Aadhar Housing Finance Limited NCD

(i) Aadhar Housing Finance Limited is a deposit taking housing finance company registered with the NHB and focused on providing affordable housing financing products for the EWS and LIG segment in India, in tier 2 to tier 4 cities and towns, to diverse customer groups with focus on salaried (both formal and informal) and self-employed (business and professional in formal and informal segments) home buyers. As on March 31, 2018, 38.92% of our portfolio falls under EWS segment, 42.92% under LIG segment and 18.16% segment under MIG. Salaried customers comprise 70.49%, 71.52% and 67.70% of our assets under management as at March 31, 2016, March 31, 2017 and March 31, 2018, respectively.

(ii) Aadhar Housing Finance Limited offer Housing Loans i.e. secured finance primarily to salaried and self-employed individuals for the purchase of plots, construction, improvement and extension of homes, new and resalable flats secured against mortgage of the same property, and project finance for residential buildings to developers. Housing Loan comprises 92.46%, 90.93% and 82.19% of our AUM, i.e. Rs.135,847 lakhs, Rs.164,577 lakhs and Rs.654,689 lakhs, as at March 31, 2016, March 31, 2017, and March 31, 2018, respectively. Our average ticket size and incremental ticket size for Housing Loans portfolio is ` 8.22 Lakhs and ` 8.99 lakhs, respectively, with an average tenure of loans being, approximately 16 years.

(iii) The Company also provide Other Property Loans including a loan against property (“LAP”) to salaried or self-employed professionally qualified individuals and others, against mortgage of property of the borrower and insurance component of Housing Loans. Non-Housing Loans comprise 7.54%, 9.07% and 17.81% of our AUM, i.e. 11,073 lakhs, 16,422 lakhs and 141,896 lakhs, as at March 31, 2016, March 31, 2017 and March 31, 2018, respectively.

(iv) The Company has a robust marketing and distribution network, with a presence across 272 branches across 20 states and union territories, comprising of 160 main branches, two small branches, 62 micro branches, 48 ultra-micro branches, one Corporate office, and one registered office, as of March 31, 2018.

(v) Recent Interaction with Management by ET.

(vi) The Aadhar Housing Finance NCD will list on Exchanges w.e.f 04 Oct 2018 in the list of “F” group.

Objective of NCD Aadhar Housing Finance Limited NCD:

Aadhar Housing Finance Limited NCD Details:

| Open Date: | Sep 14 2018 |

| Close Date: | Sep 28 2018 |

| Issue Type: | Fixed Type Issue |

| Issue Size: | ₹ 500 Cr. |

| Face Value: | ₹ 1000 Per NCD |

| Market Lot: | 1 NCD |

| Minimum Order Quantity: | 10 NCD |

| Listing At: | BSE |

Promoters:

Financials:

Financials of Merger Entity ( DVHFL and AHFL)

| Year | AUM(Cr) | Revenue(Cr) | Profit After Tax(Cr) | Equity Shares(Cr) | EPS | Gross NPA | Net NPA | Capital Adequacy Ratio |

| FY18 | 7966 | 807.31 | 99.62 | 2.52 | 39.61 | 1.17% | 0.78% | 18.76 |

Financials of DHFL Vysya Housing Finance Limited

| Year | AUM(Cr) | Revenue(Cr) | Profit After Tax(Cr) | Equity Shares(Cr) | EPS | Gross NPA | Net NPA | Capital Adequacy Ratio |

| FY16 | 1467.57 | 192 | 26 | 1.108 | 23.47 | 1.2% | 0.78% | 23.12% |

| FY17 | 1807.6 | 212 | 23 | 1.108 | 20.76 | 1.42% | 0.94% | 19.37% |

Financials of Aadhar Housing Finance Limited

| Year | AUM(Cr) | Revenue(Cr) | Profit After Tax(Cr) | Equity Shares(Cr) | EPS | Gross NPA | Net NPA | Capital Adequacy Ratio |

| FY16 | 1811 | 216 | 18.68 | 10 | 1.87 | 0.70% | 0.54% | 14.94% |

| FY17 | 3182 | 356 | 40.77 | 12.049 | 3.38 | 1.07% | 0.80% | 18.05% |

Credit Rating:

