Keystone Realtors Limited IPO

Apply

0

Avoid

0

i. Keystone Realtors is one of the prominent real estate developers (in terms of absorption in a number of units) in the micro markets that they are present in. They command a market share of 28% in Khar, 23% market in Juhu, 11% in Bandra East, 14% in Virar, 3% in Thane, and 5% in Bhandup in terms of absorption (in units) from 2017 to 2021.

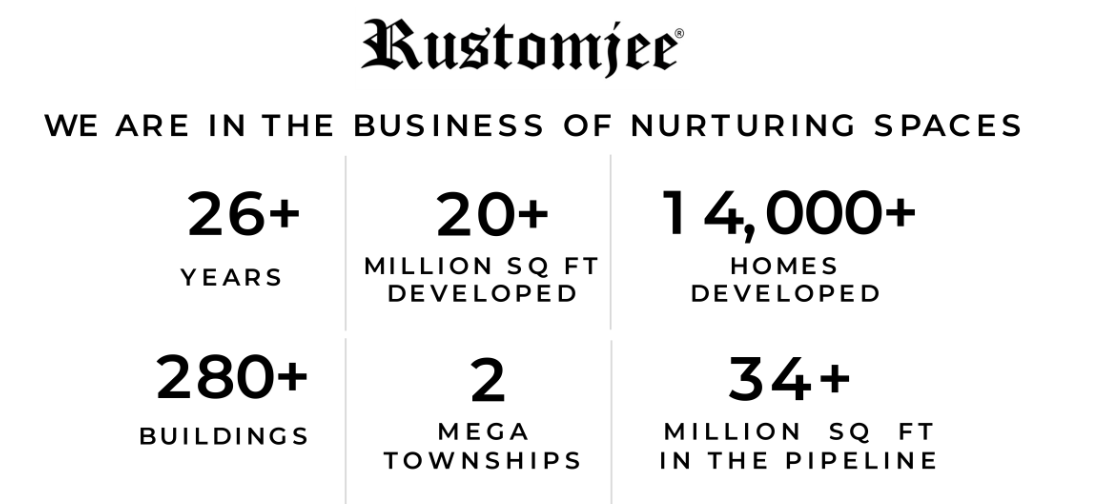

ii. The company has 32 Completed Projects, 12 Ongoing Projects, and 19 Forthcoming Projects across the Mumbai Metropolitan Region (“MMR”) that includes a comprehensive range of projects under the affordable, mid and mass, aspirational, premium, and super premium categories, all under its Rustomjee brand.

iii. Over the years, they have implemented designs based on customer insights and eco-friendly construction technologies to deliver modern lifestyle solutions and a diverse range of projects. Some of their notable projects include Rustomjee Elements, a large gated community in Upper Juhu, Mumbai; Rustomjee Paramount, a signature complex in Khar, Mumbai;

Rustomjee Seasons, a 3.82 acres gated community in Bandra Annexe, Mumbai; Rustomjee Crown, a 5.75 acres land parcel for high-end development at Prabhadevi, South Mumbai, consisting of three high-rise towers.

iv. Competitive Strengths

a. Well-established customer-centric brand in the Mumbai Metropolitan Region.

b. Amongst the leading residential real estate development companies in MMR with a well-diversified portfolio and strong pipeline.

a. Well-established customer-centric brand in the Mumbai Metropolitan Region.

b. Amongst the leading residential real estate development companies in MMR with a well-diversified portfolio and strong pipeline.

c. Asset-light and scalable model resulting in profitability and stable financial performance

Objects of the Keystone Realtors Limited IPO:

Each of the Selling Shareholders will be entitled to their respective portion of the proceeds of the Offer for Sale.

The company propose to utilise the Net Proceeds towards funding the following objects:

1. Repayment/ prepayment, in full or part, of certain borrowings availed by the Company and/or certain of the Subsidiaries.

