Basilic Fly Studio Limited IPO

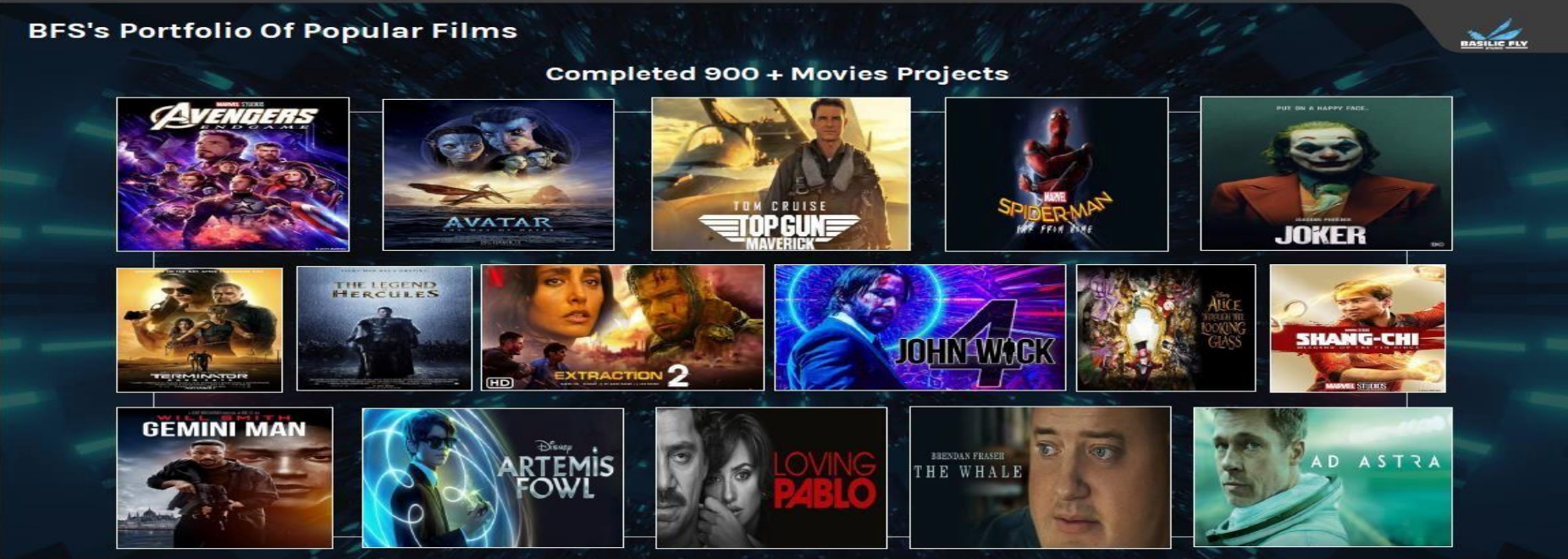

i. Basilic Fly Studio is a visual effects (VFX) studio that provides high-quality and cost-effective VFX solutions for various projects, including movies, TV & net series, and commercials.

ii. The company was founded in 2012 and has grown to become one of India’s leading VFX powerhouses, with offices in Chennai, Pune, London, and Vancouver.

iii. The company’s business model is based on the following aspects:

a. Offering a full range of VFX services, such as supervision, FX, creatures, environments, compositing, matchmove, paint and prep, and rotoscopy.

b. Leveraging the talent and cost advantages of India, while providing local points of contact for clients in the US and the UK.

c. Working with a team of experienced and skilled artists, who use the latest cutting-edge technology and software to create captivating visual experiences.

d. Handling any kind of project, either small or large, with faster turnaround and scalability3.

e. Pioneering the art and science of visual effects with unmatched creativity, technical prowess, and a relentless pursuit of excellence.

Services Offered by the Company

- Final Compositing and Rotoscopy,

- Camera/ Body Tracking and Rotomation/ Object Tracking,

- Paint And Preparation,

- Previs or Previsualization,

- Computer Graphics, and

- Onset Supervision.

Competitive Strengths

i. Well equipped with advance technology

ii. Experienced Promoters and Technically Sound Operation Team

Objects of the Basilic Fly Studio Limited IPO:

Basilic Fly Studio Limited IPO Details:

| Open Date: | Sep 01 2023 |

| Close Date: | Sep 05 2023 |

| Total Shares: | 6,840,000 |

| Issue Type: | Book Built Issue IPO |

| Issue Size: | 66.35 Cr. |

| Lot Size: | 1200 Shares |

| Issue Price: | ₹ 92 to ₹97 Per Equity Share |

| Listing At: | NSE Emerge |

| Listing Date: | Sep 13 2023 |

Promoters And Management:

Financials of Basilic Fly Studio Limited IPO:

Pariculares ( In Lakhs ) |

2021 |

2022 |

2023 |

| Revenue from Operations | 1,727 | 2,388 | 7,023 |

| Other Income | 4 | 12.9 | 28 |

| Total Revenue | 1,731 | 2,401 | 7,051 |

| Employee Benefits Expense | 730 | 1,249 | 1,749 |

| Other Direct Expenses | 818 | 971 | 1,534 |

| Other Expenses | 68 | 28 | 101 |

| EBITDA | 115 | 153 | 3,667 |

| Depreciation & Amortisation | 44 | 28 | 56 |

| Finance Cost | 18 | 9 | 69 |

| EBIT | 71 | 125 | 3,611 |

| OPM (%) | 6.66% | 6.37% | 52.01% |

| PBT | 53 | 116 | 3543 |

| Tax | 19 | 37 | 899 |

| PAT | 34 | 79 | 2644 |

| NPM (%) | 1.94% | 3.31% | 37.50% |

| No.of Shares | 232.4 | 232.4 | 232.4 |

| EPS | 0.14 | 0.34 | 11.37 |

Comparison With Peers:

| Name of the Company | Revenue (In Crore) | PAT (In Crore) | EPS ( in Rs) | P/E | CMP | Mcap (In Crore) |

| Basilic Fly Studio Limited | 70 | 26 | 11.37 | 8.52 | 97 | 255 |

| Prime Focus Limited | 4,644 | 194 | 4.92 | 21.9 | 91 | 2,729 |

| Phantom Digital Effects Limited | 58 | 16 | 13.92 | 40.3 | 561 | 653 |

Recommendation on Basilic Fly Studio Limited IPO:

Lead Manager of Basilic Fly Studio Limited IPO:

Registrar of Basilic Fly Studio Limited IPO:

Company Address:

Discussion on Basilic Fly Studio Limited IPO:

Leave a Reply

You must be logged in to post a comment.