: | ₹ 900 Per Equity Share |

Details of Buyback:

The Board of Directors of the Company at its meeting held on 15.03.2019 has interalia approved a proposal to buy back up to 2,82,100 Equity Shares of the Company, being 5.29% of the total paid up equity share capital and free reserves of the Company, for an aggregate amount not exceeding Rs.25.3890 Crores at Rs. 900 under the Tender offer route using the stock exchange mechanism

How to Participate in buyback?

1. Firstly to be eligible for the buyback the investor should have shares of Aarti Drugs Limited in demat or physical form as on record date 29.03.2019.

2. Once you have shares in demat, you can participate in the buyback process which is opening from [ 03.05.2019 to 16.05.2019 ] by selling your shares through your broker on NSE or BSE.

3. Then on [ 27.05.2019 ], the payment will be given to you for accepted shares and unaccepted shares will be returned to your demat account.

Profit from the buyback on the bases of acceptance Ratio:

Buy 222 Shares at CMP of Rs. 665 [2,00,000/900=222)

| Acceptance Ratio | 33% | 50% | 75% | 100% |

| Amount Invested in Buyback | 1,47,630 | 1,47,630 | 1,47,630 | 1,47,630 |

| No. of Shares buyback | 73 | 111 | 166 | 222 |

| BuyBack Profit | 17,155 | 26,085 | 39,010 | 52,170 |

| Profit | 11.62% | 17.66% | 26.42% | 35.3% |

Recommendation:

Review and Recommendation of Aarti Drugs Limited Buyback Offer 2019 by IZ team is: 4/10

Fair: 1-5

Good:5-7

Excellent: 7-10

[ Though there is upside of 35% from CMP of 665 however, the size of the buyback is very small and AR won't be more than 15%. ]

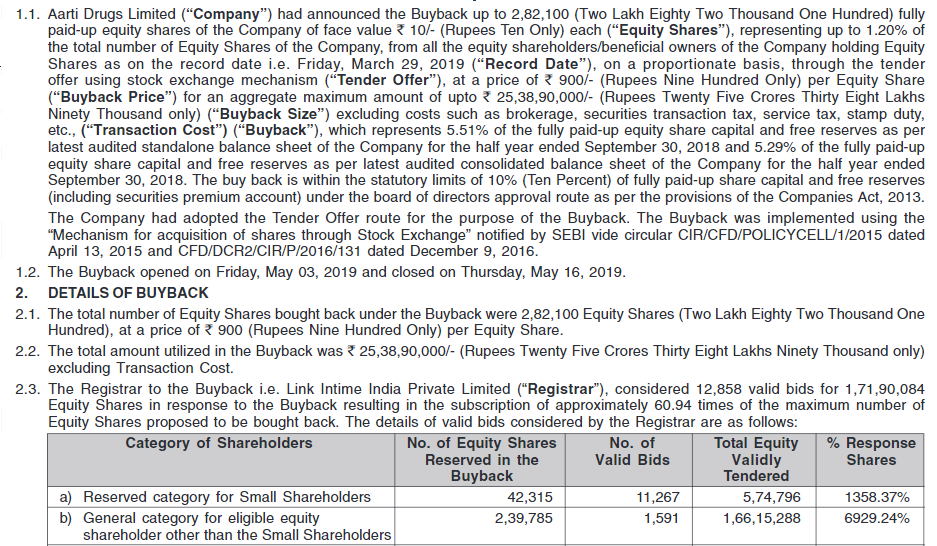

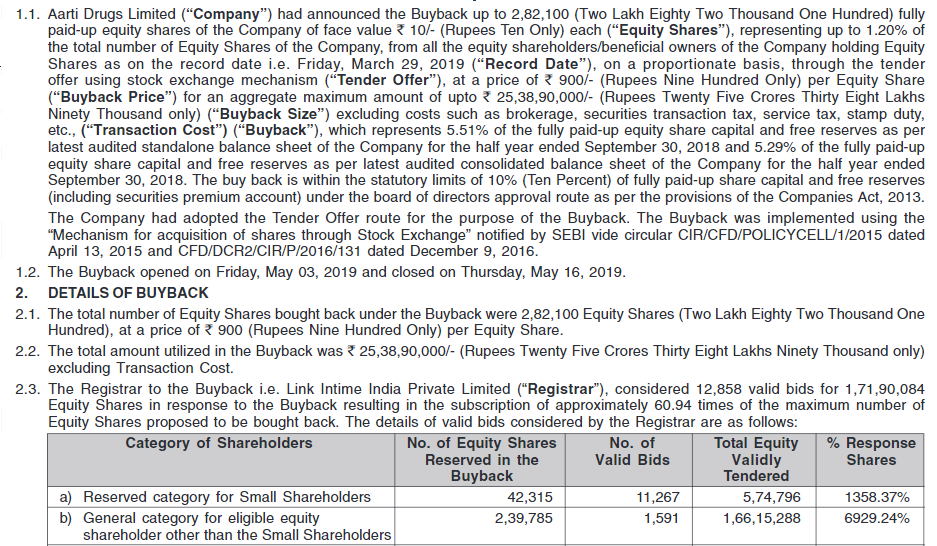

Final Acceptance Ratio

46 Comments

Leave a Reply

You must be logged in to post a comment.

i have 1 share in 15 demat they all accepted

nice!!!