2. Funding acquisition of future real estate projects and general corporate purposes.

Keystone Realtors Limited IPO Details:

| Open Date: | Nov 14 2022 |

| Close Date: | Nov 16 2022 |

| Total Shares: | 11,737,523 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Book Built Issue |

| Issue Size: | 635 Cr. |

| Lot Size: | 27 Shares |

| Issue Price: | ₹ 514-541 Per Equity Share |

| Listing At: | NSE,BSE |

| Listing Date: | Nov 24 2022 |

Promoters And Management:

Boman Rustom Irani is the Chairman and Managing Director of the Company. He holds a bachelor’s degree in engineering from M.H. Saboo Siddik College of Engineering. He is also the president of the Confederation of Real Estate Developers' Associations of India (CREDAI)-MCHI and the President-Elect of the Confederation of Real Estate Developers' Associations of India (CREDAI)- National. He has over 26 years of experience in the real estate industry. He has been a director on the Board since 2005.

Percy Sorabji Chowdhry is an Executive Director of the Company. He holds a bachelor’s degree in commerce from the University of Bombay. He has 23 years of experience in the real estate industry. He has been associated with our Company as a Director since 1999.

Chandresh Dinesh Mehta is the Executive Director of the Company. He holds a bachelor's degree in technology in electrical engineering from Banaras Hindu University, Varanasi and a post-graduate diploma in management from Xavier Institute of Management, Bhubaneswar. He has over 26 years of experience in the real estate industry. He has been associated with the Company as a Director since 2004.

Financials of Keystone Realtors Limited IPO:

| Particulars (in crores) | Mar-22 | Mar 21 | Mar-20 | Mar-19 |

| Revenue from operations | 1269 | 848 | 1211 | 2116 |

| Gain on loss of control of Subsidiary | 0 | 281 | - | - |

| Construction Cost | 1056 | 496 | 787 | 1104 |

| Changes in inventories | -67 | 116 | 113 | 448 |

| Employee Benifit Expense | 28 | 27 | 41 | 41 |

| Other Expense | 72 | 68 | 132 | 205 |

| Operating Profit | 180 | 141 | 138 | 318 |

| OPM% | 14.18% | 16.63% | 11.40% | 15.03% |

| Finance Cost | 22 | 139 | 127 | 142 |

| Depreciation | 3.4 | 1 | 2 | 2 |

| Impairment loss on financial assets | 0.2 | 26 | 0.1 | 14 |

| Other Income | 33 | 47 | 57 | 25 |

| Profit (Loss) before tax | 186 | 301 | 63 | 182 |

| Tax Expense | 48 | 57 | 48 | 45 |

| Profit (Loss) for the period | 135 | 231 | 14 | 137 |

Comparison With Peers:

| Name of the company | Revenue (cr) | Profit (cr) | EPS | P/E | CMP | MCap(in cr) |

| Keystone Realtors Limited | 1269 | 135 | 12.2 | 44 | 541 | 5970 |

| Macrotech Developers Limited | 9,233 | 1,209 | 24.97 | 35.8 | 956 | 46,029 |

| Godrej Properties Limited | 1,825 | 351 | 12.68 | 90.8 | 1,293 | 35,943 |

| Oberoi Realty Limited | 2,694 | 1,047 | 28.8 | 22.7 | 886 | 32,230 |

| Sunteck Realty Limited | 513 | 25 | 1.71 | 167 | 388 | 5,684 |

Lead Manager of Keystone Realtors Limited IPO:

Registrar of Keystone Realtors Limited IPO:

Company Address:

Keystone Realtors Limited

702, Natraj, MV Road Junction,

Western Express Highway,

Andheri (East), Mumbai, Maharashtra, 400069

Phone: +91 (22) 6676 6888

Email: cs@rustomjee.com

Website: https://www.rustomjee.com/

Discussion on Keystone Realtors Limited IPO:

1 Comment

Leave a Reply

You must be logged in to post a comment.

Though not good for Listing Gain (+5 GMP), still applied for 2 Lots with sure shot allotment.