Aashka Hospitals IPO

(i) Aashka means “Blessing” & Aashka Hospitals signifies blessing, a blessing of the fine health.

(ii) Incorporated as “Aashka Hospitals Private Limited” on November 09, 2012, and was converted into a Public Limited Company on June 25, 2018. It is certified by National Accreditation Board for Hospitals and Healthcare Providers (“NABH Accredited”) for tertiary and apical care level hospital in Gujarat.

(iii) With the support of their doctors and staffs, it has treated more than 2000 COVID19 patients. It is also a part of Ayushman Bharat, a flagship scheme of Government of India.

(iv) Its hospital, Aashka Multispeciality Hospital, located at Gandhinagar, Gujarat, India is built across 85,000 Sq ft area with an aggregate bed capacity of 140 beds extendable upto 200 beds.

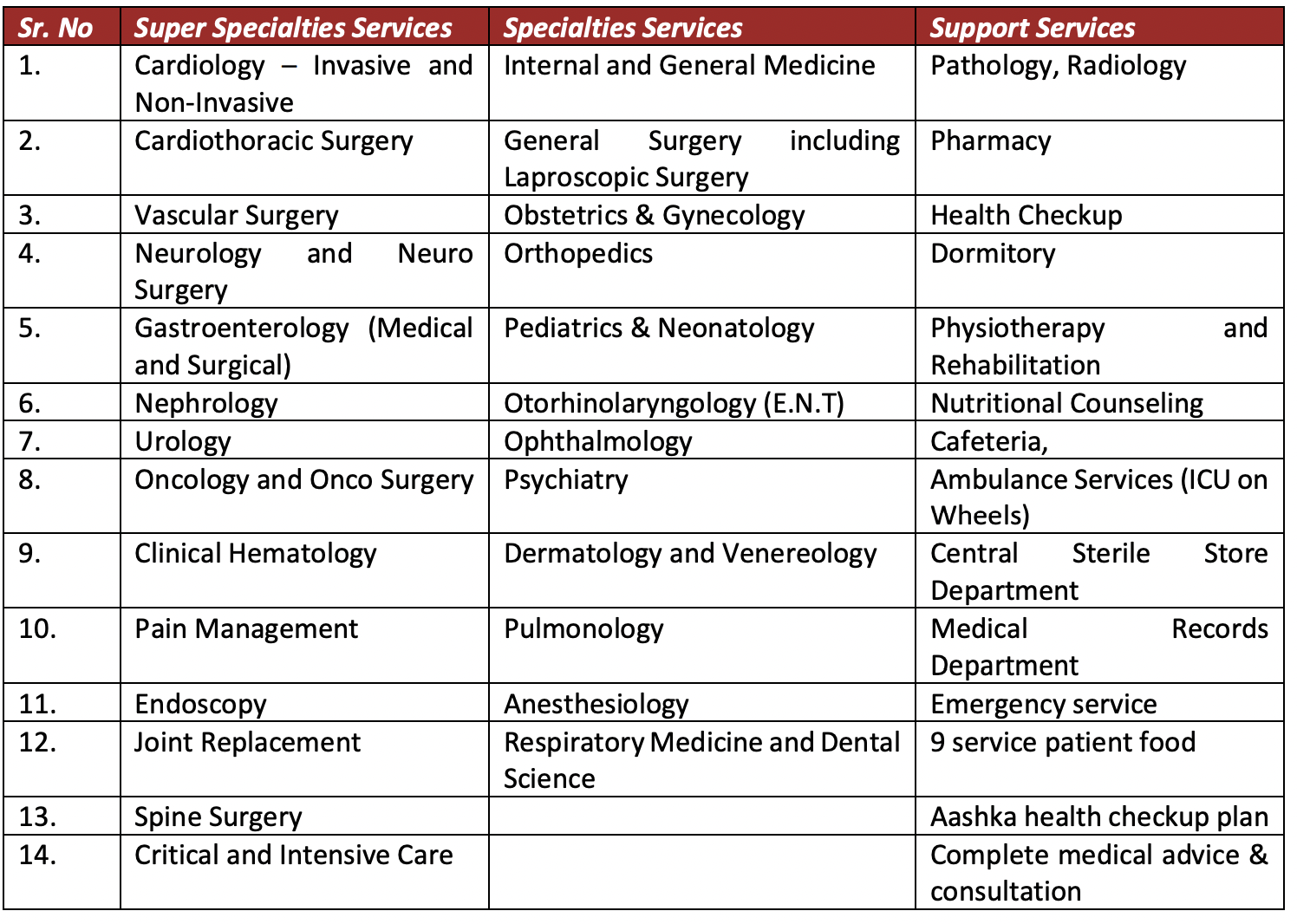

Specialty procedures performed at this hospital:

Competitive strengths

(i) Well diversified and specialty service offerings

(ii) Provision of quality healthcare services

(iii) Experienced player with longstanding presence

Objects of the Aashka Hospitals IPO:

Aashka Hospitals IPO Details:

| Open Date: | Aug 10 2021 |

| Close Date: | Aug 18 2021 |

| Total Shares: | 8,400,000 |

| Face Value: | ₹ 10 Per Equity Share |

| Issue Type: | Fixed Price |

| Issue Size: | 101.64 Cr. |

| Lot Size: | 1000 Shares |

| Issue Price: | ₹ 121 Per Equity Share |

| Listing At: | BSE SME |

| Listing Date: | Aug 24 2021 |

Promoters And Management:

Financials of Aashka Hospitals IPO:

| Particulars | Mar 21 | Mar 20 | Mar 19 |

| Revenue | 4,068 | 2,722 | 2,766 |

| Cost of material consumed | 642 | 367 | 333 |

| Direct Expenses | 1,657 | 901 | 923 |

| Change in inventories | 9 | -17 | -6 |

| Employee Benefit Expenses | 556 | 423.00 | 392 |

| Other Expenses | 211 | 186 | 171 |

| Operating Profit | 993 | 862 | 953 |

| OPM % | 24.41% | 31.67% | 34.45% |

| Other Income | 0.35 | 2.32 | 5.89 |

| Depreciation & Amortisations | 260 | 256 | 254 |

| Financial Cost | 319 | 468 | 566 |

| Profit Before Tax | 411 | 137 | 136 |

| Net Profit | 411 | 137 | 136 |

| NPM% | 10.10% | 5.03% | 4.92% |

| EPS | 2.29 | 0.78 | 0.8 |

Comparison With Peers:

| Companies | CMP | EPS | PE Ratio | RONW (%) | NAV | Face Value |

Total Income (₹ in Lakhs)

|

| Aashka Hospitals Limited | 121 | 2.29 | 52.84 | 14.07 | 16.25 | 10 | 4069.23 |

| Narayana Hrudayalaya Limited | 476.1 | -3.88 | NA | -7.05 | 53.32 | 10 | 173042.8 |

| KMC Speciality Hospitals (India) Limited | 36.45 | 0.78 | 46.52 | 20.18 | 3.88 | 1 | 10456.36 |

Recommendation on Aashka Hospitals IPO:

Lead Manager of Aashka Hospitals IPO:

Registrar of Aashka Hospitals IPO:

Company Address:

Discussion on Aashka Hospitals IPO:

Leave a Reply

You must be logged in to post a comment.