- May 31, 2023

- Posted by: Umesh Paliwal

- Category: Competitive research

R R Kabel Limited has filed its DRHP with SEBI on May 5, 2023 to raise funds through IPO. The IPO compromises both Fresh the Issue and Offer for Sale. The size of fresh issue is Up to [●] Equity Shares aggregating up to ₹225 crore Up to and OFS of 17,236,808 Equity Shares aggregating up to ₹[●] crore. As part of OFS, the major selling shareholders are Kabel Buildcon Solutions Private Limited, Ram Ratna Wires Limited and TPG Asia VII SF Pte. Ltd.

Business Model of the Company

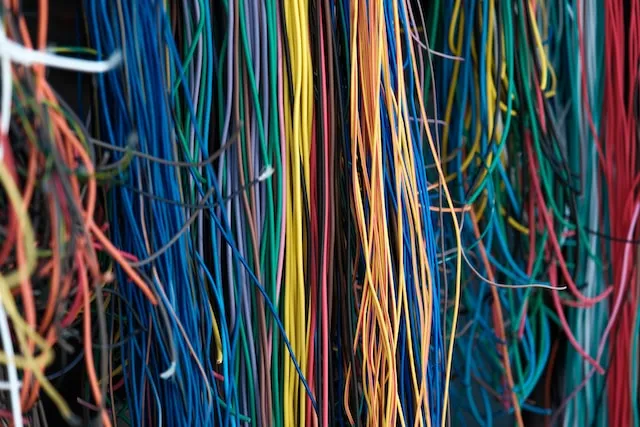

R R Kabel Limited is one of the leading companies in the Indian consumer electrical industry comprising wires and cables and fast moving electrical goods with an operating history of over 20 years in India. The Indian consumer electrical industry was estimated at ₹1,615.00 billion in Fiscal 2022 and is expected to grow at a compounded annual growth rate (“CAGR”) of 11% until Fiscal 2027 to reach a market value of approximately ₹2,665.00 billion.

The Company sells products across two broad segments – wires and cables including house wires, industrial wires, power cables and special cables and FMEG including fans, lighting, switches and appliances. The product’s end use determines whether the sale is through a business-to-business (“B2B”) or B2C channel. According to Technopak, B2C sales provide higher gross margins as compared to B2B sales.

The Company undertakes the manufacturing, marketing and sale of wires and cable products under ‘RR Kabel’ brand, and a variety of consumer electrical products, including fans and lights under the ‘RR’ brand, which is licensed by the Company. The Company also manufactures, markets and sells fans and lights under the ‘Luminous Fans and Lights’ brand, which is licensed by the Company. The Company ‘RR Kabel’ brand has over 20 years of operating history, while the ‘RR’ and the ‘Luminous Fans and Lights’ brands, which are licensed by the Company, have over 7 years and over ten years of operating history, respectively.

Object of the Issue

Offer for Sale

Each of the Selling Shareholders will be entitled to their respective portion of the proceeds from the Offer for Sale in proportion of the Equity Shares offered by the respective Selling Shareholders as part of the Offer for Sale after deducting their proportion of Offer related expenses and relevant taxes thereon. The proceeds of the Offer for Sale shall be received by the Selling Shareholders and will not form part of the Net Proceeds. The Company will not receive any proceeds from the Offer for Sale.

The Fresh Issue

i. The Company proposes to utilize the Net Proceeds towards funding of the following objects:Repayment or prepayment, in full or in part, of borrowings availed by the Company from banks and financial institutions

ii. General corporate purposes.

Further, the Company expects to receive the benefits of listing of the Equity Shares on the Stock Exchanges, including the creation of a public market for the Equity Shares in India.

Risks in the IPO

Costs of Raw Material

The costs of the raw materials that are used in the manufacturing process are subject to volatility due to factors beyond control. Increases or fluctuations in raw material prices may have a material adverse effect on the business, financial condition, results of operations and cash flows of the Company.

Disruption in supply of Raw Material

If the Company is not able to procure raw materials in sufficient quantities, it may not be able to manufacture its products according to its predetermined time frames or as contracted with the customers, at its previously estimated product costs, or at all. Therefore, any shortage, delay or disruption in supply of any of the raw materials could have an adverse effect on the business, results of operations, cash flows and reputation.

The Company is dependent on performance of the wires and cables market

The Company derives most of its revenue from operations from the manufacture and supply of wires and cables. The Company is dependent on the performance of the wires and cables market. Any adverse changes in the conditions affecting the wires and cables market can adversely impact the business, financial condition, results of operations, cash flows and prospects.

Inability to maintain and enhance the brands

If the Company is unable to maintain and enhance its brands, including its ability to protect its brand through intellectual property, the sales of the products will suffer, which would have a material adverse effect on the results of operations. We may also unintentionally infringe upon the intellectual property rights of others, any misappropriation of which could harm its competitive position.

The Company is subject to strict quality requirements and any product defect

The Company faces an inherent business risk of exposure to product defects and subsequent liability claims if the use of any of its products results in personal injury or property damage. Company and its component suppliers may not be able to meet regulatory quality standards in India or abroad, or the quality standards imposed by its customers and applicable to its manufacturing processes, which could have a material adverse effect on the business, financial condition, results

of operations and cash flows.

Financial Performance

As per the financial report, the Company clocked the total revenue of Rs. 4103 crore in 9MFY23. The total expenses during this period was Rs. 3935 crore. The profit before tax of the Company was Rs. 167 crore in 9MFY23 and the profit after tax was Rs. 43 crore. In FY22, the total revenue of the Company increased 61% to Rs. 4432 crore as against Rs. 2745 crore in the financial year 2021. The total expenses increased 61% to Rs. 4152 crore as against Rs. 2565 crore in FY21. The profit before tax of the Company increased 56% to Rs. 284 crore as against Rs. 181 crore in FY21. The net profit increased 53% to Rs. 70 crore as against Rs. 46 crore in FY21.

In FY22, the total equity and liabilities of the Company was Rs. 2050 crore as against Rs. 1716 crore in FY21. The total assets of the Company was Rs. 2050 crore as against Rs. 1716 crore in FY21.

In FY22, the total cash generated from operating activities of the Company was Rs. 171 crore as against Rs. 46 crore in FY21. During this, the total cash used in investing activities of the Company was Rs. 62 crore as against Rs. 5 crore in FY21 and total cash used in financial activities of the Company was Rs. 31 crore as against Rs. 74 crore. The net cash and cash equivalents at the end of the year of the Company in FY22 was Rs. 12 crore as against Rs. 8 crore in FY21.

Leave a Reply

You must be logged in to post a comment.