- September 3, 2023

- Posted by: Umesh Paliwal

- Category: Blog

A) Core Business and Manufacturing

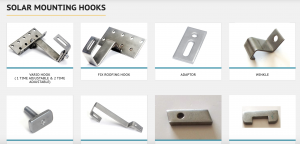

1. Product Range: Specializes in the manufacturing of stainless steel finished sheets, washers, solar roofing hooks, pipes, and tubes.

2. Vertical Integration: The company controls the entire production process, from melting steel scrap to creating finished products. They are one of the few companies who has a backward integration model (Source: D&B Report). This backward integration model is one of the major strengths and has helped company in maximising the returns on the investments.

3. Strategic Location: Four manufacturing units are strategically located in Gujarat for logistical convenience.

B) Industry Applications

1. Diverse Markets: Products find applications across numerous sectors like automotive, solar and wind energy, power plants, oil & gas, pharmaceuticals, and more.

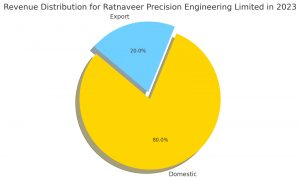

2. Global and Domestic Reach: The company operates both in India and overseas, expanding its market reach and diversifying its revenue sources.

C) Customer Engagement and Marketing

1. Customer Relations: The sales team engages directly with customers to understand industry trends and refine products accordingly.

2. Dynamic Feedback Loop: The focus on customer insights allows the company to adapt quickly to market needs.

D) Leadership and Management

Strong Leadership: Managed by Vijay Ramanlal Sanghavi, who has played a key role in the technological upgrade, diversification, and overall growth of the company.

E) Product Portfolio and Diversification

1. Expansive Offerings: Over 2500 SKUs of stainless steel washers are offered, ranging from inner ring washers to external tooth washers.

2. Future Additions: Plans to expand the washer portfolio by adding circlips, with R&D already underway.

3. Broad SKU Range: Provides a competitive edge and allows the company to meet diverse customer demands.

F) Infrastructure and Future Plans

1. Quality Control and R&D: An emphasis on research and quality gives the company a long-term growth perspective.

2. Expansion Plans: New land has been acquired on a 99-year lease for further expansion, adjacent to an existing unit.

G) Financials of the Company

1. Revenue Growth:

The company’s revenue has exhibited a promising trajectory, increasing from INR 360 Crore in Fiscal Year 2021 to INR 480 Crore in Fiscal Year 2023. This represents a Compound Annual Growth Rate (CAGR) of 15.47%, indicating a relatively strong and consistent top-line performance.

2. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA):

The EBITDA has witnessed substantial growth, surging from INR 24 Crore in FY21 to INR 47 Crore in FY23. This remarkable ascent translates to a CAGR of 40%, implying robust operational efficiency and profitability.

3. Gross Margins:

It should be noted that the company operates with slender gross margins, ranging between 10-12%. This could be indicative of high operational costs or pricing pressures and warrants further examination.

4. Profit After Tax (PAT):

The PAT has experienced exponential growth, soaring from INR 5 Crore in FY21 to INR 25 Crore in FY23. The CAGR for this period stands at an impressive 123%, which suggests potent bottom-line effectiveness.

5. Valuation Metrics:

Based on the industry average Price-to-Earnings (P/E) ratio of 33x, the company’s estimated market capitalization post-IPO could be approximately INR 800 Crore. With total shares outstanding projected to be 4.84 Crore post-IPO, the expected share price could hover around INR 160. This showcases a commendable upside potential, making the valuation appear reasonable.

6. Debt Position:

As of March 31, 2023, the total debt on the company’s books is approximately INR 230 Crore, with a net worth of INR 106 Crore. This results in a Debt-to-Equity (D/E) ratio of 2.16, which is considerably high and might raise concerns about financial leverage and risk.

7. Operational Efficiency:

The company has not been able to generate positive cash flow from operations over the last three years, accumulating a total Cash Flow from Operations (CFO) of -INR 17 Crore. Additionally, a total capital expenditure of approximately INR 42 Crore has been undertaken, financed through a combination of short-term and long-term debt amounting to ~INR 88 Crore. This paints a picture of weak operational efficiency and could be a potential area for improvement.

Leave a Reply

You must be logged in to post a comment.