- August 20, 2023

- Posted by: Umesh Paliwal

- Category: Blog

A) Products of the Company

1. Solar Inverter – A solar inverter is a critical component in a solar power system. Its main function is to convert the direct current (DC) produced by solar panels into alternating current (AC), which is the type of electricity commonly used in homes and business.

2. Rooftops Solar Power Plant Installation – SunGarner specializes in Turnkey Solar EPC (Engineering, Procurement and Construction) for Utility Scale Solar Power Plants, Solar farms and Rooftops. They are leading solar plant installation company and offer the best solution & construction of solar power plant across India and the world.

SunGarner’s Solar EPC Division has commissioned over 50 large solar projects in the past 8 years. They’ve executed prestigious projects for notable clients like Interglobe Enterprises, DLF, Jubilant Life Sciences, Eli Lilly, Modi Xerox, and ITC Hotels in Delhi, among others. Additionally, they’ve expanded internationally, marking a significant achievement by installing the largest solar power project in Bhutan in 2021.

3. Solar PV Modules – SunGarner is a leading manufacturer and suppliers of Solar PV Modules (Photovoltaic Modules). Photovoltaic modules, commonly known as solar panels, are connected together in chains to form larger units known as modules or panels.

4. Online UPS – Online Uninterruptible Power Supply (Online UPS) is an essential tool in settings where a continuous supply of power is critical. Unlike offline or standby UPS systems, an online UPS continuously powers the connected devices from its battery, while simultaneously charging the battery using the main power source. This ensures that there is zero transfer time to battery during a power outage, providing truly uninterrupted power.

5. Inverter Battery – SunGarner is a leading manufacturer and suppliers of Vault Tubular Batteries for Inverter.

6. SwitchGears And Wires – Seltrik SwitchGears And Wires manufacturers in India offering SwitchGears And Wires under the name “Seltrik.

B) History of the Company

Sungarner Energies Limited (SEL) began its operations as a Design Engineering and Solar EPC company, emphasizing solar project design and construction in 2015. As the company grew, it diversified its operations to include the manufacturing of Power Electronics and Energy Storage Products. Today, SEL’s product lineup boasts Solar Inverters, Online UPS Systems, EV Chargers, and Lead Acid Batteries.

Venturing into the realm of electric vehicles, SEL secured a WMI code for EV manufacturing, indicating their intention to join this market, though they’ve currently only developed a prototype. Recognizing the importance of innovation in the fast-paced energy sector, SEL established a dedicated in-house R&D facility in 2017. This facility is spearheaded by experts who are focused on advancing and developing efficient power electronic products.

C) Management of the Company

Sumit Tiwari is the promoter and managing director of Sungarner Energies Limited. As a first-generation entrepreneur, he boasts over 18 years of diverse experience, notably in the power sector. His professional journey includes associations with renowned firms like Tata BP Solar, Emerson Network Power, and Delta. Tiwari joined Tata BP Solar in 2010, where he focused on green energy solutions.

Over the years, he has played a pivotal role in establishing various business segments for different organizations, such as Power Audit for Emerson Network, and introducing UPS Systems in the IT and Telecom sectors. At Tata BP Solar, he was instrumental in developing solar solutions for rooftops and telecom. Tiwari’s deep understanding of the market and commercial acumen has been a driving force in shaping and strengthening various divisions of Sungarner.

D) Distribution Network of the Company

SunGarner has an established distribution network in key Indian markets including Haryana, UP, Bihar, Rajasthan, and Assam. The company operates six service centers across India, located in Delhi, UP, Haryana, Bihar, Assam, and Bengal. To further expand its reach, SunGarner plans to add 500 franchisees by the end of 2025, aiming to have a presence in all major Indian districts.

Additionally, over the past two years, SunGarner has begun exporting products to international markets, including Nigeria, Lebanon, Nepal, Dubai, and Bhutan.

E) Raw Material used by Company

They used components made of aluminium, brass, and steel. Plastic in the form of granules and components. Bare Printed Circuit Boards. Semiconductor components. Pressure die casting components. These materials are sourced from various states across India, such as Delhi and Uttar Pradesh.

They selects vendors based on their quotations and ensures the quality of the materials before using them in production. Additionally, some components and raw materials are imported from countries like Germany, the US, China, and Taiwan. These imports are facilitated through agents located within India.

F) Manufacturing Capacity and %Utilisation

|

Product Category

|

Fy23 | Fy22 | FY21 | |||

| Capacity | % Utilization | Capacity | % Utilization | Capacity | % Utilization | |

| Solar and Non-Solar Inverter | 8,250 | 54.55% | 3,500 | 57.14% | 2,400 | 66.67% |

| Residential Inverters | 22,500 | 22.22% | 3,000 | 13.33% | – | – |

| Solar Industrial Rooftops | 7.5 MW | 26.66% | 4 MW | 25.00% | 3 MW | 33.33% |

| Solar & Inverter Batteries | 36,000 | 44.44% | 24,000 | 20.83% | – | – |

| Online UPS | 150 | 33.33% | 100 | 30.00% | – | – |

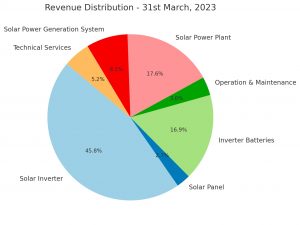

G) Products wise Revenue Distribution

Majority of revenue is coming from Solar Inverter and Inventor batteries. It has a small customer base where more than 75% of revenue from operations are arrived from top 5 customers.

H) Financial and Valuation Performance

1. Revenue experienced a significant surge, moving from ₹5.36 crore in FY21 to ₹17.65 crore in FY23.

2. For FY23, the company recorded an EBITDA margin of 9%, marking an improvement from the 7.2% in FY21.

3. Profit After Tax (PAT) witnessed an impressive ascent, from ₹15 lakh in FY21 to ₹74 lakh in FY23.

4. Over the past three years, despite a commendable uptick in PAT, operational cash flow remains in the negative. This can be attributed to the substantial working capital requirements, characterized by significant inventory and trade receivables.

5. As of 31st March 2023, the company held just ₹7 lakh in cash.

6. The duration for trade receivables remained manageable, averaging 57 days in FY23.

7. After the issuance, the net worth is projected to be approximately ₹8 crore. With short-term liabilities amounting to ₹4.03 crore and long-term debts at ₹20 lakh, the Debt-to-Equity ratio stands at a comfortable 0.5x.

8. The IPO has been valued at a P/E ratio of 26x, and a market capitalization close to ₹20 crore, suggesting that the valuation is reasonable.

Conclusion

SunGarner Energies Limited presents a compelling investment case given its diversified product portfolio, strategic growth initiatives, experienced leadership, and expanding distribution network.

While the company shows promising financial growth, potential investors should keep an eye on liquidity concerns and the negative operational cash flow. Overall, with a reasonable valuation, the company offers a good opportunity for investors bullish on the renewable energy sector and looking for growth-oriented investments.

However, the size of company is very small and competition is very tough from established players like Luminous, V guard, Exide, Insolation Energy Limited, Servotech Power Systems Limited, and Waaree Energies Ltd. Etc.

Leave a Reply

You must be logged in to post a comment.