Vishnusurya Projects and Infra Limited IPO

i. Vishnusurya Projects is in mining of rough stones and manufacturing of aggregates & Manufacture-sand by using Crushing Plants and Sand washing plants. In addition to mining activities, we are engaged in EPC Projects (construction and infrastructure) delivered across all key sectors such as water, transportation, rail, resource, and institutional development. The Company executed and delivered multiple real estate projects in past such as construction of villas, multi storied apartments, specific contracts like compound wall, renovation works, site formation, etc. and design and construction of various infrastructure projects for the government, autonomous and private bodies in state of Tamil Nadu. The Company is also engaged in buying, selling and providing integrated solutions for Drones as a Service for surveillance, mapping and surveying purposes.

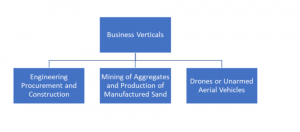

ii. Their business operations are broadly divided into the following categories:

iii. They have been accredited as a Class I contractor with various departments and agencies viz. (1) Greater Chennai Corporation (“GCC”), (2) Government of Tamil Nadu Water Resources Department, (3) Tamil Nadu Water Supply and Drainage Board, (4) Highways Departments pursuant to which we are eligible to participate and undertake projects awarded by various other departments and agencies.

iv. They have executed a diverse range of construction and infrastructure projects in sectors such as roads and highway construction, railways, waterways, sewerage operation, building construction, etc. and successfully completed key projects across diverse market segments and have diversified exposures across property, civil, infrastructure, mining, and aggregates sectors.

v. They have executed 17 projects in the recent years, out of which 10 (Ten) are civil construction projects, 1 (One) is of road construction and 6 (Six) are infrastructure related projects with an aggregate value of Rs. 13,619.06 Lakhs.

Objects of the Vishnusurya Projects and Infra Limited IPO:

Vishnusurya Projects and Infra Limited IPO Details:

| Open Date: | Sep 29 2023 |

| Close Date: | Oct 05 2023 |

| Total Shares: | 7,350,000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Fixed Price Issue IPO |

| Issue Size: | 49.98 Cr. |

| Lot Size: | 2000 Shares |

| Issue Price: | ₹ 68 Per Equity Share |

| Listing At: | NSE Emerge |

| Listing Date: | Oct 09 2023 |

Promoters And Management:

Financials of Vishnusurya Projects and Infra Limited IPO:

Particulars ( In Lakhs ) |

2021 |

2022 |

2023 |

| Revenue from Operations | 6,322 | 7,646 | 13,237 |

| Other Income | 17 | 1,958 | 89 |

| Total Revenue | 6,339 | 9,604 | 13,326 |

| Direct Cost | 4,172 | 3,827 | 6,528 |

| Purchases of Stock-In-Trade | 410 | 0 | 155 |

| Changes in Inventories | -328 | 328 | -434 |

| Employee benefits expenses | 611 | 896 | 914 |

| Other Expenses | 639 | 1,000 | 2,845 |

| EBITDA | 836 | 3,553 | 3,319 |

| Depreciation & Amortisation | 182 | 354 | 673 |

| Finance Cost | 333 | 240 | 414 |

| EBIT | 654 | 3,199 | 2,646 |

| OPM (%) | 13.19% | 37.00% | 24.91% |

| PBT | 321 | 2959 | 2231 |

| Tax | 92 | 800 | 495 |

| PAT | 229 | 2159 | 1737 |

| NPM (%) | 3.62% | 22.48% | 13.03% |

| No.of Shares | 246.09 | 246.09 | 246.09 |

| EPS | 0.93 | 8.77 | 7.05 |

Comparison With Peers:

| Name of the Company | Revenue (In Crore) | PAT (In Crore) | EPS ( in Rs) | P/E | CMP | Mcap (In Crore) |

| Vishnusurya Projects and Infra Limited | 132 | 17 | 7.05 | 9.6 | 68 | 167 |

| Rachana Infrastructure Limited | 64 | 2 | 1.21 | 84.1 | 99 | 184 |

| Sonu Infratech Limited | 64 | 3 | 3.48 | 17.3 | 60 | 47 |

| A B Infrabuild Limited | 123 | 8 | 5.95 | 20.3 | 27.6 | 122 |

Recommendation on Vishnusurya Projects and Infra Limited IPO:

Vishnusurya Projects: An In-depth Financial and Legal Analysis

Vishnusurya Projects operates in the domains of mining, manufacturing of aggregates, Manufacture-sand, and EPC (Engineering, Procurement, and Construction) projects. The company has a diverse portfolio, including real estate development and providing drone services for surveillance, mapping, and surveying. While the company's operational breadth is impressive, potential investors need to weigh various financial and legal factors before making an investment decision, particularly in light of the impending IPO.Financial Liabilities and Short-term Loans

Vishnusurya Projects holds a substantial stake of around 19% in Agni Estates & Foundations Private Limited. The latter has been subjected to income tax search and seizure proceedings, with assessment orders totaling ₹376 Cr. This level of scrutiny and the corresponding financial penalties could significantly affect Agni Estates' financial stability and valuation, thereby indirectly affecting Vishnusurya's investment and balance sheet. Furthermore, Forthforce Surveillance Indo Private Limited ("FSIPL"), presumably a related entity, has been penalized ₹3 Cr following assessment proceedings under Section 153C of the Income Tax Act for the assessment years 2013-14 to 2018-19.Financial Risk Exposure

Given that Vishnusurya has also extended a short-term loan of ₹16 Cr to Agni Estates, the financial risk is twofold. If Agni Estates faces challenges in settling its legal issues, not only does the value of Vishnusurya's investment risk depreciation, but the likelihood of loan repayment could also become uncertain.Contingent Liabilities

Vishnusurya Projects itself has a contingent liability of ₹15 Cr, adding an additional layer of financial risk that needs to be accounted for.Elevated Risk Profile

Given these financial and legal complexities, the risk profile for investing in Vishnusurya Projects is elevated. The ongoing income tax cases add an additional layer of uncertainty. Should these cases result in unfavorable outcomes, the repercussions could be severe for Vishnusurya Projects, potentially affecting their ability to repay short-term loans and impacting their overall financial health.Conclusion

While the company's diverse operations may offer a varied revenue stream, the current financial and legal challenges cannot be overlooked. Investors must exercise caution and perhaps seek professional advisory services to fully understand the risks involved in investing in Vishnusurya Projects' IPO. This analysis aims to provide potential investors with a comprehensive view, but it is advisable to conduct your own due diligence or consult a financial advisor before making any investment decisions.Lead Manager of Vishnusurya Projects and Infra Limited IPO:

Registrar of Vishnusurya Projects and Infra Limited IPO:

Company Address:

Discussion on Vishnusurya Projects and Infra Limited IPO:

1 Comment

Leave a Reply

You must be logged in to post a comment.

avoid