Aarti Drugs Limited Buyback Offer 2018

Aarti Drugs Limited is engaged in manufacturing of Pharmaceuticals products. The Company has established a strong presence in the Anti-diarrhea, Anti-inflammatory therapeutic groups. With its manufacturing facilities at Tarapur and Sarigam, the Company manufactures Vitamins, Anti-arthritis, Anti-fungal, Antibiotics, ACE inhibitors, besides its range in, anti-diabetic, anticholinergic, sedatives and anti-depressant drugs. The Company is a part of the Alchemie Group of Companies.

Buy Back Offer Deal:

| Buyback Type: | Tender Offer |

| Buyback Record Date: | Jan 19 2018 |

| Buyback Opening Date: | Feb 14 2018 |

| Buyback Closing Date: | Feb 28 2018 |

| Buyback Offer Amount: | ₹ 24.06 |

| Date of Board Meeting approving the proposal: | Jan 08 2018 |

| Date of Public Announcement: | Jan 08 2018 |

| Buyback Offer Size: | 1.15% |

| Buyback Number of Shares: | 2.75 Lacs |

| FV: | 10 |

| Buyback Price: | ₹ 875 Per Equity Share |

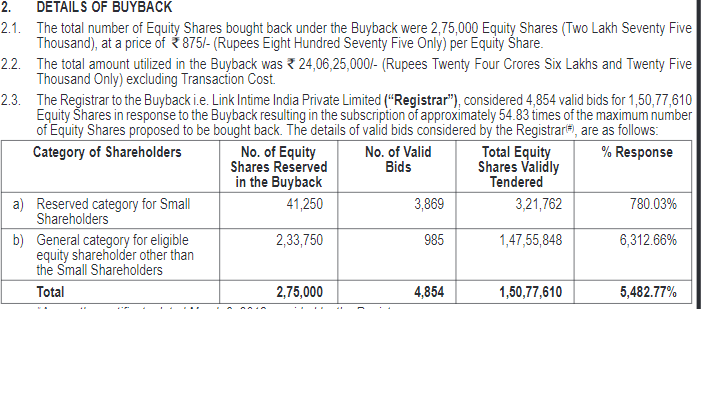

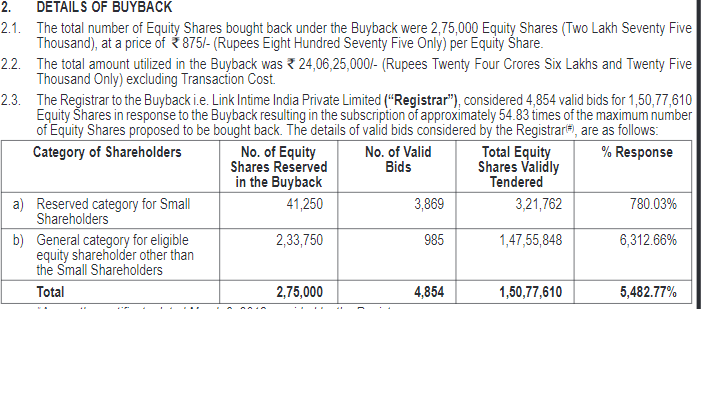

Details of Buyback:

The Board of Directors of Aarti Drugs Limited , approved the Buyback up to 2,75,000 fully paid-up equity shares of face value of 10/- (Rupees Ten Only) each of the Company (“Equity Shares”) representing up to 1.15% of the total number of equity shares of the Company at a price of 875/- in cash for an aggregate amount of up to 24,06,25,000/- (“Buyback Size”) , which represents 5.97% of the fully paid-up equity share capital and free reserves proportionate basis through the tender offer (“Tender Offer”).

Salient financial parameters:

| Parameter | Standalone | Consolidated | ||

| PreBuyback* | Post Buyback* | PreBuyback* | Post Buyback* | |

| Networth (in Lakhs) | 40,727.91 | 38,321.66 | 42,701.46 | 40,295.21 |

| Return on Networth (%) | 7.02% | 7.46% | 8.19% | 8.68% |

| Earnings per Share (`) @ | 11.99 | 12.13 | 14.66 | 14.83 |

| Book Value | 170.72 | 162.50 | 178.99 | 170.87 |

| P/E | 43.50 | 43.00 | 35.57 | 35.16 |

| Debt/Equity Ratio | 1.20 | 1.28 | 1.21 | 1.29 |

How to Participate in buyback?

1. Firstly to be eligible for the buyback the investor should have shares of Aarti Drugs Limited in demat or physical form as on record date 19 January 2018.

2. Once you have shares in demat, you can participate in the buyback process which is opening from [14.02.2018 to 28.02.2018] by selling your shares through your broker on NSE or BSE.

3. Then on 19 March 2018, the payment will be given to you for accepted shares and unaccepted shares will be returned to your demat account.

Profit from the buyback on the bases of acceptance Ratio:

| Aarti Drugs Ltd Buyback offer calculation for an investment of Rs 2,00,000 @745 per share | ||

| % Share Accepted | No of Shared Accepted | Gain from Buyback |

| 33% | 88 | Rs 11440 |

| 50% | 134 | Rs 17420 |

| 75% | 201 | Rs 26130 |

| 100% | 268 | Rs 34840 |

Recommendation:

IZ Rating: 4/10

Fair: 1-5

Good: 5-7

Excellent: 7-10

Final Acceptance Ratio

Registrar Contact Details:

Link Intime India Private Limited

C 101, 247 Park, L.B.S. Marg,

Vikhroli (West), Mumbai

400 083, Maharashtra, India

Phone No. 91 22 4918 6200

Fax No. 91 22 4918 6195

Email:aartidrugs.buyback2018@linkintime.co.in

Website: www.linkintime.co.in

Company Contact Details:

Aarti Drugs Limited

Plot No. - 198, M.I.D.C., Village - Pamtermbhi,

Taluka & Dist. Palghar - 401 506, Maharashtra.

Phone No. 9122 2404 8199

Fax: 91 22 2407 3462

Email: investorrelations@aartidrugs.com;

2 Comments

Leave a Reply

You must be logged in to post a comment.

is this correct that acceptance ratio for this was 100 % as showing on your past performance screen…???

Updated. It was by mistake put it at 100%. Thanks for the support.