- January 4, 2021

- Posted by: Umesh Paliwal

- Category: Blog

If you see the FIIs data of the last 3 months, it is staggering.

Oct = 16000 Crores

Nov = 70000 Crores

Dec = 54000 Crores

They have invested in excess of 1.30 Lakh Crores. This is humongous.

But the question is why so much money is being attracted to the Indian stock market?

One of the biggest reason is the fall of dollar index or in simple terms dollar is falling against the rupee in the last 3-6 months.

Why Dollar is falling?

Analogy to understand > If there is a large supply of a particular item in the economy, the price of that item will reduce considerably.

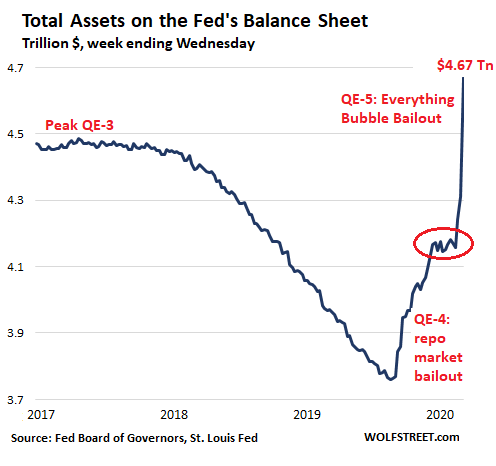

See the balance sheet of Federal, the Central bank of USA, it has increased by ~4.6 Trillion Dollars in the last 9 months. This much money is being printed in the USA economy. The size is almost twice the size of India’s GDP. This has provided huge supply of dollars in the market, thereby, reduces the value of dollar. If you see the interest rates in USA, they are almost at Zero level. So, nothing much left for the investors in the USA market.

Why the falling dollar support emerging markets?

Imagine a foreign investor has 100 dollars and decided to invest in India. When he comes to India, he will sell dollars and buy INR.

1 dollar = 100 INR

So, he will get 100*100 = 10,000 INR.

Suppose he has invested in Asian Paints. Imagine the share price of Asian Paints is Rs.100 per share. So, he will get 100 shares of Asian Paints,

After 1 year……

Case 1:

The price of Asian Paint increased to say 120 per share and dollar has remained same against the INR.

1 dollar = 100 INR

And he has decided to sell the Asian Paints shares.

How much dollar he will get?

>100*120 = 12,000 INR by selling Asian Paints shares.

1 INR = 1/100 dollars

>12000/100 = 120 dollars

Case 2:

The price of Asian Paint increased to say 120 per share and dollar has depreciated against the INR and now;

1 dollar = 90 INR

And he has decided to sell the Asian Paints shares.

How much dollar he will get?

>100*120 = 12,000 INR by selling Asian Paints shares.

1 INR = 1/90 dollars

>12000/90 = 133 dollars

So, we can see clearly, the foreign investor will make more money if dollar is depreciating.

That is why global investors across the world are removing money from the USA market and putting money in emerging markets.

Leave a Reply

You must be logged in to post a comment.