1 share is accepted in this buyback as heard in the street.

1 Share was accepted but the gain was meagre Rs 200 per share.

Final Acceptance is 6.22% for retail. The amount would be credited on 27th May 2019

When do we get payment against buyback order executed?

This year buyback is 3 times more popular than last year. Last year final number of bids was about 4k. This year already 12 k bids in place. Acceptance should be pretty close to entitlement.

When settlement will take place?

27.05.2019

The Letter of Offer has come. The entitlement ratio is a pittance. It is 2.63% and 1.09% for reserved and general category.

Paltry returns in this buyback almost 2 laks shares added by some 6000 individuals in the 31 St March filing. Expect acceptance to be sub 8 percent in this share.

Buyback from deemat account starting from?

There should not be any issue with Zerodha. Please intimate where you are facing the issue?

hey MW…do u suggest zerodha?

as i hv listen from many sources that its nt good…it will make our money zero…plz suggest

We will nor eligible for buyback if we are trading through Zerodha

I am facing this problem. Is this a known issue or any specific restriction?

Means?

My question is why cant we do it in Zerodha? Are there any restriction?

I do not see Aarti drugs buyback as on today. Are there any changes to the date?

Opening date not announced as yet. 29.03.2019 is the record date.

MW Sir, Please let me know …

If i sell shares today, will my share considered for buyback?

Yes

Today (28 Mar 2019) i bought the shares. 29 Mar 2019 is the cutoff. I am using Zerodha, Will i eligible for buyback?

No.

Nothing is kaplnic there is collusion everywhere but need to have proof. You can report to SEBI. Recently SEBI took action against ADF Foods promoters for gaining with Sensitive Unpublished information.

price action is the only proof as of now… have you checked the price action before 3days of the intimation date. it almost killed all the gains of buyback….

hi!

correct me if i am thinking or observing wrong about aarti drug BB?

aarti drug shoots up 3 days before the intimation. whereas there was no news/announcement that can lead to this price boost .

my ques is aarti drugs management or someone known is playing through BuyBack.

is it ok to question the company governance?

or it is all kalpanic? 🙂

Please advice for Eclerx

Buyback Rate 1600/-

Market rate 1135-40 hai

Attractive lag raha hai

Difference good hai

Kindly add eclerx and mindtree…

This one is complete ignore. Last year, acceptance ratio was 7%. My buyback price never came back in last one year after buyback and I am still stuck. Hope 5-10% stock will again get out in buyback this time also 🙂

whom to ignore???Are you reffering to Arati Drugs OR Eclerx??

Sorry, I am referring Aarti Drugs.

eClerx board approves share buyback for up to Rs 262 cr (24.95% equity) at maximum Rs 1,600/Sh via tender offer route

Eclerx cmp 1149/

Buyback size is very small. ignore this.

Buyback Size is 25 Cr at Rs. 900. Total Shares size is 2,82,100

Eclerx not updated in IZ dear moderator

Ignore Eclerx, not having a good reputation.

Eclerx buyback – 2019

Buyback price ———————————- 1600

Total buyback ———————————- 16,37,500 (262 Cr)

Reserved for small shareholders ———- 2,45,625

Eclerx Previous buyback

===================

2018 Buyback (22 Feb – 08 Mar)

Buyback price ———————————- 2000

Total buyback ———————————- 12,90,000 (258 Cr)

Reserved for small shareholders ———- 1,93,500

Share price on record date —————————– 1434.55 (NSE)

small shareholders holding on record date ——- 15,13,267

Entitlement ratio (small shareholders) ————– 12.7869% (6 out of 47)

Shares tendered by small shareholders ———– 10,54,035

Response by small shareholders ——————– 544.72%

2016 Buyback (28 Nov – 9 Dec)

Buyback price ———————————- 2000

Total buyback ———————————- 11,70,000 (234 Cr)

Reserved for small shareholders ———- 1,75,500

Share price on record date —————————– 1518.10 (NSE)

small shareholders holding on record date ——- 9,81,204

Entitlement ratio (small shareholders) ————– 17.8862% (22 out of 123)

Shares tendered by small shareholders ———– 5,75,344

Response by small shareholders ——————– 327.83%

great info . Thanks PM for sharing this

Thanks bro

eClerx board approves share buyback for up to Rs 262 cr (24.95% equity) at maximum Rs 1,600/Sh via tender offer route

Eclerx cmp 1149/-

Meeting is tomorrow

Thanks bro for giving information to us

Last time size was only 24 Cr.

Last year also they have done a buyback of 2,75,000 Shares at a price of 875.

Shares Reserved for Small category = 41,250

Total Shares bid= 3,21,762

Final AR was only 12.8%.