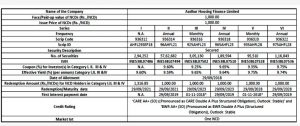

Interest Rates:

| Tenure | 3 years | 5 years | 10 years | ||||

| Nature | Secured | ||||||

| Series | I | II | III | IV | V | VI | |

| Frequency of Interest Payment | NA | Annual | Monthly | Annual | Monthly | Annual | |

| Minimum Application | 10 NCDs (Rs.10,000) (across all Series) | ||||||

| In multiples, of | 1 NCD after the minimum application | ||||||

| Face Value of NCDs (`/NCD) | Rs.1,000 | ||||||

| Issue Price (`/NCD) | Rs.1,000 | ||||||

| Mode of Interest Payment/ Redemption | Through various modes available | ||||||

| Coupon (%) per annum for NCD Holders | NA | 9.60% | 9.25% | 9.65% | 9.35% | 9.75% | |

| Coupon Type | Fixed | ||||||

| Redemption Amount | Rs.1,316.85 | Rs.1,000 | Rs.1,000 | Rs.1,000 | Rs.1,000 | Rs.1,000 | |

| Effective Yield (% | 9.60% | 9.59% | 9.65% | 9.64% | 9.75% | 9.74% | |

| Maturity/Redemption Date | 3 years | 3 years | 5 years | 5 years | 10 years | 10 years | |

Post Tax returns:

Recommendation:

Lead Manager of Aadhar Housing Finance Limited NCD:

- A. K. Capital Services Limited

- Axis Bank Limited

- Edelweiss Capital Limited

- Green Bridge Capital Advisory Private Limited

- Trust Investment Advisors Private Limited

- YES Bank Limited

- Yes Securities (India) Limited

Registrar of Aadhar Housing Finance Limited NCD:

- Karvy Computershare Private Limited

Discussion on Aadhar Housing Finance Limited NCD:

7 Comments

Leave a Reply

You must be logged in to post a comment.

What Could be the Merge Entity Called? How will it Structured?

The new, merged company is called Aadhar Housing FinanceLimited (Aadhar). Majority of shares are held by WGC (Wadhawan Global Capital) with equity participation from DHFL (Dewan Housing Finance Ltd.) and IFC (International Finance Corporation).

After the merger, Aadhar now spans across 18 states with around 270 branches with a loan book of 6000 Cr(as on 30th Sept 2017)

Why merger would be a win-win situation for both the companies?

DHFL Vysya Housing Finance and Aadhar Housing Finance are subsidiaries of WGC(Wadhawan Global Capital). Both, Aadhar and DHFL Vysya provide housing loans to LIG(Low Income Groups) but in mutually exclusive locations. While Aadhar is a well-established financial services brand in North, West and East India, DHFL Vysya has a strong foothold in South India. The merger will result in the creation of a stronger brand with a pan-India presence. The new entity would be able to create better products and services for their customers. This will result in economies of scale, uniform acquisition structure, common policies, strong business growth and cost reduction.

Source of Funding for the Company

The weighted average borrowing cost as of March 31, 2018, was 8.77% which is reduced from 9.15% as of 31st March 2017. As of March 31, 2018, the Company’s sources of funding were primarily from banks and financial institutions 68.38%. followed by non-convertible debentures 16.21%, Public deposits 1.29%, commercial papers 5.07%, NHB refinance 7.33% and Subordinate debt 1.33%. The Company continues to gradually reduce its reliance on the borrowings from banks and financial institutions and focus on capital market instruments with lower funding costs.

To synergise the growth merger of WGC (Wadhawan Global Capital)’s two region-specific subsidiaries – AHFL( Aadhar Housing Fin limited) and DVHFL( DHFL Vysya Housing Finance Limited), has been done in FY17-18 which has led to the creation of a new, bigger and better entity, combining the strengths and the reach of the original

Operational Highlights of FY17-18

(i) 138 Branches added and 6 States added.

(ii) 262% increase in interest income of housing loans.

(iii) 56% increase in profit after tax.

(iv) 58% increase in AUM, from Rs. 4,991 Crores in FY 2016-17 to Rs. 7,966 Crores in FY 2017-18.

(v) 67% increase in disbursements, from Rs. 2,338 Crores in FY 2016-17 to Rs. 3,905 Crores in

FY 2017-18.

(i) Incorporated in 2010 with an authorized capital of Rs. 100 Crores, promoted by DHFL with equity participation of 20% from IFC, (an arm of the World Bank in India).

(ii) 1st branch established in Lucknow on 26th January 2011.

(iii) Crossed milestone of 1,000 Home Loan Disbursements on 11th February 2012.

(iv) Reaches 100 branches milestone on 22nd June 2016.

(v) Crosses Rs. 2,000 Crores of Loan Book on 30th June 2016.

Overall Summary of Aadhar Housing Finance

1) 68% of the loan is disbursed to salaried class. (Fewer chances of NPA)

2) 3905 Cr of disbursement in FY17-18 and increase of 67% on a comparable basis.

3) 0.58% of Gross NPA.

4) 8.2 Lakh is the average ticket size of the home loan.

5) 60% financing in semi-urban and small towns.